The Bitcoin market is experiencing a seismic shift, with latest knowledge revealing fascinating developments that make clear the evolving dynamics. From a major decline in Bitcoin inflows to a historic drop in provide on exchanges, coupled with a surge in institutional fund accumulation, these developments spotlight a maturing market and altering investor sentiment.

Unprecedented Decline In Bitcoin Inflows and Provide

The on-chain analytics service CryptoQuant has right now published extraordinarily attention-grabbing knowledge on the conduct and cohorts of Bitcoin hodlers by way of Twitter.

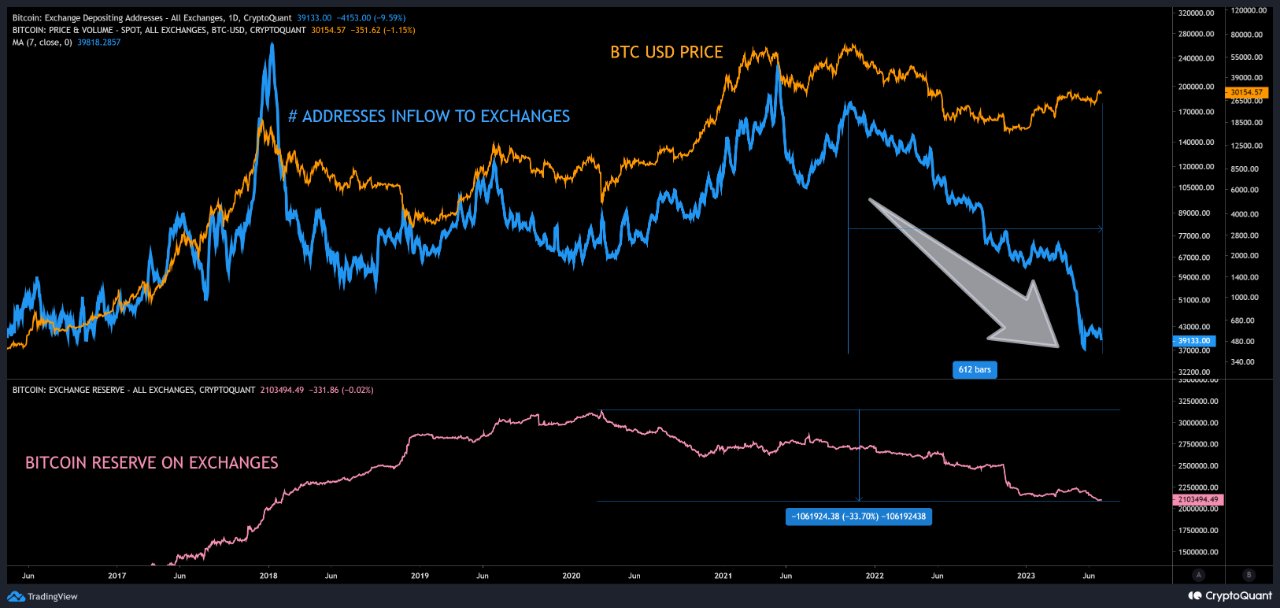

Over the previous 612 days, Bitcoin has witnessed an 80% decline within the variety of addresses recording inflows, which may be interpreted as promoting exercise. This decline reaches a fair larger determine of 84% when measured from the height in Could 2021. These numbers even surpass the earlier file set through the 2017 parabolic prime, demonstrating the magnitude of the present pattern.

Each narrowly beat the second highest decline in addresses related to inflows between the 2017 parabolic prime into 2018 bear, at 78.5%.

It is very important word that these figures don’t account for addresses which have moved to self-custody or differentiate between miner exercise and retail traders. This implies that the decline in addresses related to inflows could also be much more important than the info implies, doubtlessly indicating a shift in the direction of long-term holding methods or various custodial strategies.

In a parallel pattern, the general provide of Bitcoin on exchanges has been steadily shrinking since March 2020, marking a interval of constant decline that had not been witnessed earlier than in Bitcoin’s historical past. This decline just isn’t solely important in its period but in addition in its depth, as Bitcoin reserves on exchanges have dropped by over 30%. CryptoQuant’s specialists additional word:

March 2020 was the best ever provide recorded on exchanges, and preceded by constant ten years of provide development. The 1200 days since, are the primary interval of constant decline in Bitcoin’s historical past. […] Retail merchants and establishments are holding extra Bitcoin than ever.

This additionally signifies a significant potential shift from lively buying and selling and speculative conduct in the direction of long-term holding methods.

Institutional Fund Accumulation Indicators Confidence

Because the decline in inflows and provide unfolds, one other intriguing pattern emerges: institutional fund accumulation, as noticed by CryptoQuant. Institutional traders, together with hedge funds, funding companies, and cryptocurrency non-public funds, are presently actively growing their holdings of Bitcoin.

This exponential enhance in fund holdings demonstrates a robust curiosity in buying Bitcoin, even at its present value stage. Institutional traders typically take a extra affected person and long-term strategy in comparison with short-term merchants who carefully monitor value fluctuations.

By carefully monitoring fund holdings, traders can achieve useful insights into market sentiment and the arrogance that institutional traders have in Bitcoin as a long-term asset. And the next chart by CryptoQuant is displaying simply that, an extremely bullish stance by establishments.

The constructive evolution of Bitcoin’s notion might be additional strengthened by latest developments within the regulatory panorama and the introduction of exchange-traded funds (ETFs). Regulatory frameworks, particularly these being applied by international locations within the European Union with MiCA, are useful for the institutional Bitcoin adoption.

Furthermore, the filings and re-filings of Bitcoin spot ETFs by main monetary establishments, together with BlackRock and Constancy, point out a rising recognition of Bitcoin’s potential as a reputable funding. These ETFs present a extra accessible and controlled means for traders to realize publicity to Bitcoin, doubtlessly driving additional institutional adoption and market development.

At press time, the BTC value stood at $30,716, remaining in its vary between $29,800 and $31,000.

Featured picture from iStock, chart from TradingView.com