Right here’s the on-chain indicator which will have foreshadowed the current dip within the value of Ethereum under the $1,800 degree.

Ethereum Has Plunged After Multi-Collateral Dai Repaid Metric Spikes

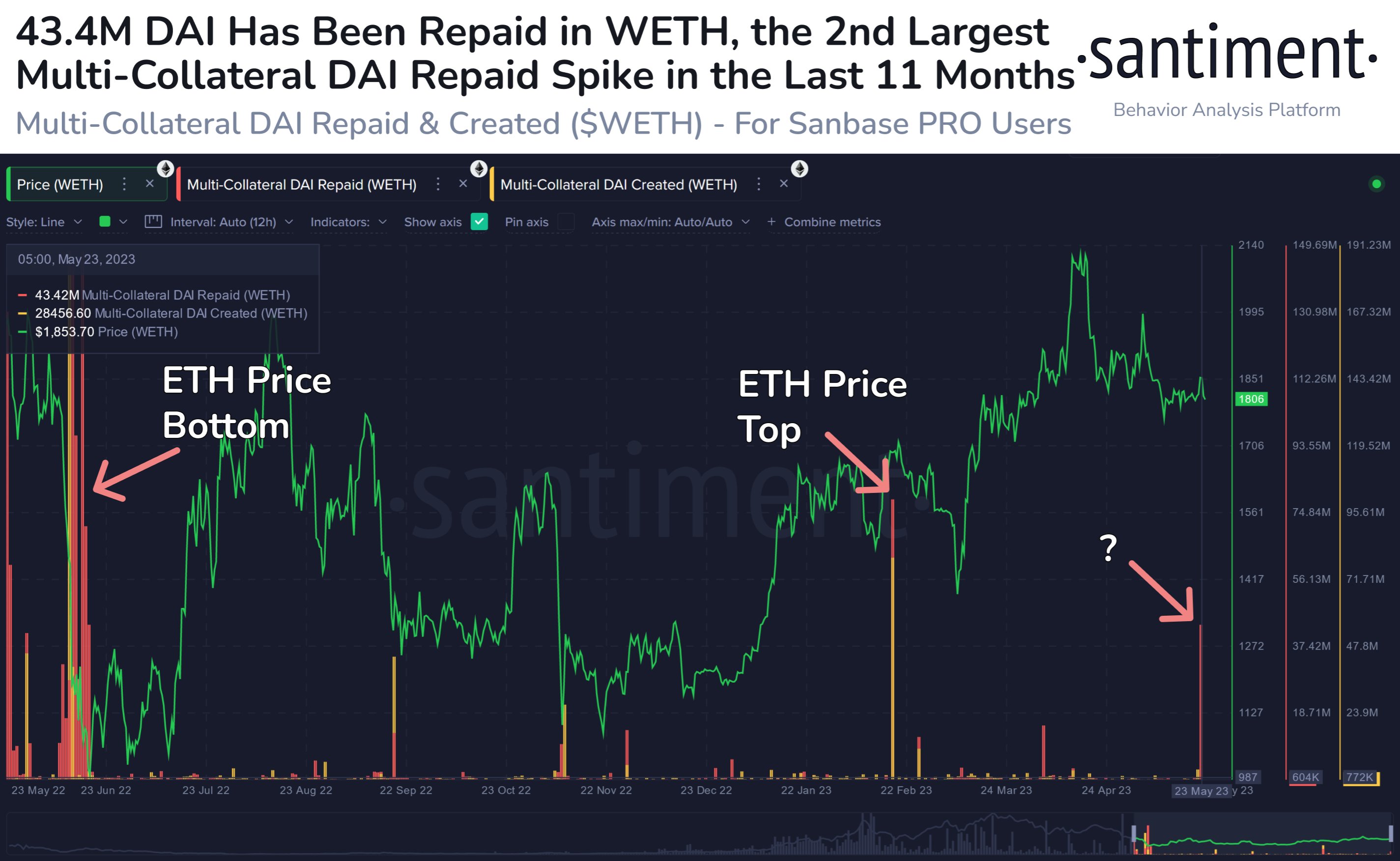

In accordance with information from the on-chain analytics agency Santiment, 43.4 million Dai was repaid in Wrapped ETH (WETH) through the previous day. Multi-Collateral Dai (DAI) is a decentralized stablecoin constructed on the Ethereum blockchain that’s smooth pegged to the US Greenback, which means that its worth stays fastened at $1.

The coin is named multi-collateral as a result of it’s backed by a mixture of cryptocurrencies. An earlier model of the coin was Single-Collateral Dai (SAI), and it was solely backed by one asset.

When Dai is minted (that’s, new cash enter into circulation), customers should deposit their collateral into the sensible contract vaults. Within the context of the present dialogue, the stablecoin tokens minted utilizing WETH as collateral are of curiosity.

The “Multi-Collateral DAI created” is an indicator that measures the whole quantity of cash of the stablecoin which can be being minted utilizing WETH proper now. The counterpart metric of this indicator is the “Multi-Collateral DAI repaid,” which naturally tracks the cases of WETH being returned after the issued tokens are destroyed.

Here’s a chart that exhibits the development in these two Wrapped Ethereum indicators over the previous 12 months:

One of many metrics appears to have noticed a big worth in current days | Supply: Santiment on Twitter

As you possibly can see within the above graph, Santiment has highlighted an attention-grabbing sample that the Ethereum value has adopted in response to spikes within the Multi-Collateral Dai repaid indicator.

It seems like at any time when a considerable amount of Dai has been destroyed to launch WETH, the worth of the cryptocurrency has registered both a prime or a backside. Previously 12 months, there have been two cases of this development.

The primary of them happened nearly one 12 months in the past, proper after the ETH value crashed because of the 3AC bankruptcy. This spike coincided with the underside formation of the cryptocurrency.

The opposite one was earlier in February of this 12 months and in contrast to the primary one, this spike coincided with the asset forming a neighborhood prime.

Lately, the indicator has as soon as once more noticed a big spike, which means that somebody has withdrawn a considerable amount of the wrapped type of Ethereum that was beforehand getting used to again Dai tokens.

In whole, 43.4 million DAI has been destroyed with this newest spike. That is the third largest that the indicator’s worth has been through the previous 12 months and solely the aforementioned cases of the metric registered withdrawals of bigger scales.

If the sample of the earlier spikes holds any weight in any respect, then the present Dai WETH repayments can also result in Ethereum observing both a neighborhood prime or a neighborhood backside.

Yesterday, Ethereum plunged under the $1,800 degree, so maybe the decline was because of the indicator’s spike. Immediately, nevertheless, the cryptocurrency has already rebounded again above this degree, so it’s exhausting to say whether or not the metric’s affect is already achieved with, or if the actual impact is but to return.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,800, down 1% within the final week.

ETH has already recovered at this time | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web