Obtain free Cryptocurrencies updates

We’ll ship you a myFT Day by day Digest electronic mail rounding up the newest Cryptocurrencies information each morning.

Whats up and welcome to the newest version of the FT’s Cryptofinance e-newsletter. This week, Coinbase invokes nationwide safety issues.

I’m coming to you this week from New York, the place I attended The State of Crypto Summit, an occasion hosted by Coinbase in partnership with the Monetary Instances.

The crypto alternate has a long-running and deep distinction of opinion with the Securities and Change Fee over crypto regulation. That relationship hit a brand new low this month when the SEC mentioned Coinbase was in violation of a number of federal securities legal guidelines, most notably working an unregistered securities alternate. Coinbase disagrees with the SEC’s interpretation and has mentioned it should battle the lawsuit.

For some, the SEC case — which is analogous to expenses the company laid towards each Binance and Bittrex — represents an existential threat for each Coinbase and the US crypto trade. If the SEC wins, that may hit the vast majority of Coinbase’s income. There was hypothesis Coinbase and others will probably be pushed offshore, unable to function within the US.

In any case, if a San Francisco firm with an American chief govt that trades on the Nasdaq can’t survive the SEC’s assault, what hope do smaller corporations have?

However Brian Armstrong, Coinbase’s chief govt, thinks there’s another excuse folks ought to care deeply about the place the US and its regulators are going.

“I do assume it’s a nationwide safety threat for the US . . . that is a very powerful expertise to replace the monetary system,” Armstrong instructed me throughout a quick sit-down interview between panels.

“If different international locations seize that chance, long run, it places in danger the US greenback as a reserve forex, it places in danger the flexibility for the US to do sanctions, it places in danger the flexibility for the US to have smooth energy with expertise corporations,” he added.

It’s a lofty self-assessment to see your self within the vanguard of America’s future safety. Particularly when one considers that the US has repeatedly proven it should go after actors perceived to be a nationwide safety menace, no matter whether or not they exist onshore or offshore.

This yr the US arrested the Russian founding father of crypto alternate Bitzlato, described as a “essential monetary useful resource” to the darkish internet. It used a strong new part of the Combating Russian Cash Laundering Act, highlighting the seriousness with which the US is treating crypto-related exercise.

Authorities have additionally gone after crypto mixing service Twister Money, which served as a software for North Korea-backed legal teams to scrub illicit funds by disguising the audit path of crypto funds.

There’s additionally little proof as but that crypto is wherever close to updating the monetary system. Most likely probably the most high-profile try to date was the trouble by ASX, the Australian inventory alternate, to make use of a distributed ledger because the spine for commerce settlement. It failed after seven years of making an attempt. Proper now, the one factor that appears like being improved is the inefficiency of the crypto system.

So I requested the Coinbase chief to increase on his rationale: why would a departing American crypto trade hamstring the federal government’s efforts to maintain the nation protected?

“The most important tech corporations bought constructed within the US, and they need to ensure that the most important crypto corporations get constructed within the US, in any other case it’s going to be like 5G or semiconductors, the place there’s going to be some main initiative in 5 years that [creates] an emergency,” he mentioned.

Presumably, though proudly owning the mental property and manufacturing functionality for a microchip is hardly the identical as possession of a market that kinds itself as extremely decentralised.

However Coinbase’s pushback towards the SEC does elevate a problem that may have to be addressed sooner or later. Will there be a manner for a US client to commerce crypto and never fear that they’re not directly contributing to terrorism financing, the drug trade or nuclear weapons constructing?

“The most effective step that we might take as a rustic to guard shoppers, shield the trade, and to guard america, could be to make sure that there’s compliance with US anti cash laundering and counter-terrorism financing requirements,” mentioned Courtney Simmons Elwood, who served on the CIA earlier than turning into a regulatory adviser for Coinbase Asset Administration.

What’s your tackle the nationwide safety angle to crypto? As all the time, electronic mail me your ideas at scott.chipolina@ft.com.

Weekly highlights

-

Examine how the Matt Damon-endorsed and Singapore-based crypto alternate, Crypto.com, deploys inside groups to commerce cryptocurrencies for revenue, on this great scoop by my colleague Nikou Asgari. Crypto.com mentioned its observe was not controversial.

-

A complete of $200mn in charges has been racked up by legal professionals and others engaged on the FTX chapter, in keeping with impartial auditor Katherine Stadler. Legislation agency Sullivan & Cromwell pocketed greater than $40mn inside the first three months of FTX’s chapter submitting, whereas administration consultants Alvarez & Marsal — performing as monetary advisers to FTX debtors — have invoiced nearly $28mn. Try the story here.

-

Bitcoin, the trade’s flagship cryptocurrency, out of the blue surged increased and broke through the $30,000 stage, which many crypto-punters think about to be an necessary psychological milestone for the coin. It’s solely the second time bitcoin has reached the determine this yr.

-

Additionally in the course of the week BitGo, the digital asset custodian, known as off its proposed buy of Prime Belief. The latter is likely one of the few “crypto-friendly” US monetary establishments with some regulatory approvals to function within the conventional US banking and funds system. Others, like Silicon Valley Financial institution, Silvergate and Signature Financial institution, collapsed this yr. Hours after the deal was known as off on Thursday Nevada regulators ordered Prime Belief to halt its operations within the state, saying Prime was unable to fulfill buyer withdrawal requests due to a shortfall of buyer funds.

Soundbite of the week: Stablecoins and the Fed

Jay Powell, chair of the US Federal Reserve, appeared at a Home monetary providers committee listening to this week and was requested about stablecoins. He mentioned stablecoins have been a type of cash however caveated:

We consider that it will be applicable to have fairly a sturdy federal function in what occurs in stablecoins going ahead . . . leaving us with a weak function and permitting lots of personal cash creation on the state stage could be a mistake.”

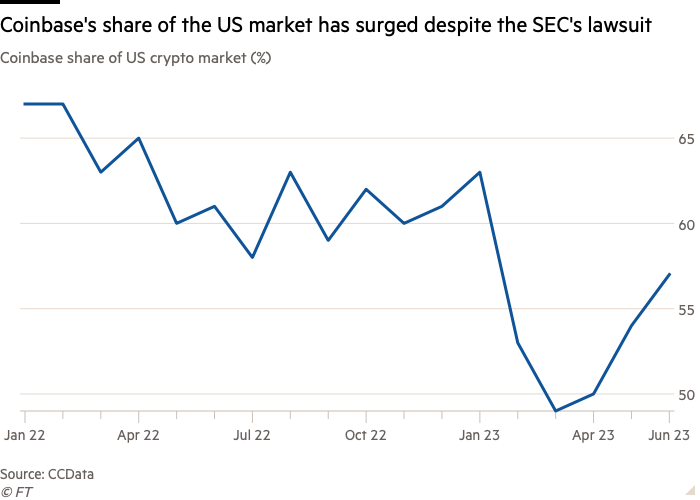

Knowledge mining: Coinbase fortunes defy expectations

You will have thought the SEC’s lawsuit towards Coinbase may need frightened away prospects. Not fairly.

Numbers from CCData present Coinbase’s share of the US market has elevated for 4 consecutive months, shifting as much as 57 per cent in June. How a lot of that’s all the way down to prospects deserting rivals and the general market shrinking within the face of the SEC’s broad crackdown is one other matter. Nonetheless, it does counsel US crypto punters are unfazed by the lawsuits for now.

Cryptofinance is edited by Philip Stafford. Please ship any ideas and suggestions to cryptofinance@ft.com.