On-chain knowledge from Glassnode reveals that Ethereum locked into the Beacon Chain contract is at the moment carrying an unrealized lack of $4.7 billion.

Ethereum Locked On Beacon Chain Is Carrying A Massive Quantity Of Loss

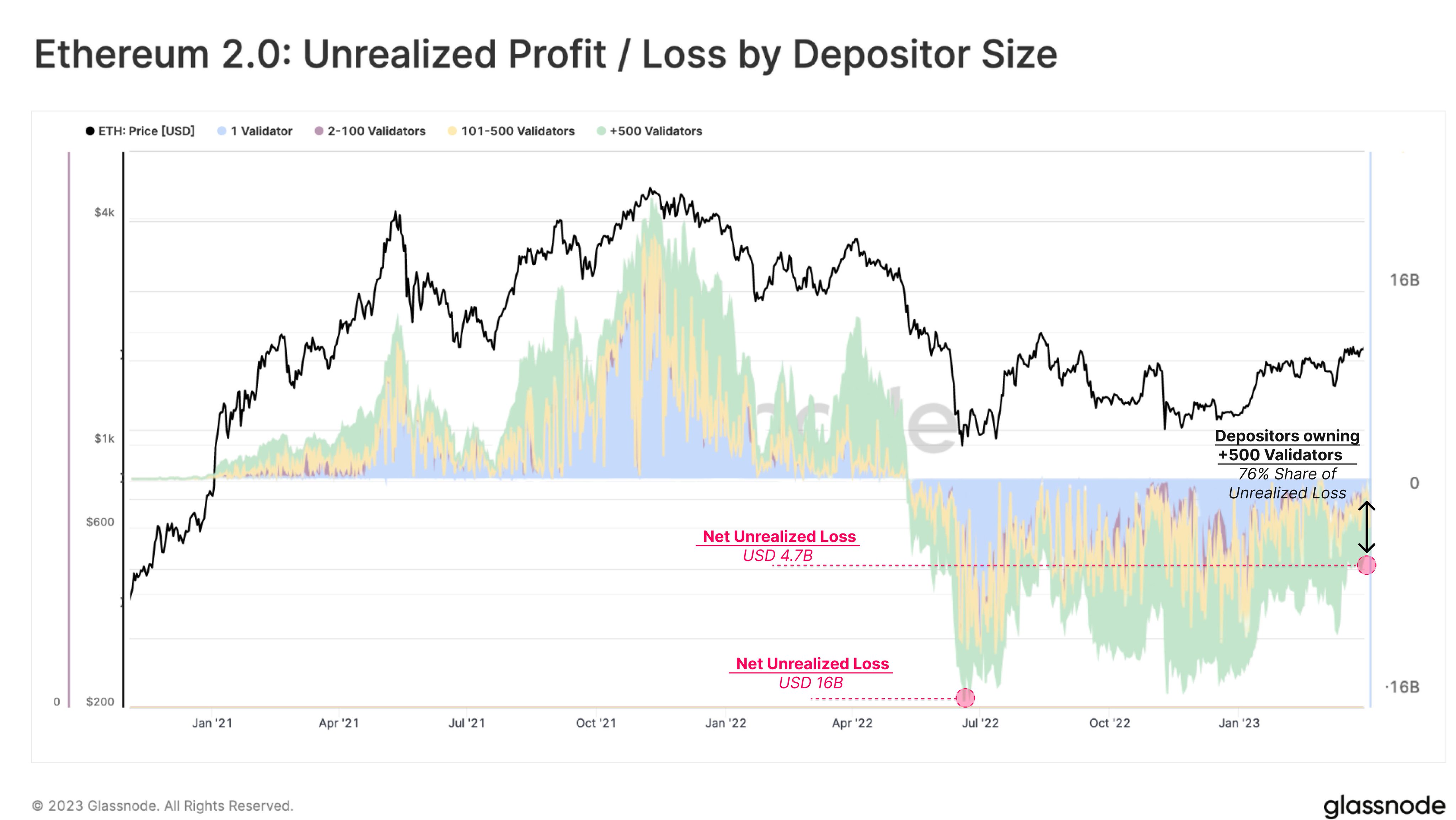

In accordance with knowledge from the on-chain analytics agency Glassnode, the Beacon Chain was carrying a peak unrealized lack of $16 billion again in the course of the LUNA crash. The “Beacon Chain” was the title of the blockchain that launched again in December 2020 with the intention of testing an ETH proof-of-stake (PoS) consensus mechanism.

The Beacon Chain was merged with the mainnet again in September of final 12 months, in an occasion often called the Merge. Which means the whole ETH community now runs on PoS.

In a PoS system, the traders can select to deposit a sure minimal quantity of the asset (32 ETH within the case of Ethereum) right into a contract to turn out to be a validator and earn rewards for it. That is known as staking.

To this point, the ETH staking contract solely helps deposits; the withdrawals will open for the primary time tomorrow when the much-anticipated Shanghai upgrade takes place.

As a result of withdrawals should not open, the staking contract is carrying a considerable amount of dormant provide at this level. To see whether or not this locked provide is carrying a revenue or loss, the “unrealized profit/loss” indicator is used.

This metric measures the web quantity of revenue or loss {that a} sure section of traders is carrying at the moment. Within the current case, the holders who’ve locked their cash into the Ethereum 2.0 contract are the section of curiosity.

When the worth of this indicator is constructive, it means the holders in query as an entire are carrying some unrealized beneficial properties at the moment. Alternatively, unfavorable values counsel unrealized losses dominate the traders’ holdings in the meanwhile.

Now, here’s a chart that reveals the pattern within the unrealized revenue/loss for the Ethereum locked into the staking contract:

Appears to be like just like the metric has had an underwater worth for fairly some time now | Supply: Glassnode on Twitter

As proven within the above graph, the Ethereum Beacon Chain contract unrealized revenue/loss had a constructive worth in the course of the 2021 bull run and early months of 2022, however with the plunge following the LUNA crash, the indicator’s worth collapsed to deep unfavorable values.

At its peak purple worth round that point, the ETH 2.0 locked tokens had been carrying a mixed lack of $16 billion. Throughout the remainder of the 12 months 2022, the metric’s worth continued to be close to these extremely unfavorable ranges.

With the beginning of the rally this 12 months, nevertheless, the losses being carried by these cash have shrunken considerably, however they’re nonetheless considerably underwater nonetheless. Presently, this section of the Ethereum market is holding a web unrealized lack of $4.7 billion.

The chart additionally breaks down which kind of depositors are contributing to how a lot of those losses. It appears to be like like the most important depositors (with quantities equal to greater than 500 validators) are carrying round 76% of those losses.

These cash being so underwater signifies that when the Shanghai improve goes reside tomorrow, a excessive quantity of loss-taking could happen within the Ethereum market if traders select to unlock their cash.

ETH Value

On the time of writing, Ethereum is buying and selling round $1,900, up 3% within the final week.

ETH has seen some rise in the course of the previous day | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com