Because the Bitcoin value reached a brand new yearly excessive of $31,840 final week, solely to invalidate the bullish breakout inside a number of hours and fall in direction of $30,000, there was an odd tranquility out there. Already since June 23, BTC has been within the buying and selling vary between $29,800 and $31,300, with each breakout try to the upside and draw back having failed inside a really brief time frame.

Nevertheless, one of the crucial distinguished technical indicators, the Bollinger Bands, predict that this calm could quickly be over. Created by the esteemed dealer John Bollinger, these bands present invaluable insights into market volatility and potential value ranges.

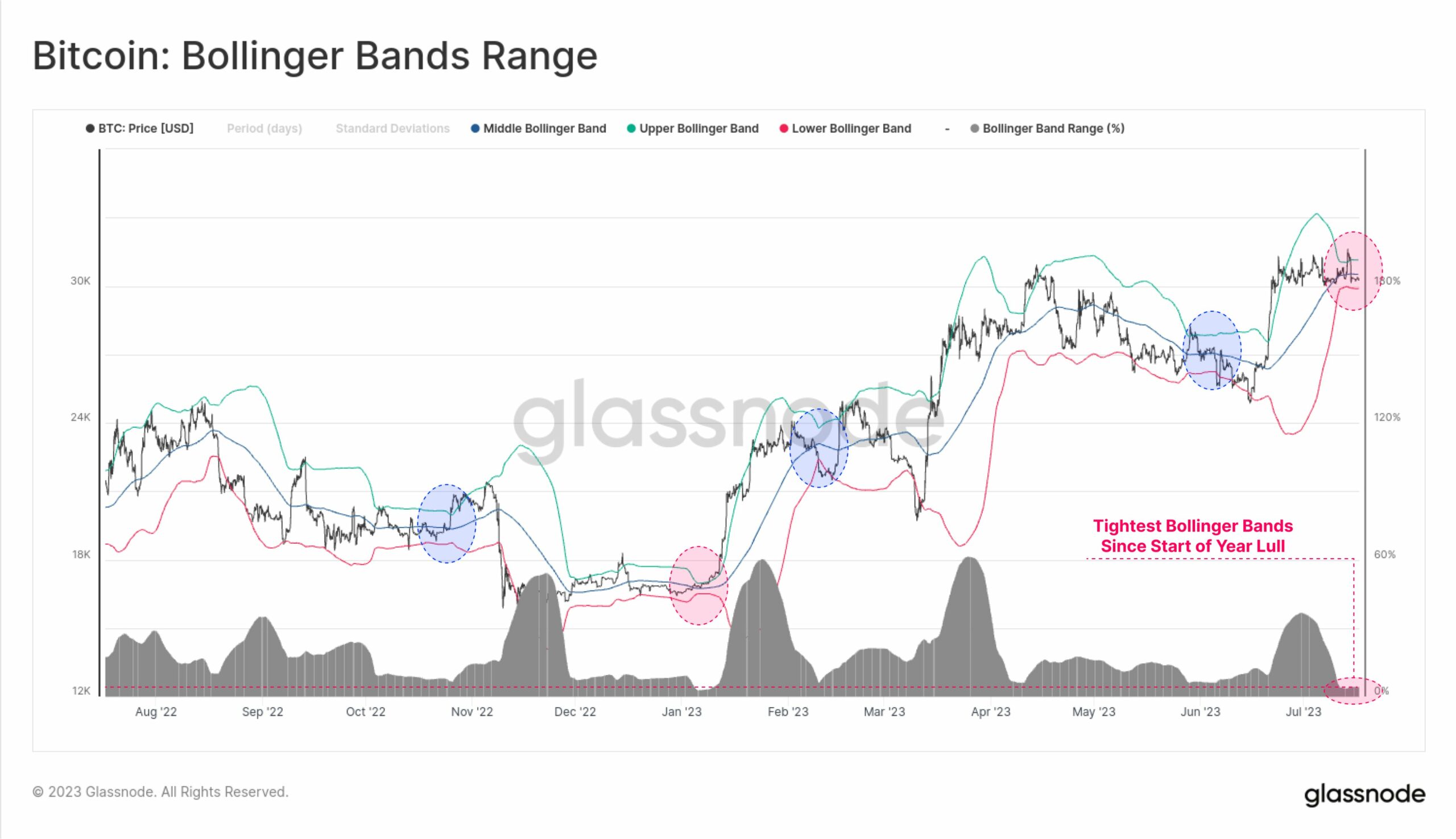

Bollinger Bands Predict Massive Transfer For Bitcoin

The Bollinger Bands encompass three distinct strains on a value chart: the center band, the higher band, and the decrease band. The center band is a straightforward transferring common (SMA) that represents the typical value over a specified interval. The higher and decrease bands are derived from the center band, with the higher band often set two commonplace deviations above the SMA, and the decrease band set two commonplace deviations under it.

The first goal of the Bollinger Bands is to measure market volatility. When the worth of an asset experiences vital fluctuations, the bands widen, indicating elevated volatility. Conversely, during times of decreased value motion, the bands contract, indicating decrease volatility. This contraction is often known as a “squeeze,” the place the higher and decrease bands come nearer collectively, forming a narrowing value channel.

When the Bollinger Bands squeeze, the potential for a big value motion looms. The squeeze means that the market is in a state of short-term equilibrium, akin to a coiled spring able to launch its saved vitality. The path of the breakout determines whether or not it’s a bullish or bearish sign.

Up Or Down?

Glassnode, a revered on-chain knowledge supplier, highlighted at present the present state of the Bitcoin market, noting a remarkably low volatility atmosphere. The 20-day Bollinger Bands are experiencing an excessive squeeze, with a mere 4.2% value vary separating the higher and decrease bands. This implies that Bitcoin is at the moment in a interval of restricted value motion, “making this the quietest Bitcoin market for the reason that lull in early January.”

As Bitcoin traders could bear in mind, the Bollinger Bands squeeze in January marked the tip of a prolonged downtrend. After the FTX collapse, the BTC market was in a state of shock paralysis, which was in the end resolved by Bollinger Bands squeeze, resulting in a 42% value enhance in 26 days.

The Bollinger Bands’ squeeze, mixed with diminishing buying and selling volumes, creates a state of affairs of mounting stress within the Bitcoin market. As buying and selling quantity declines, the potential vitality saved on this coiled spring intensifies.

In keeping with the analysts at CryptoCon, the bullish state of affairs is the one to be favored in the mean time. “When Bitcoin volatility will get low in a bear market, it’s very bearish. When volatility will get low in a bull market, it’s insanely bullish,” the analysts say. As Bitcoin is unanimously seen to be initially of a brand new bull market, a powerful transfer to the upside may very well be in retailer.

Featured picture from iStock, chart from TradingView.com