Bitcoin has plunged over the past 24 hours and now finds itself on the $26,200 stage. Right here’s why this stage is necessary for the asset.

Bitcoin 200 WMA & 111 DMA Are Each At $26,200 Proper Now

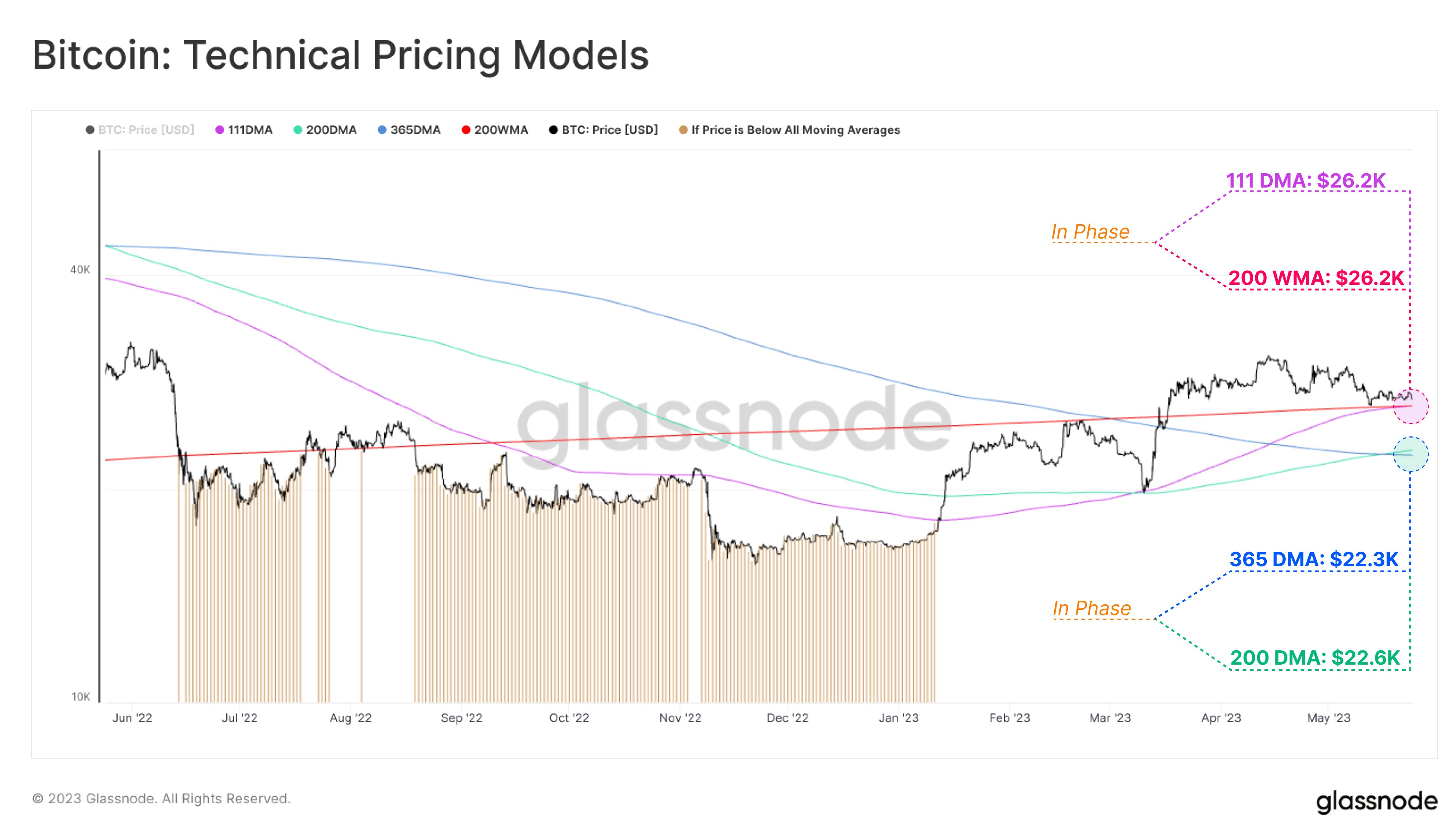

In a brand new tweet, the analytics agency Glassnode has talked about how the totally different technical pricing fashions for Bitcoin could also be interacting with the asset’s value at present.

There are 4 related technical pricing fashions right here, and every of them is predicated on totally different moving averages (MAs) for the cryptocurrency.

An MA is a instrument that finds the common of any given amount over a specified area, and as its identify implies, it strikes with time and adjustments its worth in accordance with adjustments in stated amount.

MAs, when taken over lengthy ranges, can easy out the curve of the amount and take away short-term fluctuations from the information. This has made them helpful analytical instruments since they will make learning long-term traits simpler.

Within the context of the present matter, the related MAs for Bitcoin are 111-day MA, 200-week MA, 365-day MA, and 200-day MA. The primary of those, the 111-day MA, is named the Pi Cycle indicator, and it usually finds helpful in figuring out brief to mid-term momentum within the asset’s worth.

The 200-week MA is used for locating the baseline momentum of a BTC cycle as 200 weeks are equal to nearly 4 years, which is about what the size of BTC cycles within the widespread sense is.

Here’s a chart that reveals the pattern in these totally different Bitcoin technical pricing fashions over the previous yr:

Appears to be like like pairs of fashions have come collectively in part in current weeks | Supply: Glassnode on Twitter

As proven within the above graph, these totally different Bitcoin pricing fashions have taken turns in offering assist and resistance to the value throughout totally different durations of the cycle.

For instance, the 111-day MA changed into assist not too long ago, as the value rebounded off this stage again in the course of the plunge in March of this year, as might be seen within the chart.

The 111-day and 200-week MAs have not too long ago come into part, as each their values stand at $26,200 proper now. That is the extent that Bitcoin has been discovering assist at in current days, so it might seem that the bottom fashioned by these traces could also be serving to the value at present.

Glassnode notes that if a break under this area of assist takes place, the following ranges of curiosity might be the 365-day and 200-day MAs. The previous of those merely characterize the yearly common value, whereas the latter metric is named the Mayer Multiple (MM).

The MM has traditionally been related to the transition level between bullish and bearish traits for the cryptocurrency. When the 111-day MA offered assist to the value again in March, the metric had been in part with the MM.

From the graph, it’s seen that the 365-day and 200-day MAs have additionally curiously discovered confluence not too long ago, as their present values are $22,300 and $22,600, respectively. This could suggest that between $22,300 and $22,600 stands out as the subsequent main assist space for the asset.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,200, down 4% within the final week.

BTC has plunged in the course of the previous day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com