Bitcoin liquidations have been ramping up during the last day following the market crash that rocked the crypto area on Thursday. The results of this can be a liquidation occasion, the likes of which haven’t been seen because the FTX collapse again in 2022. And Bitcoin’s numbers have shot up as lengthy merchants are fully obliterated within the course of.

Largest Single Crypto Liquidation Occasion In 2023

Following Bitcoin’s value decline to the low $25,000s, the liquidations picked up shortly with over $1 billion {dollars} of crypto positions being closed quickly. Bitcoin, specifically, suffered the brunt of those liquidations as its numbers shortly climbed to 9 digits.

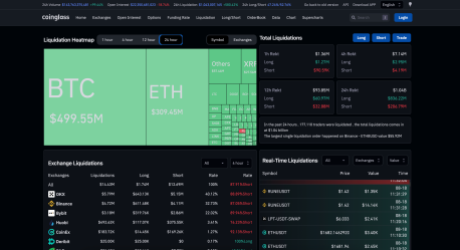

By the point Friday morning rolled round, the digital asset’s liquidation was at roughly $500 million with lengthy merchants struggling the vast majority of losses. Based on knowledge from Coinglass, Bitcoin’s lengthy liquidation figures have been already over $373 million, with shorts coming in at $125 million.

BTC liquidations virtually at $500 million | Supply: Coinglass

Whereas Bitcoin was within the lead as anticipated, Ethereum was not that far behind. The second-largest cryptocurrency by market cap noticed a fair bigger proportion of lengthy liquidations in comparison with shorts. Out of the $308 million in liquidations, lengthy merchants misplaced $254.59 million whereas brief merchants got here in at $54.3 million.

Ethereum additionally noticed the most important single liquidation order. The order which was value $55.92 million on the time happened on the Binance crypto change throughout the ETH/BUSD pair. Nonetheless, the OKX change noticed the most important Ethereum liquidations at $108.87 million, 92.8% of which have been longs.

The Tide Is Beginning To Flip For Bitcoin

Following the preliminary plummet, Bitcoin started to point out power which noticed its value add over $1,000. This restoration to $26,000 signaled a potential flip for the digital property and the shorters started to really feel the warmth at this level.

Within the final 4 hours, lengthy merchants have gotten some reprieve as $8.53 million of the $10.96 million in liquidations to date have been brief trades. Nonetheless, lengthy merchants are nonetheless not neglected with $2.46 million in liquidations as nicely.

Because the Bitcoin value stays extraordinarily unstable at this level, liquidation volumes are anticipated to rise. Nonetheless, there is no such thing as a indication to date of the place the value of the digital asset is likely to be headed subsequent as bulls and bears proceed a tug-of-war for management.

Bitcoin is at the moment buying and selling at a value of 26,451, representing a value decline of seven.48% during the last day, based on knowledge from Coinmarketcap. The asset has additionally seen a 110% improve in day by day buying and selling quantity which is now sitting at $34.47 billion.

BTC value falls from $29,000 to $25,000 | Supply: BTCUSD on TradingView.com