US cryptocurrency exchanges are organising offshore venues in a hunt for abroad prospects and to flee being ensnared in a regulatory blitz from US authorities.

Two of the most important venues, Nasdaq-listed Coinbase and Gemini, have stepped up plans to launch marketplaces exterior the US following enforcement instances towards home crypto corporations.

US regulators have toughened oversight of the digital belongings market following the failure of lenders similar to Celsius Community and FTX, the alternate run by Sam Bankman-Fried. In addition to focusing on people, watchdogs have additionally deemed some merchandise unlawful within the US and compelled corporations to drag profitable enterprise.

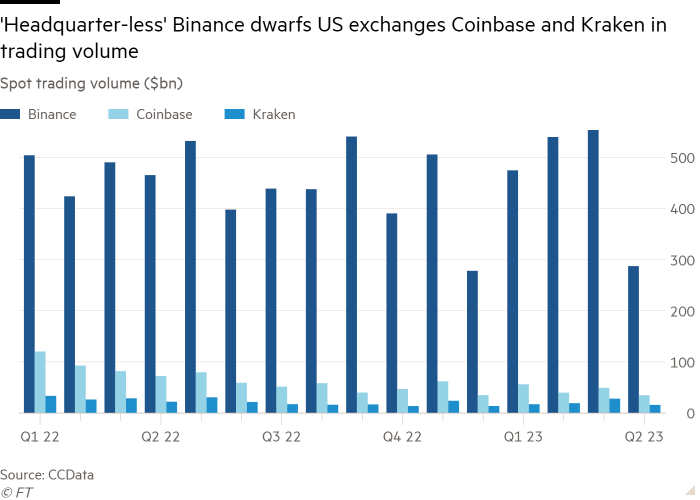

Against this US crypto exchanges’ offshore rivals have been in a position to launch merchandise and take market share with much less worry of reprisal. Binance, which says it has no headquarters, has develop into the world’s largest crypto alternate with every day volumes that dwarf US rivals.

“For crypto corporations attempting to have interaction in compliance, they get punished within the market by opponents that imagine it’s higher to beg for forgiveness than ask for permission,” stated John Reed Stark, former head of the Securities and Alternate Fee’s web enforcement division.

Coinbase stated securing a licence in Bermuda would improve “financial freedom and alternative” for its prospects. However the US crackdown has additionally heightened buyers’ nerves about utilizing the US market.

Because the begin of the 12 months Kraken agreed to finish its staking enterprise within the US, through which prospects conform to lock up their tokens in different crypto tasks in return for a excessive yield, as a part of a settlement with the SEC.

Paxos shut down additional issuance of BUSD, the Binance-branded stablecoin, a token used to assist merchants transfer extra shortly out and in of the crypto market; the SEC warned Coinbase it could face an enforcement motion; and Bakkt shortly delisted 25 of the 36 obtainable tokens on buy of Apex Crypto, citing “regulatory steerage”.

Digital belongings dashboard

Click on here for real-time knowledge on crypto costs and insights

As uncertainty lingers, US marketplaces are shedding floor to offshore rivals. Since January Coinbase’s share of the spot crypto market has virtually halved to five per cent, based on knowledge from Kaiko. Binance gained 30 per cent, partly on the again of free buying and selling.

Smaller rivals similar to Turkish crypto platform BtcTurk, Korea’s UpBit and EU-based Bitpanda have recorded double-digit features in cumulative commerce quantity within the first 4 months of 2023, in comparison with the earlier four-month interval. Coinbase and Gemini have declined in the identical interval, Kaiko additionally discovered.

With out frequent international requirements, exchanges are wanting all over the world for a beneficial regime as a base for his or her development plans. From offshore areas Coinbase and Gemini will each launch perpetual futures, a sort of spinoff extensively favoured by common merchants, and a supply of earnings for corporations similar to Binance.

“Regulation and requirements for this market have been rolled out in a different way in several markets, in some instances there’s bespoke regimes, in some instances there’s no regime . . . it’s all very a lot a shifting goal at this second in time,” Eva Gustavsson, head of public affairs at digital belongings firm Copper.co, informed an FT convention final week.

The kind of cash mostly utilized in crypto markets has additionally flowed out of the US in current months. Most every day buying and selling is completed by means of shopping for and promoting standard tokens similar to bitcoin with stablecoins like tether. Stablecoins are usually pegged to the world’s greatest currencies and act as a bridge between crypto and conventional markets.

Since January the market share of British Virgin Islands-registered Tether has risen by a fifth to $82bn, representing greater than 60 per cent of the market.

In distinction Circle, a stablecoin issuer that holds an array of US cash transmitter licenses, has misplaced a 3rd of its market share in the identical interval. Solely $30bn of Circle’s USDC cash at the moment are in circulation.

Hester Peirce, an SEC commissioner, argued strong US guidelines for governing crypto would reverse the stream, as investors would be attracted by predictable guidelines.

“When you might have . . . central corporations which can be coping with prospects, it’s very seemingly you’re going to wish to have some regulatory regime round them since you discover out that centralised corporations do the identical sort of dastardly issues whether or not or not they’re in crypto or one thing else.”

However many crypto executives acknowledge there are limits to escaping US guidelines.

“Crypto companies contemplating offshore areas like Bermuda in response to intensifying regulation might view this as an interesting short-term resolution . . . if you wish to serve the US market, then you should work with US regulators,” stated Thomas Hook, chief compliance officer at Bitstamp, an Austrian alternate.

Furthermore the legal costs introduced towards some of FTX’s senior management, and civil charges against Binance for illegally serving US prospects, underscore how US authorities have lengthy prolonged their attain throughout borders, when it impacts shoppers or the greenback.

“US regulation may be very clear on this: you could be a international entity however as quickly as you contact American prospects you might have established jurisdiction for US regulatory businesses, interval,” stated Charley Cooper, former chief of workers on the Commodity Futures Buying and selling Fee.

Click here to go to Digital Asset dashboard