A few of the finance trade’s best-known names are constructing their very own digital markets buying and selling platforms, betting that fund managers will favor acquainted and trusted manufacturers to the opaque cryptocurrency exchanges that dominate the sector.

Customary Chartered, Nomura and Charles Schwab are among the many conventional monetary establishments which can be creating or backing new, separate crypto corporations, together with alternate and custody teams that may deal with digital tokens reminiscent of bitcoin and ether.

The established corporations are wagering that fund managers are nonetheless eager on buying and selling crypto, even after costs crashed final yr and a string of corporations — together with crypto alternate FTX and lenders Celsius and Voyager — failed.

For asset managers, the collapses have underscored the dangers of placing cash into companies which can be largely unregulated and face questions over their transparency. Many are demanding assurances that their cash is protected earlier than they begin buying and selling crypto.

“The massive, pedigreed, conventional institutional traders undoubtedly favor coping with counterparties who they know have been in existence for years and have been regulated within the conventional sense,” mentioned Gautam Chhugani, senior analyst of world digital belongings at Bernstein.

Crypto’s attract comes after the value of fashionable cash bitcoin and ether have risen by about 68 per cent and 56 per cent, respectively, this yr, in contrast with an 8.8 per cent rise within the MSCI World Index.

“Numerous institutional gamers are testing totally different bits of exercise to check the waters, construct a little bit of expertise available in the market but in addition . . . ensuring they’ve an possibility for additional development avenues,” mentioned Alexandre Birry, chief analytical officer for monetary companies at S&P World Scores.

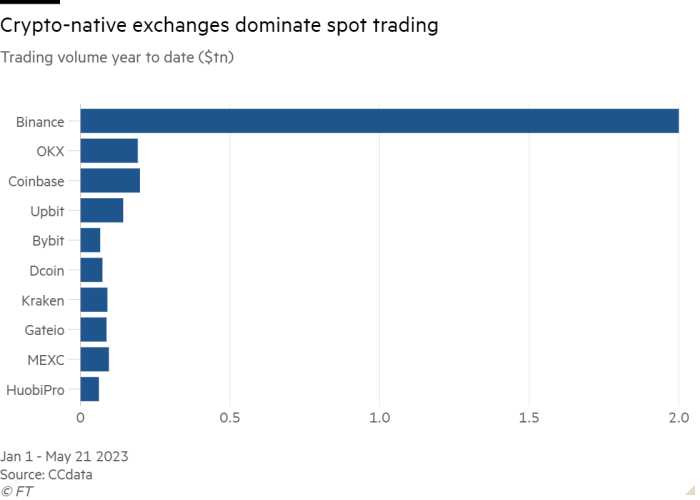

The newcomers are breaking right into a market dominated by corporations reminiscent of Binance and Coinbase, which have their very own institutional clients.

However they’re betting that their finance trade experience and their reputations, unsullied by the wave of crypto scandals and enforcement actions from US regulators, will show persuasive.

Dealer Charles Schwab and market makers Citadel Securities and Virtu Monetary are among the many teams backing EDX Markets, whereas UK lender Customary Chartered has supported alternate Zodia Markets and custody home Zodia Custody.

“They needed to construct an alternate they felt comfy buying and selling on,” mentioned Jamil Nazarali, head of EDX Markets and former Citadel Securities govt.

The infrastructure being constructed by massive establishments is markedly totally different to the crypto trade’s unique construction. Wall Avenue executives are eager to separate enterprise models reminiscent of buying and selling from custody, as a method to cut back danger and potential conflicts of curiosity.

The collapse of Sam Bankman-Fried’s FTX alternate and buying and selling agency Alameda Analysis, which had been carefully entwined, has introduced these issues to the fore.

Custody, the place belongings are saved securely to guard funds from hacks or theft, has emerged as essentially the most easy approach for conventional finance teams to develop their crypto presence.

“I don’t need my custody to be run by the identical particular person as my alternate,” mentioned Michael Safai, co-founder of buying and selling agency Dexterity Capital, including that the extent to which some corporations didn’t separate such capabilities “isn’t interesting, and it’s even a bit unsettling”.

BNY Mellon and Constancy have already got their very own digital asset custody arms and US inventory alternate Nasdaq is awaiting approval from US regulators with a purpose to launch its personal service.

A survey of 250 asset managers revealed this month by consultancy EY-Parthenon discovered that half of them would swap from a crypto-native group to a traditional-backed firm that provided the identical companies. Furthermore, 90 per cent mentioned they’d belief a standard monetary group to behave as custodian of their crypto tokens.

S&P’s Birry mentioned crypto custody was typically step one as a result of “it’s safer and foundational. It’s a low-margin exercise, you need to do two or three duties and you need to do it effectively”.

If Wall Avenue-backed crypto corporations do reach attractive institutional asset managers, that will pose a problem to the dominance of incumbent crypto exchanges reminiscent of Binance or Coinbase.

Jez Mohideen, chief govt of Laser Digital, a crypto buying and selling and enterprise capital group owned by Nomura, mentioned some exchanges had been “not offering finest execution or finest costs” and that additional involvement of conventional establishments in crypto would result in “extra transparency and extra convergence in pricing”.

Nevertheless, Bernstein’s Chhugani mentioned that current crypto exchanges remained a key supply of liquidity. “Buying and selling desks supply liquidity from these exchanges,” he mentioned, including that it will take time for brand new corporations to realize market share.

The Wall Avenue-backed companies are constructing their infrastructure alongside extra conventional strains. Nazarali mentioned EDX had purposely not constructed its venue on cloud computing expertise, as different crypto exchanges had executed. He mentioned the cloud had helped the established crypto exchanges scale “very, very quick”, however that it was too gradual and unreliable for skilled merchants.

“Market makers hate that, that creates a whole lot of danger for them, they will’t quote as tight costs,” he added.

Because the smoke clears, some executives see two markets growing; a shallower, retail-facing one with large discrepancies between shopping for and promoting costs, and a deep institutional one, the place costs are extra aggressive.

Usman Ahmad, chief govt of Zodia Markets, mentioned that, because the crypto trade developed, it “might result in a disparity of spreads between establishments and retail [and lead to] establishments paying a tighter unfold in a extra liquid market”.

“It’s going to be a two-tier construction with Binance being the face of retail,” mentioned Chhugani.

Local weather Capital

The place local weather change meets enterprise, markets and politics. Explore the FT’s coverage here.

Are you interested by the FT’s environmental sustainability commitments? Find out more about our science-based targets here