Hi there and welcome to the newest version of the FT Cryptofinance publication. This week, we’re having a look on the stablecoin market, which welcomed a brand new participant on Monday.

The crypto market appeared to obtain a much-needed shot within the arm this week when PayPal stated it could launch its personal stablecoin. If crypto is ever to grow to be a broadly used retailer of worth, who higher to offer it a push than one of many world’s greatest client funds manufacturers?

What’s odd about it’s the timing. Different well-known manufacturers, reminiscent of Revolut, are strolling again their plans whereas US regulators are busy waging a protracted crackdown on digital belongings.

However the thriller goes past that. Stablecoins are as important to crypto markets and are akin to chips at casinos: they permit merchants to maneuver out and in of bets simply, into wallets fairly than a lot of traceable accounts.

Sadly, they’re additionally basically tied to sectors of the crypto market which have underperformed all 12 months. In accordance with analysis supplier CCData, the circulating worth of crypto’s dollar-pegged tokens has fallen to $125bn, down from $188bn in March final 12 months.

The decline not solely represents the sector’s lowest market cap since August 2021, however stablecoins are on development to file 17 consecutive months of declines.

Volumes in crypto derivatives, the place traders punt on the longer term worth of “conventional” cryptocurrencies reminiscent of bitcoin, have fallen nearly 50 per cent for the reason that begin of this 12 months, as per CCData.

“Crypto derivatives buying and selling tends to induce stablecoin exercise as stablecoins function collateral. Crypto derivatives volumes have been weak over the previous 12 months,” JPMorgan’s Nikolaos Panigirtzoglou advised me.

Even then, the figures don’t inform the entire story. A lot of the cash that has been drained from the system has come at Circle, which operates USDC, one of many world’s largest stablecoins.

In March, the group admitted to holding greater than $3bn of its reserves in now-collapsed Silicon Valley Financial institution. That admission brought on its token to quickly depeg from the greenback and kick-started the corporate shedding roughly 40 per cent of its pre-SVB share of the stablecoin market. It now has $26bn price of tokens in circulation.

In the identical interval, Tether, the market chief, strengthened its place within the sector by grabbing roughly two-thirds of the stablecoin market share. The BVI-registered operator now has roughly $83bn tokens in circulation, up from roughly $70bn in March.

“USDC’s short-term depeg occasion, attributable to Silicon Valley Financial institution’s insolvency, led to a lack of credibility for traders,” stated Rajeev Bamra, head of DeFi and digital belongings technique at Moody’s.

It begs the query as to why PayPal is doing it. There are some similarities with different stablecoins in the marketplace.

Coin operators often put their reserves backing the stablecoin in liquid belongings reminiscent of short-dated US authorities bonds. They’re not solely straightforward to faucet however at the moment are providing as much as 4 per cent a 12 months curiosity — which accrues to the operator, not the shopper.

PayPal’s effort, often called PayPal USD, follows the identical sample, and can again its reserves 1:1 with short-term Treasury payments and different belongings.

Heavy customers of stablecoins are delicate to rates of interest and returns that may be made elsewhere. That’s prone to be particularly so if the market and coin costs are flat, as they’re now.

“In an elevated rate of interest setting, as [PayPal’s stablecoin] is backed by US Treasury payments, it ought to generate a couple of 5 per cent yield, which they’re unlikely to share with their clients,” Sankar Krishnan, head of digital belongings and fintech at consultancy Capgemini, advised me.

However PayPal USD comes with caveats. Most notably, its token can solely be used throughout the PayPal ecosystem, not like different dollar-pegged tokens that commerce on public blockchains.

““They’re not going to compete with Tether. I feel they’re attempting to be stablecoin with real-world use instances…they need to use blockchain expertise to offer a fee mechanism. It’s not designed for individuals to make use of to leap out and in of crypto,” stated Ilan Solot, co-head of digital belongings at London dealer Marex.

“Why would a crypto native use it as a substitute of one other present stablecoin? I don’t assume it should compete in any respect with established stablecoins,” he added.

The obvious comparability that springs to thoughts with PayPal is Meta/Fb’s failed try with its Libra stablecoin — one other huge Silicon Valley identify that misjudged what it was getting into.

Meta didn’t anticipate the regulatory blowback: PayPal has to indicate who its product is for.

“Again within the day, everybody was establishing web banking firms as a result of they didn’t need to get omitted even when they weren’t fairly positive why they have been doing it,” Tom Keatinge, founding director of the Centre for Monetary Crime and Safety Research at UK think-tank Rusi, advised me.

“PayPal has an present client base, it’s attempting to reverse into the crypto market by monetising its person base,” Keatinge added.

Whether or not that’s possible is one other matter. 4 years on from Libra, PayPal USD has to bridge a gaping chasm between crypto designed for widespread use and people merchandise which were developed by crypto for crypto markets.

Weekly highlights

-

The SEC crackdown on crypto continues: late on Thursday night the regulator introduced that Bittrex Inc. and the platform’s co-founder and former chief government William Shihara agreed to settle costs that that they had operated an unregistered nationwide securities change, dealer and clearing company. Bittrex International GmbH, the corporate’s international affiliate, additionally agreed to settle costs that it didn’t register as a nationwide securities change.

-

Final month, the Securities and Change Fee was dealt a setback when a New York decide dominated Ripple Labs didn’t violate securities regulation by promoting digital tokens to members of the general public. This week, the Gary Gensler-led regulator stated it meant to problem the choice. You’ll be able to learn the submitting here.

-

Russia’s central financial institution introduced on Wednesday it could launch pilot testing of a digital rouble with the participation of 13 banks. Olga Skorobogatova, first deputy governor of the Financial institution of Russia, stated by the beginning of 2025 “people and companies will have the ability to actively use the nationwide digital foreign money, in fact in the event that they want to”.

Soundbite of the week: pushback on PayPal

Unsurprisingly, an enormous client identify moving into crypto attracted the eye of politicians.

Democratic congresswoman Maxine Waters, who serves on the Home monetary providers committee, wasn’t best pleased since there are nonetheless no federal guidelines on stablecoins.

“Given PayPal’s dimension and attain, federal oversight and enforcement of its stablecoin operations is crucial so as to assure client protections and alleviate monetary stability considerations.”

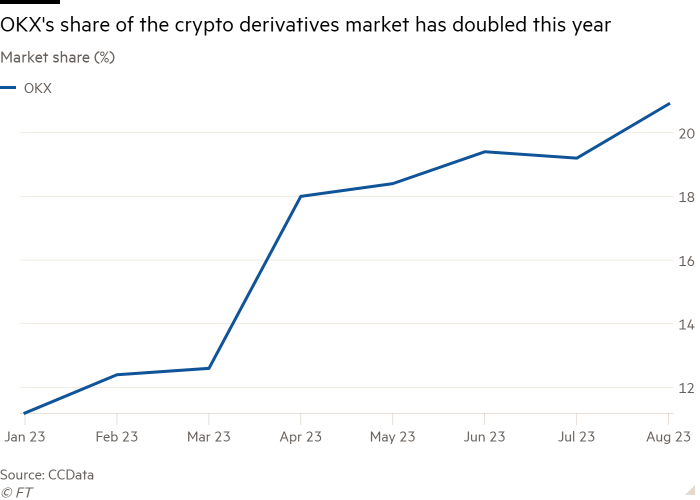

Information mining: OKX makes headway in derivatives

One consequence of the US regulatory clampdown has been to redirect buying and selling flows world wide, as US-based markets lose out and offshore exchanges profit. One of many greatest beneficiaries has been OKX, which is headquartered within the Seychelles and is a regulated entity within the Bahamas, a well known hub for crypto enterprise.

In accordance with knowledge from CCData, OKX’s share has surged from 11 per cent in January to nearly 21 per cent in August to this point. The expansion strengthens OKX’s place because the second-largest change for crypto derivatives.

FT Cryptofinance is edited by Philip Stafford. Please ship any ideas and suggestions to cryptofinance@ft.com