On-chain knowledge from Santiment reveals that Bitcoin sharks and whales have gone on a 93,000 BTC shopping for spree because the native high again in April.

Bitcoin Sharks & Whales Have Accrued Since The April Prime

In line with knowledge from the on-chain analytics agency Santiment, these holders have turn into a bit extra cautious in the previous couple of weeks. The related indicator right here is the “Provide Distribution,” which measures the full quantity of Bitcoin that every pockets group available in the market is holding proper now.

The addresses are divided into pockets teams primarily based on the full variety of cash that they’re carrying of their balances presently. The 1-10 cash cohort, for instance, contains all buyers which are holding not less than 1 and at most 10 BTC.

Within the context of the present dialogue, there are two investor teams which are of curiosity: the “sharks” and the “whales.” The previous of those is a cohort that features the buyers holding a average quantity of cash, whereas the latter contains giant holders.

As a result of quantity of provide that the mixed wallets of those teams maintain, they are often fairly influential available in the market. Naturally, the whales are the extra highly effective entities, as they maintain considerably bigger quantities.

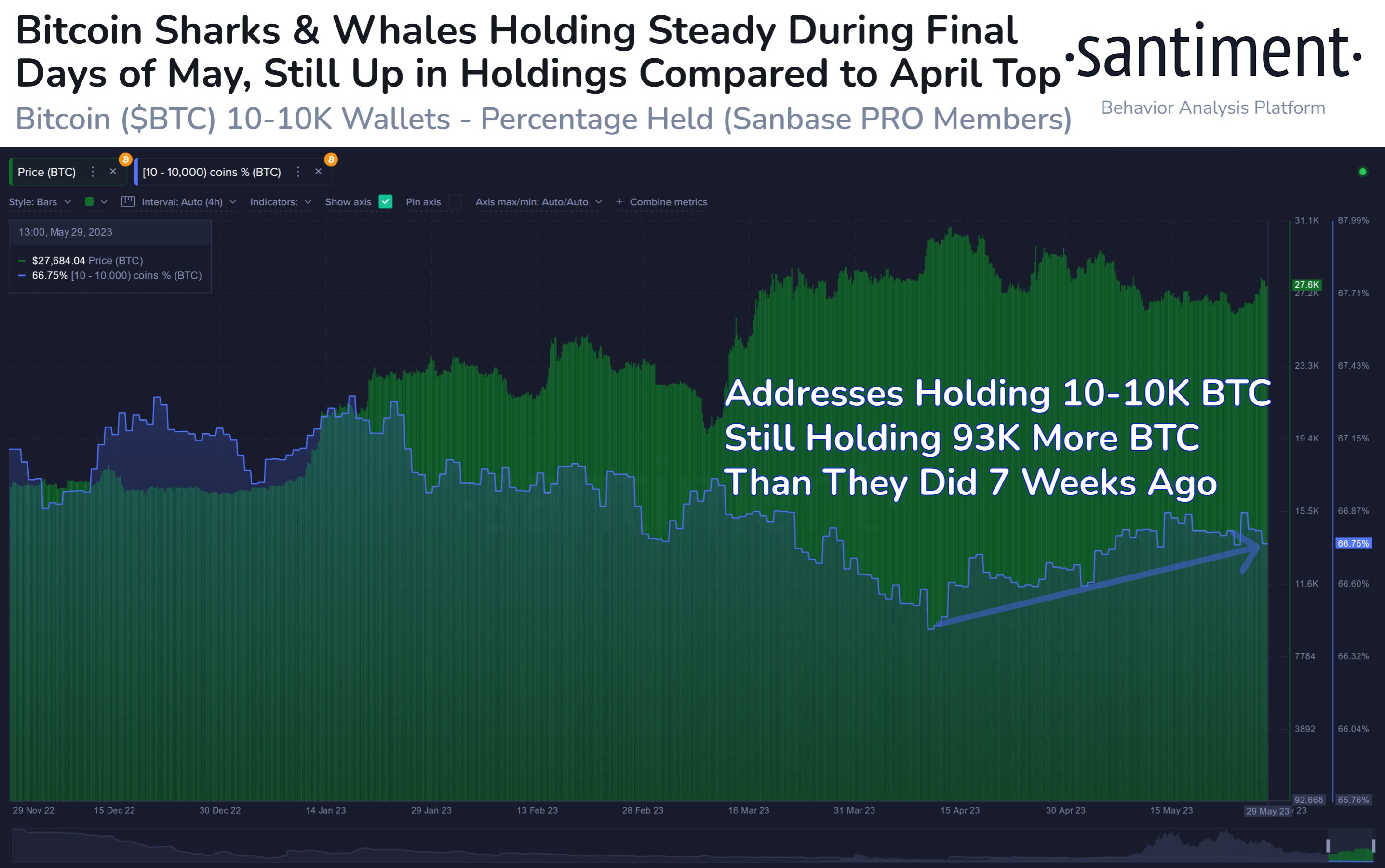

Right here, Santiment has outlined the mixed pockets ranges of those sharks and whales as 10-10,000 BTC. Here’s a chart that reveals the development within the Provide Distribution of this deal with group over the previous couple of months:

The worth of the metric appears to have been climbing prior to now month or so | Supply: Santiment on Twitter

From the above graph, it’s seen that the mixed holdings of the Bitcoin sharks and whales began observing some decline when the surge passed off again in March.

As these buyers have been distributing, the worth moved largely sideways, implying that it was this promoting from these cohorts which will have slowed down the rally. Then, in the midst of April, because the cryptocurrency hit an area high across the $31,000 mark, the availability of the sharks and whales conversely reached an area backside.

These buyers then started to build up, because the asset’s worth registered a downtrend. This sample would indicate that these holders well started to take the chance provided by the dips to purchase once more.

Since this shopping for began following the native high in April, the Bitcoin sharks and whales have added a complete of about 93,000 BTC ($2.6 billion on the present change charge) to their wallets.

In current weeks, nonetheless, their provide has gone stagnant because the asset has confronted some struggle. This new sideways development of the indicator could also be an indication that these giant buyers at the moment are cautious in shopping for extra, as they’re uncertain about the place the coin might go subsequent.

Bitcoin has tried to mount collectively a transfer prior to now couple of days, and to date, these buyers haven’t proven any vital response to it. Naturally, if they begin accumulating once more, it could be a sign that they’re supportive of the surge.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,900, up 2% within the final week.

BTC has made a restoration push | Supply: BTCUSD on TradingView

Featured picture from Jake Gaviola on Unsplash.com, charts from TradingView.com, Santiment.internet