Ethereum price has been in a steep downtrend for the previous few days forward of the Fed’s two-day financial coverage assembly. The asset has been struggling under the essential degree of $1,900 over the previous few days amid a decline in market sentiment. At press time, Ethereum was buying and selling barely decrease at $1,855.

Financial Headwinds

Ethereum worth has been underneath intense strain for the previous few days because the Fed’s two-day coverage assembly sparks market jitters. The worldwide crypto market cap has crashed over the previous few days to $1.17 trillion, whereas the whole crypto market quantity decreased. Bitcoin, the most important cryptocurrency by market cap, has dropped under the important $30,000 degree, buoyed by the weak crypto market sentiment.

A take a look at the Crypto Worry and Greed Index reveals that the boldness amongst buyers in regards to the crypto sector has continued to dwindle. The Index has declined from a Greed degree of 63 final week to a impartial degree of 52, indicating that the majority buyers are in conservation mode.

The US Treasury yields climbed greater on Tuesday because the Federal Reserve is because of kick off its assembly. The assembly is anticipated to finish on Wednesday when the central financial institution is anticipated to announce its rate of interest choice. Markets are pricing in a 98.9% likelihood of the Fed implementing a 25 foundation factors rate of interest hike after its assembly.

Buyers may also be watching the steerage by the central financial institution and feedback by the Fed chair, Jerome Powell, attempting to find clues in regards to the Fed’s financial coverage path. Moreover, the European Central Financial institution (ECB), in addition to the Financial institution of Japan, is anticipated to satisfy later this week, when the policymakers are anticipated to announce their rate of interest selections.

Notably, buyers may also be looking out for a number of key knowledge factors, together with the Fed’s favourite inflation gauge, the private consumption expenditures (PCE) index on Friday. The CB Client Confidence Index knowledge for July can also be slated to be printed later at the moment.

Ethereum Worth Evaluation

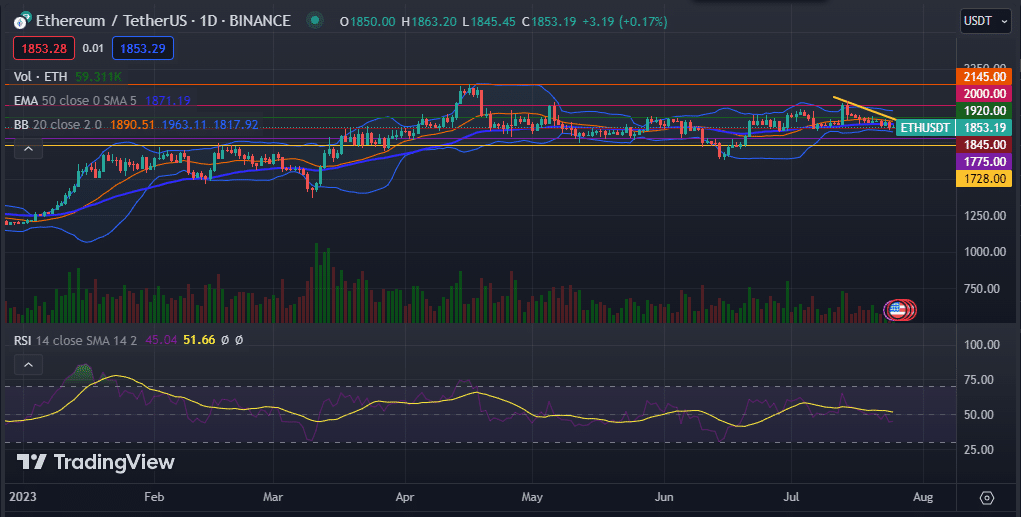

The day by day chart reveals that the Ethereum worth has been on a steep decline for the previous few days after going through a powerful rejection on the necessary degree of $2,000. Throughout this era, ETH has managed to drop under and stay above the 50-day and 200-day exponential shifting averages.

Its Relative Power Index (RSI) has moved under the impartial line, with the Shifting Common Convergence Divergence (MACD) indicator pointing to a promote sign. The Bollinger Bands have narrowed as indicated on the chart, displaying a decline in volatility.

As such, the Ethereum worth is more likely to pull again additional within the speedy time period as considerations a few hawkish Fed proceed to weigh on costs. If this occurs, the subsequent assist ranges to observe might be $1,845 and $1,775. Alternatively, a transfer previous the bullish assist degree at $1,920 would possibly push the value greater to $2,000, invalidating the bearish thesis.