Bitcoin worth has oscillated round $29k up to now 5 months regardless of the ETF frenzy and crypto regulatory readability in the USA.

After having fun with a bullish first half of the yr, Bitcoin (BTC) and the altcoins costs have struggled to keep up momentum within the second half. Based on the newest crypto market information, Bitcoin worth traded round $29.3k on Tuesday, an important assist stage for the bullish uptrend to proceed within the coming weeks. Nevertheless, the opportunity of a double prime on the weekly timeframe and the falling divergence on the RSI has most analysts and traders satisfied of an incoming Bitcoin correction in the direction of $25k.

On this regard, specialists have argued if the altcoin market will take over the bullish pattern as funds circulation from prime digital property to mid and low-cap cryptos. Alternatively, sudden weaknesses within the Bitcoin market have traditionally pulled the altcoin business with it amid worry of uncertainty.

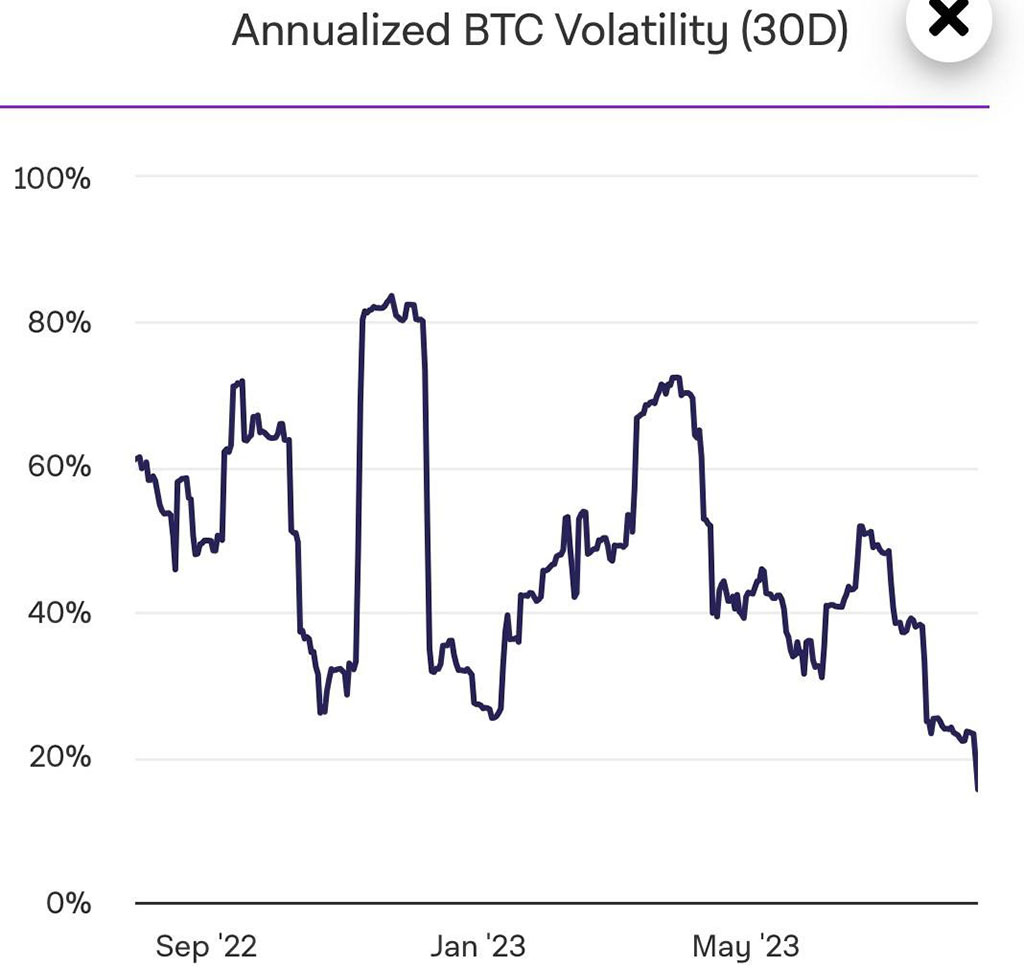

Bitcoin (BTC) Volatility Drops amid Elevated Money Inflows

Based on market information provided by The Block, Bitcoin (BTC) volatility has dropped to an all-time low of round 15 p.c because the bulls and bears cope with the value motion. For comparability functions, the typical annualized 30-day volatility for Bitcoin in 2022 was about 61.4 p.c, whereas the figures averaged about 43.8 p.c in 2023. However, there have been a number of high-impact information – together with the collapse of TerraLunaUST, FTX, and Alameda Analysis, amongst others – that noticed over $100 billion worn out of the crypto market.

Picture: The Block

The notable decline in Bitcoin (BTC) volatility comes amid combined money circulation returns as noticed by CoinShares. Reportedly, Bitcoin managed to get the eye of traders up to now week with a complete influx of about $27 million. Nevertheless, the highest coin had recorded a complete outflow of about $144 million in the course of the prior three weeks.

“Digital asset funding merchandise noticed inflows this week totaling US$29m, doubtless because of the latest US inflation information, which was barely beneath expectations, signifying {that a} September charge hike is much less doubtless,” the report noted.

Greater Image

Bitcoin worth is anticipated to proceed consolidating horizontally with a variety of (+/-) $10k from present ranges till after subsequent yr’s halving. Though most crypto analysts don’t appear to agree on the following plan of action for Bitcoin, one factor that is still unanimous is the macro bullish outlook triggered by the halving occasion. In the meantime, the controversy on the regulatory framework in the USA stays an enormous obstacle to the institutional and mainstream adoption of Bitcoin and different digital property merchandise.

Furthermore, the US SEC has continued to delay the approval of a Bitcoin ETF, whereas different markets like Canada have a working comparable product. In consequence, the CoinShares report concluded that Canada recorded probably the most crypto exercise with $24 million in inflows YTD.

Let’s discuss crypto, Metaverse, NFTs, CeDeFi, and Shares, and deal with multi-chain as the way forward for blockchain expertise.

Allow us to all WIN!