Bitcoin’s sturdy bounce again regardless of the SEC lawsuits has made analysts optimist in regards to the starting of the following bull run.

After dealing with sturdy promoting strain earlier this week, the world’s largest cryptocurrency Bitcoin (BTC) has given a robust bounceback right now transferring nearer to $27,000. As of press time, BTC is buying and selling 3.2% up at a worth of $26,603 and a market cap of $515 billion. The current bounce again has created optimism amongst Bitcoin fanatics with analysts turning bullish on the crypto as soon as once more. Former BitMEX CEO Arthur Hayes not too long ago tweeted that it’s time to hitch the following bull run for Bitcoin.

“The wall of fear is being climbed, include me on the $BTC bull market bus. We’re nonetheless on battle avenue, however the moon ain’t distant,” wrote he.

Earlier this week, Bitcoin (BTC) and the broader crypto market got here below main promoting strain following the SEC lawsuit on crypto change Binance. Quickly after, crypto change Binance noticed huge withdrawals on the platform, pushing the BTC worth all the best way below $26,000.

Right this moment’s bounceback, nonetheless, brings attention-grabbing technical chart patterns into the image. Widespread crypto analyst Ali Martinez wrote:

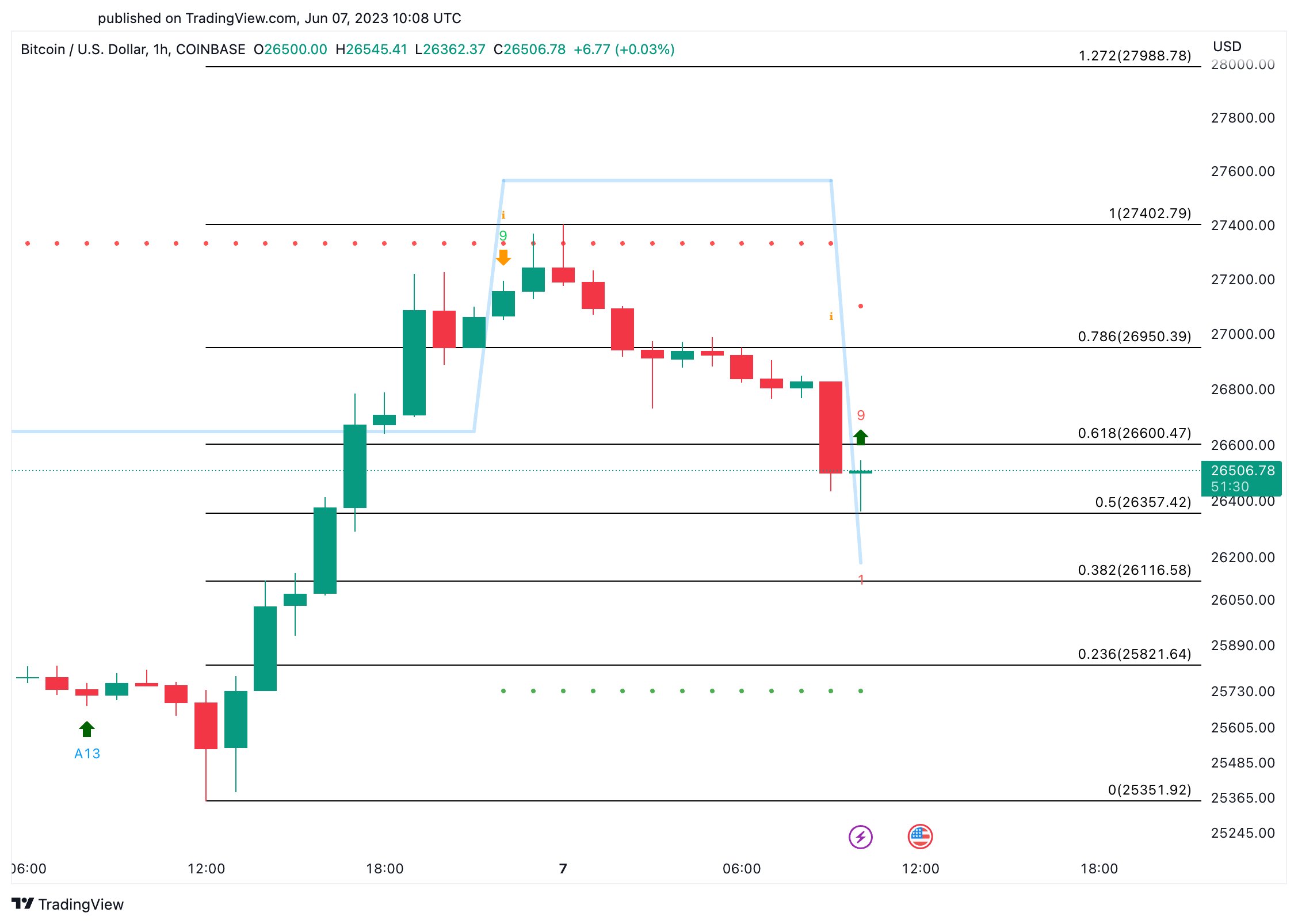

“The TD Sequential presents a purchase sign on the hourly chart, which may see $BTC rebound to $27,000 – $27,300. Nonetheless, #BTC should keep away from an hourly shut beneath $26,360 as a result of it may result in a downswing to $25,800.”

- Photograph: TradingView

Equally, widespread analyst Michael Van de Poppe noted:

“Nice transfer of #Bitcoin, however you’d ideally wish to see it maintain above $26,100 to keep away from a cascade. If $26,100 is misplaced, that’s the set off that we’ll be shedding the 200-Week MA on the Whole Market Cap of #Crypto too.”

Merchants Liquidate Shorts, However the Dips

The current surge within the Bitcoin worth and crypto market reveals that buyers are keen to look previous the SEC’s regulatory actions on Binance and Coinbase. Amid the V-shaped restoration within the Bitcoin worth, merchants needed to liquidate many brief positions. On-chain information supplier Santiment reports that”merchants had many #liquidated #shorts right now after displaying some over-eagerness to guess towards markets. The most important shorts in 3 months acted as rocket gas as $BTC jumped again above $27k. We noticed an identical worth bounce when merchants shorted on March tenth.

However, the investor’s curiosity in shopping for the dip shot up because the crypto costs corrected closely. Because the US SEC picks up the battle with the highest two crypto buying and selling platforms, it will likely be attention-grabbing to see what lies forward.

The lawsuits’ outcomes have the potential to determine an important precedent for cryptocurrencies. If the courts aspect with the SEC and classify quite a few digital belongings as securities, it may result in a considerable transformation in cryptocurrency regulation, probably granting the SEC authority over them.

Bhushan is a FinTech fanatic and holds an excellent aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in the direction of the brand new rising Blockchain Know-how and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and generally discover his culinary abilities.