On-chain knowledge reveals the Ethereum alternate deposits have hit an 8-month excessive, an indication that could possibly be bearish for the cryptocurrency’s worth.

Ethereum Lively Deposits Metric Has Noticed A Surge Lately

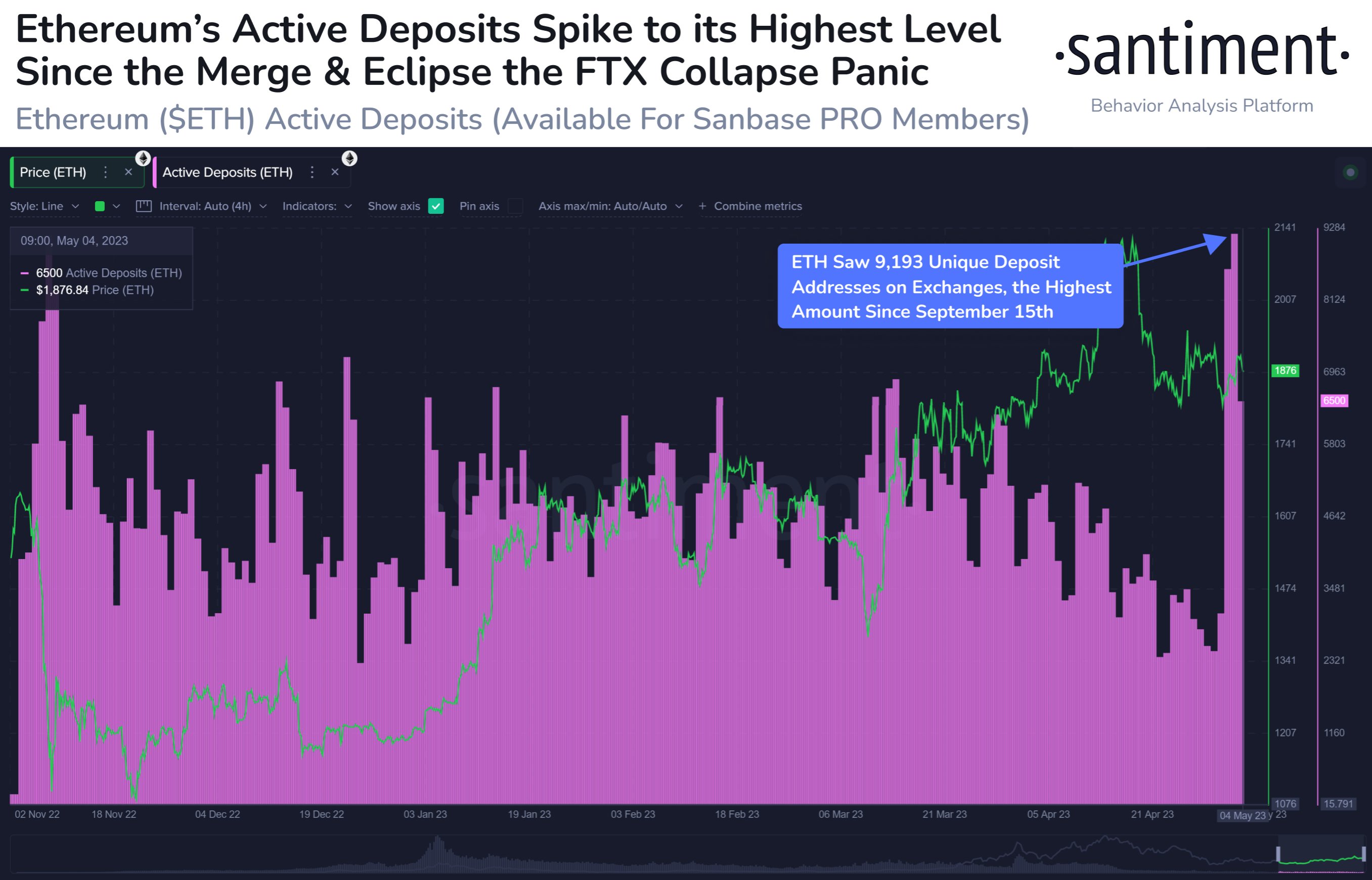

Based on knowledge from the on-chain analytics agency Santiment, the present values of the indicator are the very best for the reason that Merge again in September 2022. The “energetic deposits” is an indicator that measures the overall variety of Ethereum addresses which might be participating in an exchange deposit transaction.

This metric solely tells us in regards to the distinctive variety of such addresses, that means that if an tackle takes half in a couple of deposit transaction, its contribution to the indicator’s worth remains to be just one.

Setting this restriction offers a extra correct illustration of the development within the wider market, because the distinctive variety of addresses could be considered the variety of customers collaborating in these transfers. With out this limitation, only a few merchants making numerous forwards and backwards transactions may skew the metric.

When the indicator has a excessive worth, it means numerous addresses are getting concerned in deposit transactions proper now. As one of many fundamental explanation why traders deposit to those platforms is for selling-related functions, this sort of development can have bearish penalties for the worth.

Alternatively, low values of the metric indicate not many traders are making deposit transfers at present. Such a development can recommend there aren’t many sellers available in the market in the mean time.

Now, here’s a chart that reveals the development within the Ethereum energetic deposits over the previous couple of months:

Seems to be like the worth of the metric has shot up during the last couple of days | Supply: Santiment on Twitter

As displayed within the above graph, the Ethereum energetic deposits have spiked in the course of the previous few days. This implies that a considerable amount of customers have began making deposit transactions to the exchanges not too long ago.

Earlier than this spike, the metric had been in a decline and had hit comparatively low values, implying that the urge for food for utilizing exchanges had been shrinking again then. This surge within the energetic addresses thus indicators a change available in the market mentality.

On the peak of this spike, the indicator assumed a price of 9,193, that means that there have been 9,193 distinctive deposit addresses on exchanges. This degree is the very best the metric has been for the reason that September 2022 “Merge,” which transitioned the community in direction of a Proof-of-Stake (PoS) consensus system.

The present values of the energetic addresses are additionally corresponding to these noticed in the course of the FTX crash again in November 2022. Each these occasions noticed the worth turning into fairly risky, so the indicator having such excessive values proper now can also imply that Ethereum may face related bearish volatility within the close to future.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,900, down 1% within the final week.

ETH has stagnated not too long ago | Supply: ETHUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet