At present, Bitcoin took one other dive, this time to its lowest stage since June 21. A verify on Bitfinex reveals a BTC value stoop to $28,641. Coinbase, America’s largest crypto change, reported an much more drastic drop to $28,478. Though the worth bounced again barely to hover slightly below $29,000 (-1.4% within the final 24 hours), the downward pattern sparks questions.

Why Is The Bitcoin Worth On The Decline?

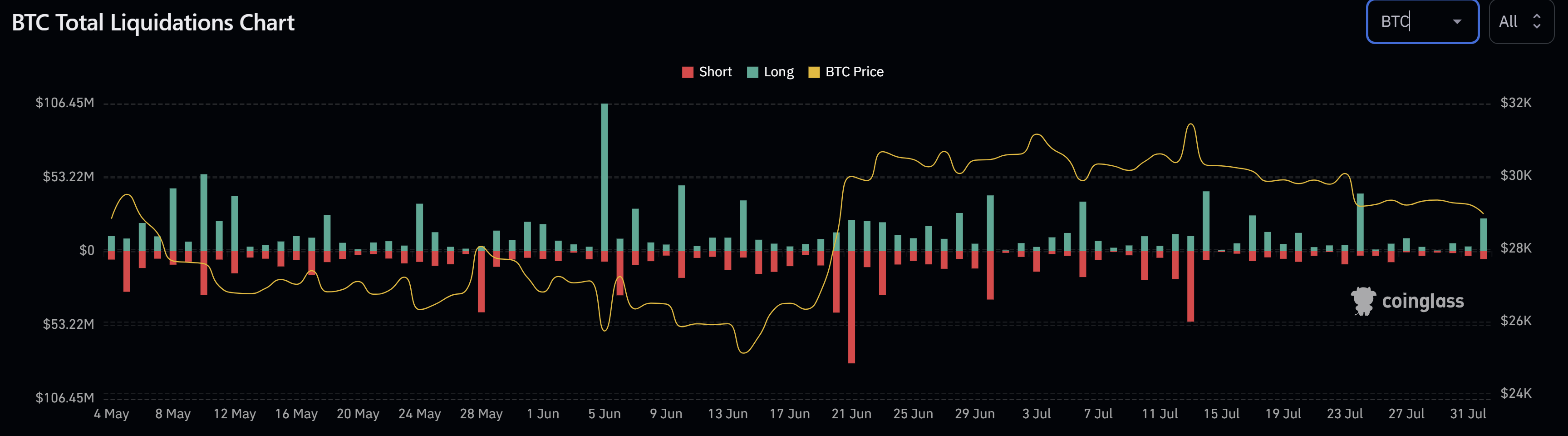

James V. Straten, a famend on-chain analyst, just lately tweeted: “Bitcoin drops under $29,000 as open curiosity spikes whereas funding charges go decrease. On account of the largest lengthy liquidation since twenty fourth July.” Because the analyst states, Bitcoin’s value pattern will be majorly attributed to lengthy liquidations. The liquidation information from Coinglass signifies that $23.6 million in BTC longs had been liquidated, a comparatively small quantity however vital contemplating the market’s state.

In an illiquid market, smaller orders can considerably sway the market. Based on information from Kaiko, BTC and ETH have seen a decline in 90-day realized volatility this yr, with volatility ranges at present hovering round two-year lows.

Furthermore, Kaiko’s information additionally reveals that Bitcoin’s correlation with the S&P 500 continued to say no in July, falling to only 3%. The final time it was this low was again in August 2021. This implies that the standard monetary market’s affect on Bitcoin’s value is waning, an impulse a lot wanted in the meanwhile.

Analyst @52Skew noted that BTC Spot CVDs & Delta Retrospective had been hinting on the downtrend. “There have been clear indicators of spot provide & sellers, particularly on Coinbase. Mixture Spot CVD indicated heavy provide previous to unload: Worth grinding increased into restrict provide & market spot promoting.”

In the meantime, famend dealer @exitpumpBTC pointed out on Twitter: “Somebody sitting with 400 BTC purchase wall at $28,900 on Binance spot orderbook. Totally closed my quick.” This purchase wall may present some assist for Bitcoin’s value on the present stage.

Bitcoin Market Sentiment Weighs On Worth

The Bitcoin Market Sentiment, as represented by the Worry & Greed Index, is presently at 50 – impartial. Nonetheless, the sentiment on the Bitcoin and crypto market is lukewarm, regardless of BTC being up 76% year-to-date. The fading momentum appears to be because of the Bitcoin and crypto market’s present “summer time slumber.” The bullish information appears already priced in, and volumes on exchanges are dwindling.

Apparently, regardless of some main bullish developments for the broader crypto market, together with Blackrock’s filing for a spot ETF and the victory for XRP and Ripple, the retail and institutional curiosity stays low. That is mirrored within the low liquidity and volatility available in the market.

Remarkably, the crypto area has been rocked by an array of occasions just lately. From the rise of liquidity absorbing meme cash to rip-off tokens, the market has seemingly descended into chaos. Within the midst of all these, impending occasions such because the Curve (CRV) hack in addition to fears of a possible DOJ motion towards Binance and Tether, proceed so as to add nervousness to the market. On this unsure state, there aren’t any new buyers to catapult the market upward.

At press time, BTC traded at $28,990.

Featured picture from iStock, chart from TradingView.com