Evaluating Bitcoin’s Lightning Community to legacy bank card processing makes it clear that Lightning settles funds rather more effectively and affordably.

The article beneath is an excerpt from a current version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The normal use of the Bitcoin community for on-chain settlement is extraordinarily environment friendly by settling transactions roughly each 10 minutes. Bitcoin may be most intently associated to the Fedwire Funds Service which solely settles about 200 million transactions per yr in comparison with Bitcoin’s trailing 1-year determine of 98.5 million transactions.

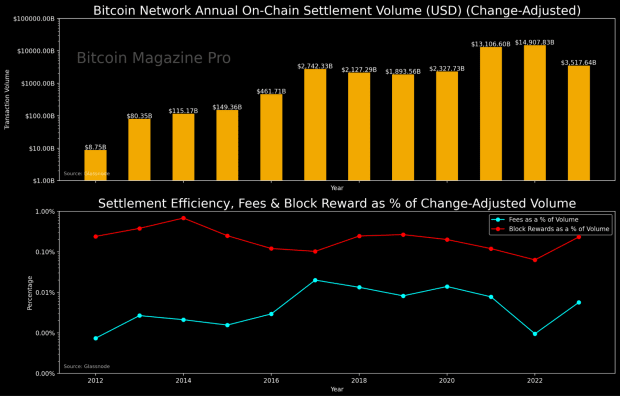

Because it stands at present, the Bitcoin community is on tempo to settle $3.5 trillion value of change-adjusted worth over the course of 2023, for prices of simply $198 million, an equal price price of 0.006% for the common transaction. Whereas common transaction prices are clearly skewed by the most important transfers within the information set, we are able to have a look at the median transaction settlement worth and account for the median transaction price, and nonetheless see that on-chain bitcoin transactions are a tremendously environment friendly approach to ship and obtain worth in a trustless method over the web.

Regardless of bitcoin’s excessive efficiencies as a world immutable settlement community, it remained unideal for minuscule and instantaneous transfers, because the 10-minute block interval goal provides a latency to the settlement of transactions. That is okay for big sums of cash, evidenced by the incumbent monetary system, the place internet settlement of funds between monetary intermediaries typically don’t finalize for days or perhaps weeks on finish — suppose MasterCard or Visa settling their books on a internet foundation with a banking establishment like JPMorgan.

Nonetheless, the necessity for a sound web cash that might settle instantaneously for practically no price was nonetheless there. With the arrival of the Lightning Community, the latency concerned with sending a bitcoin transaction, significantly for micropayment settlements, has all however vanished. This has led to a complete new use case for bitcoin, because the financial medium is now discovering itself being inserted into the tech stacks of internet functions and companies throughout the globe.

As a refresher and overly simplified description, the Lightning Community works by node runners doing an on-chain transaction to open up fee channels with different nodes. This provides liquidity to the community and creates a community of channels when sufficient customers open channels to 1 one other. Lightning funds are despatched from one node and hop throughout different nodes who’ve sufficient liquidity of their channels till the fee reaches its supposed vacation spot.

By doing one on-chain fee to open a channel, funds on the Lightning Community are in a position to transfer with much less friction and settle with out ready for 10-minute intervals between blocks for every transaction, till the channel will get closed with one other on-chain transaction. These channels enable for decrease charges as funds solely pay to hop throughout nodes which have liquidity of their channels.

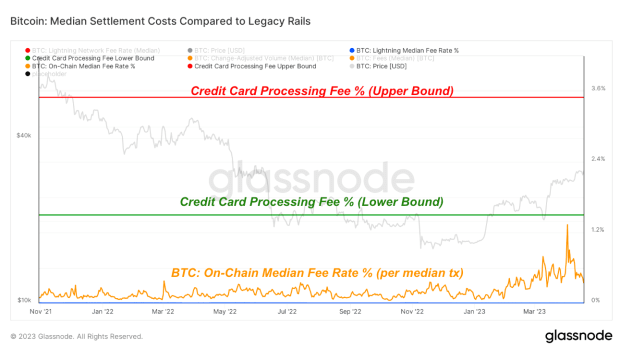

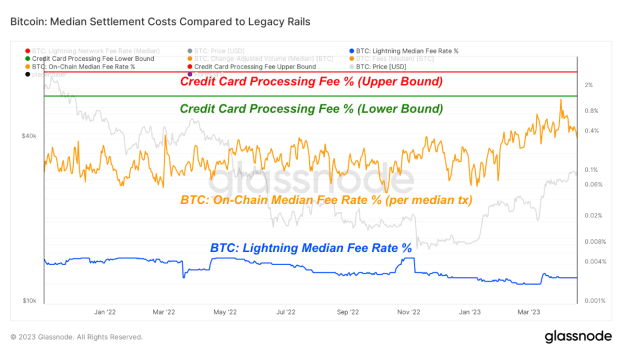

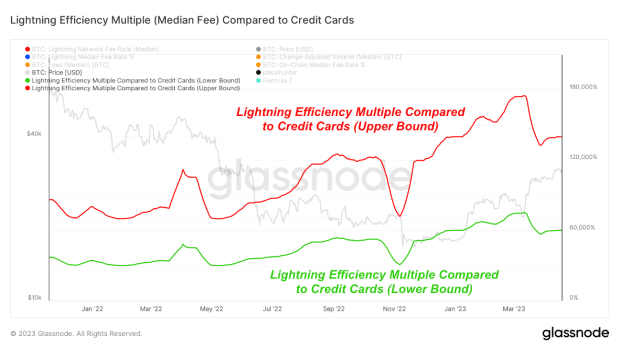

With a refresher on the technical workings out of the way in which, let’s check out the prices of the Bitcoin settlement stack in comparison with present retail settlement choices like bank cards and give attention to the huge effectivity positive aspects of the Lightning Community specifically. Proven beneath, we evaluate the upper- and lower-bound prices of legacy fee processors to the median settlement price of a Bitcoin on-chain transaction — median price paid divided by median transaction quantity — and the Lightning median price price share for sending the equal of 1 BTC.

We acknowledge that the comparability between the median price of a bitcoin on-chain transaction to legacy fee processing prices isn’t fairly an apples-to-apples comparability as a result of bank card processors enable for close to instantaneous funds to be made (however not settled!). That being mentioned, that is the place the huge efficiencies of the Lightning Community come into play.

The identical chart above can also be displayed beneath, in logarithmic scale, to be able to present a extra consultant visible.

The 2 charts above exhibit how rather more cheaply the Lightning Community is settling funds when in comparison with bank card processors.

Sure, legacy fee processors facilitate the switch of trillions of {dollars} a yr, which dwarfs the Lightning Community’s settlement quantity. As a aspect word, it isn’t doable to quantify the switch quantity of Lightning like it’s with on-chain transactions. Given the relative measurement of the Lightning Community, it’s critical to keep in mind that the community has continued to develop exponentially, whereas facilitating instantaneous switch for near-to-no price, all of the whereas rising ever extra related.

Along with cheaper settlement, the Lightning Community can also be facilitating funds 60,000% to 140,000% extra effectively than bank cards.

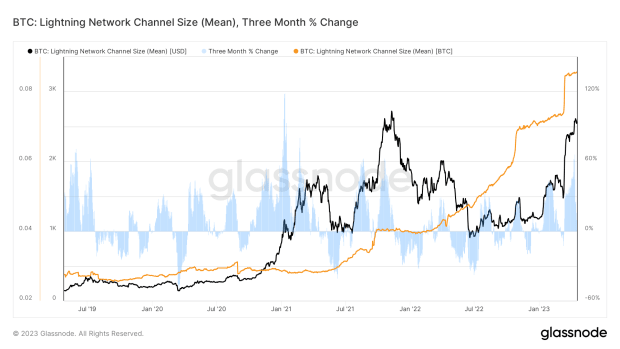

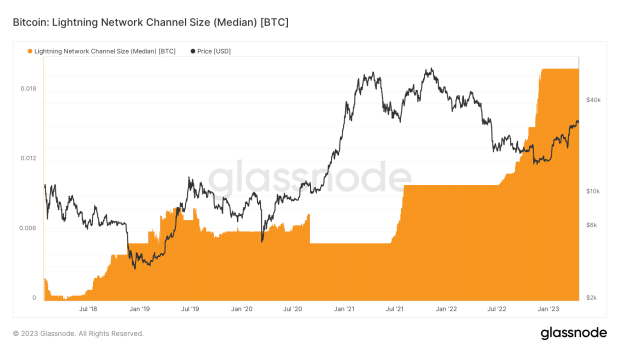

Whereas it might be a little bit of a stretch to instantly evaluate the median lightning fee price to that of a multinational bank card processing agency, significantly given the minuscule micropayments of many Lightning transactions, the character of public Lightning channels and transactions implies that this know-how could be very able to scaling to accommodate a lot bigger transactions if/when wanted. There’s already oblique proof of this taking place with the common measurement of public channels pushing all-time highs in each BTC and USD phrases on the time of writing.

A lot of our current focus has been on the financial alternative of bitcoin when it comes to the overall addressable market of shares, bonds and different shops of worth, however we discover the present improvement and progress of the Lightning Community to be extraordinarily compelling.

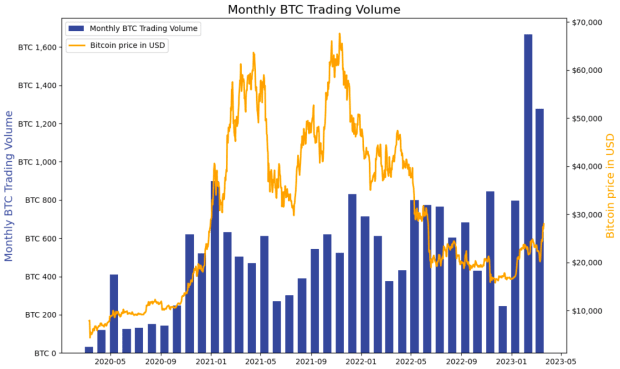

The Lightning Community has a flourishing ecosystem that’s constantly rising, with micropayments being built-in into paywalled media content material, value-for-value platforms, crowdfunding alternatives, tipping on social media (Whats up nostr), bitcoin by-product marketplaces comparable to LN Markets (which is seeing buying and selling volumes at all-time highs) and extra.

Remaining Be aware:

First enabled by the Segwit smooth fork in 2017, the Lightning Community has gone from a conceptual thought to a flourishing international ecosystem within the span of lower than six years. Paying homage to the early days of the web, Lighting Community nodes and person participation has gone from area of interest hyper-technical software program builders to the sting of mainstream adoption in a brief period of time.

Whereas the Lightning Community is probably not headline information, the know-how enabled by Lightning — the flexibility to direct a digitally native bearer asset in a trustless method throughout the web for practically no price — is an especially important improvement within the historical past of fee networks, and it’s the first to take action in an open and decentralized method.

We’re extraordinarily bullish on the continued improvement and adoption of the Lightning Community, and suppose that the arrival of a typical open-standard for sending and receiving internet-native worth instantaneously for terribly low prices could be the killer app that brings bitcoin to a billion individuals.

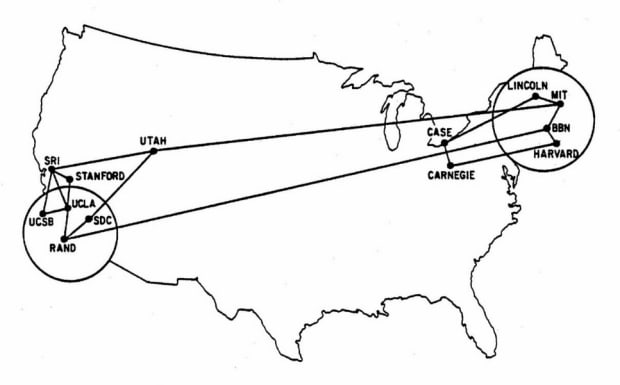

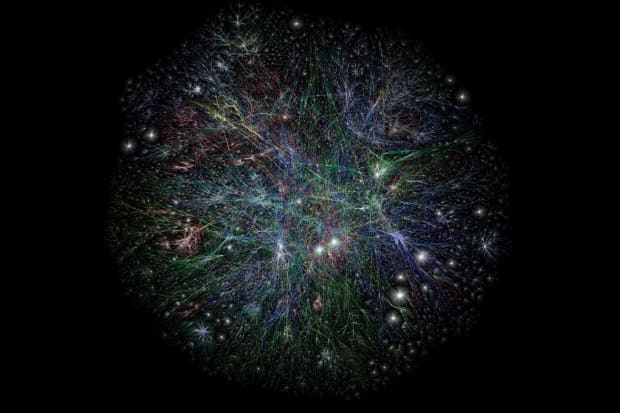

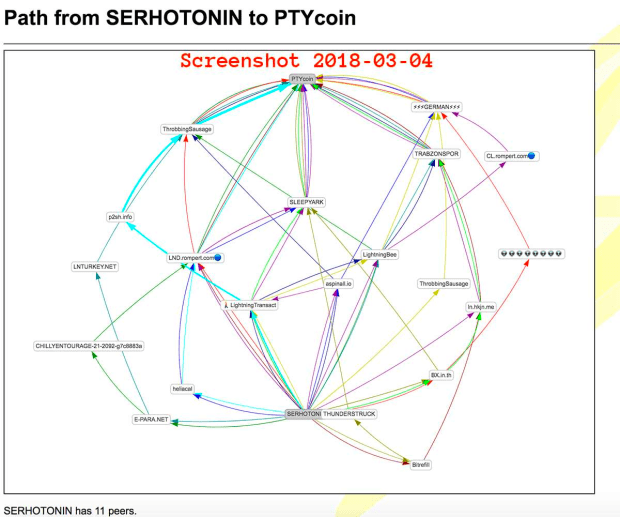

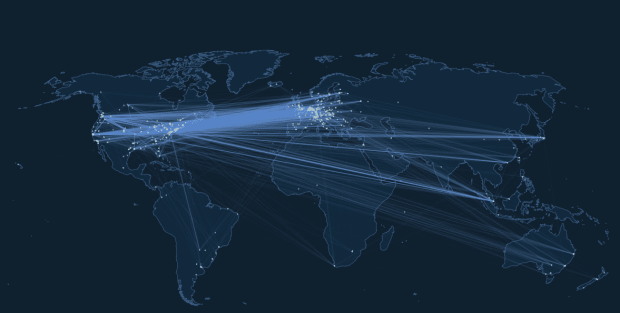

It’s useful to check the early days of the web to the place Bitcoin is in its lifecycle. Wanting on the progress of the 2 networks beneath can provide us a small glimpse into the place Bitcoin and Lightning could also be heading as adoption will increase.

How the web began:

How its going:

How the Lightning Community began:

How its going:

That concludes the excerpt from a current version of Bitcoin Journal PRO. Subscribe now to obtain PRO articles instantly in your inbox.