Information from a analysis agency has revealed that just about 80% of the Ethereum staking rewards have been withdrawn because the Shanghai improve.

1.5 Million ETH In Whole Has Been Withdrawn Since Ethereum Shanghai Improve

In September 2022, Ethereum lastly switched in direction of a Proof-of-Stake (PoS) consensus mechanism. In such a system, a consensus is met on the blockchain by way of stakers and never miners.

Anybody can change into a staker in the event that they deposit 32 ETH into the staking contract. Whereas the mainnet solely transitioned to the PoS system in September 2022, as talked about earlier, the staking contract had already been dwell on a take a look at blockchain since November 2020.

This implies holders have been depositing into the contract and incomes staking rewards since then. Nevertheless, till the current Shanghai improve, there was a limitation hooked up to this contract all these years.

Whereas the deposit performance was in place, the traders couldn’t but withdraw their cash from the contract. Due to this purpose, a lot of rewards had amassed with the validators whereas this restriction remained.

The Shanghai improve launched simply earlier within the month allowed the traders to withdraw their locked ETH and staking rewards. Because the rewards had piled up on the contract all these years, it was anticipated that many withdrawals would happen when the improve was in place.

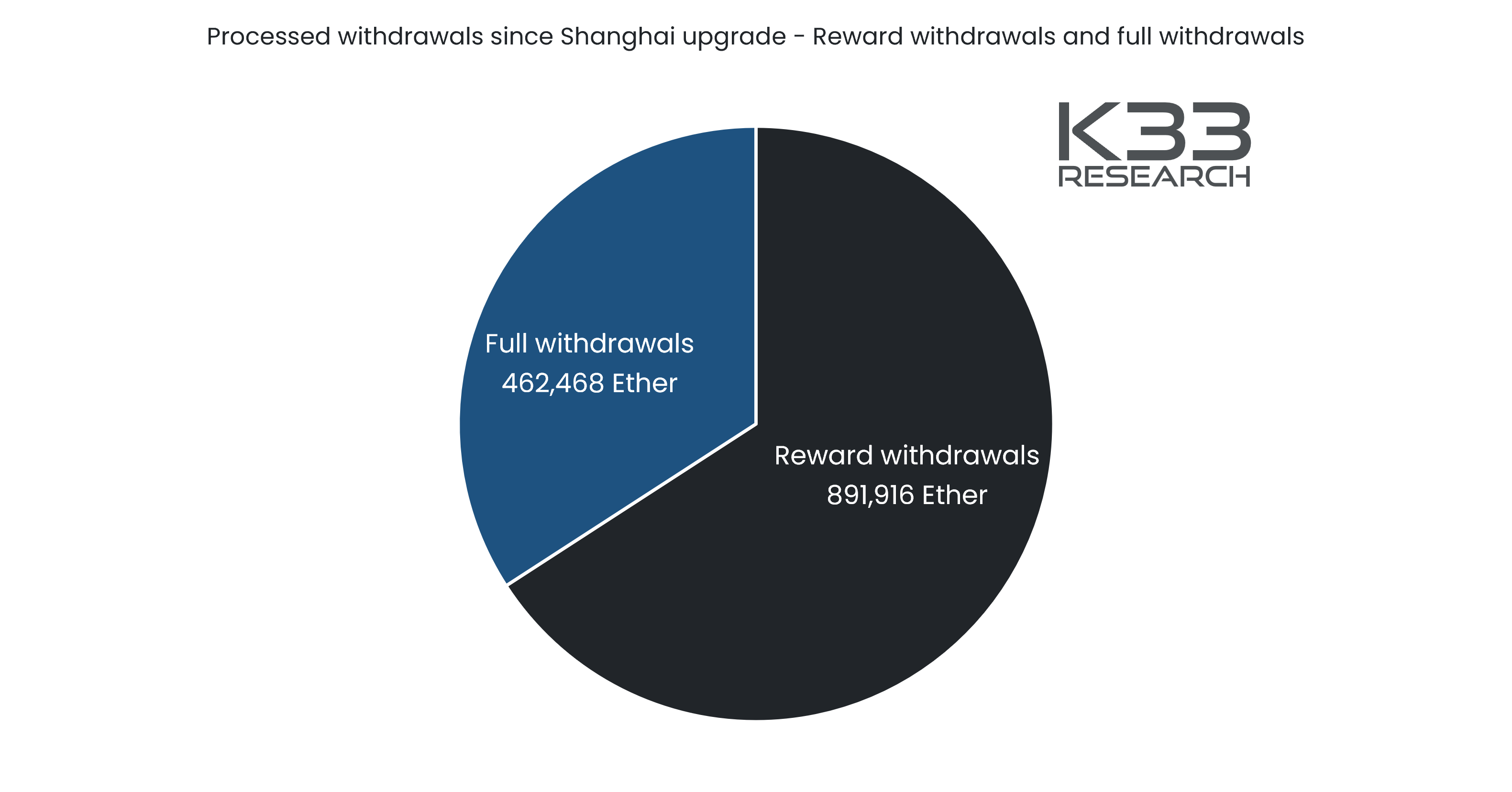

In keeping with a brand new publish from K33 Research (previously Arcane Analysis), almost 1.5 million ETH ($2.8 billion) has been withdrawn since 12 April 2023, when the onerous fork occurred. The pie chart beneath exhibits these withdrawals’ division between full and reward-only ones.

The withdrawals which have taken place because the Shanghai improve | Supply: K33 Research

The “full withdrawals” right here seek advice from withdrawals involving the whole exit of the 32 ETH stack that the validator needed to put into the staking contract originally (which means that after this type of withdrawal, the investor now not stays a validator).

Solely about one-third of the entire withdrawals had been of this sort (round 462,468 ETH); the opposite two-thirds concerned solely the exit of the staking rewards (891,916 ETH).

Now, here’s a chart that breaks down how these reward withdrawals which have taken place since Shanghai evaluate with the gathered rewards but to be touched:

Appears to be like like a majority of the rewards have already been withdrawn | Supply: K33 Research

As displayed within the above graph, the Ethereum staking rewards which have been withdrawn because the Shanghai improve has gone dwell far outweigh these which are nonetheless being taken out. Extra exactly, round 80% of the entire rewards gathered previous to the onerous fork have already been withdrawn.

From the chart, it’s additionally obvious that the rewards amassed throughout the final seven days have been minuscule in comparison with these beforehand gathered.

This might counsel that any extraordinary selling pressure coming into the market because the begin of those withdrawals ought to already be virtually completely exhausted. The identical strain wouldn’t be stored up sooner or later as a result of sluggish tempo of latest rewards being distributed amongst Ethereum validators.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,800, down 8% within the final week.

ETH has plummeted not too long ago | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, K33 Analysis