The Bitcoin worth skilled a resurgence yesterday, reaching a excessive of $26,843, a 3.7% enhance after its current crash from $29,000. The explanations behind this uptick are manifold.

Why Is Bitcoin Up?

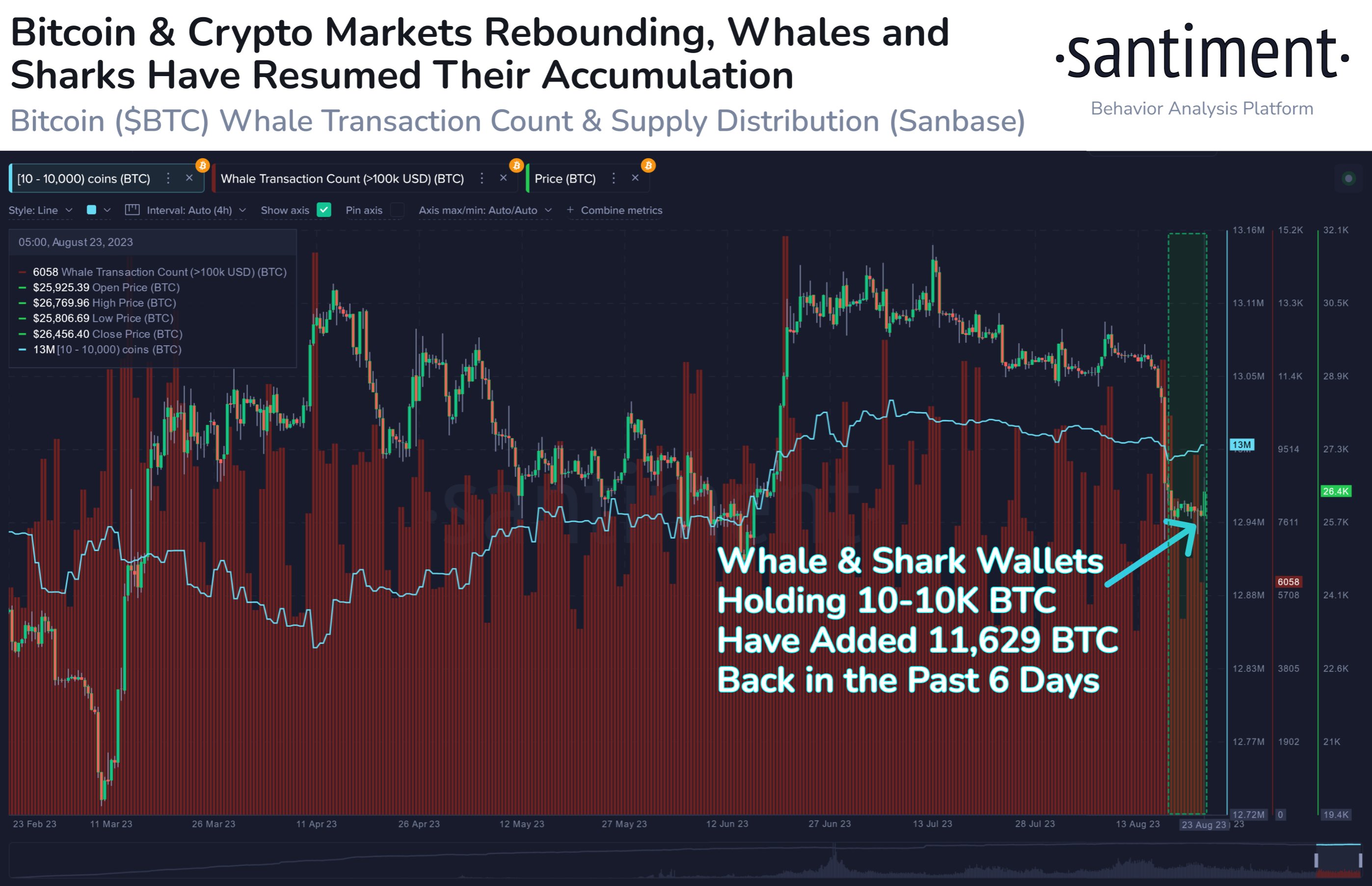

Based on on-chain analytics agency Santiment, important Bitcoin holders, also known as whales and sharks, have been actively including to their holdings. As of now, there are 156,660 wallets holding between 10 to 10,000 BTC, with a collective accumulation of $308.6M since August seventeenth. Whale and shark wallets have added 11,629 BTC previously six days.

Michaël van de Poppe, a well-regarded crypto analyst, drew consideration to the energy proven by Silver & Gold, particularly after the disappointing PMI charges yesterday. He believes that as yields seem like topping out, Bitcoin may observe the trajectory of those commodities.

Current financial indicators from the US non-public sector present additional context. The S&P World Composite PMI for early August confirmed a decline, falling to 50.4 from 52 in July. Each the Manufacturing and Companies PMI indices additionally registered drops from 49 to 47 and 52.4 to 51 respectively.

Furthermore, the Bitcoin futures market actually performed a sure function in yesterday’s Bitcoin worth motion. Yesterday, $28.06 million briefly positions had been liquidated on this market. In any case, that is the third largest quantity in August to date, surpassed solely by August 17 ($120 million) and August 8 ($37 million).

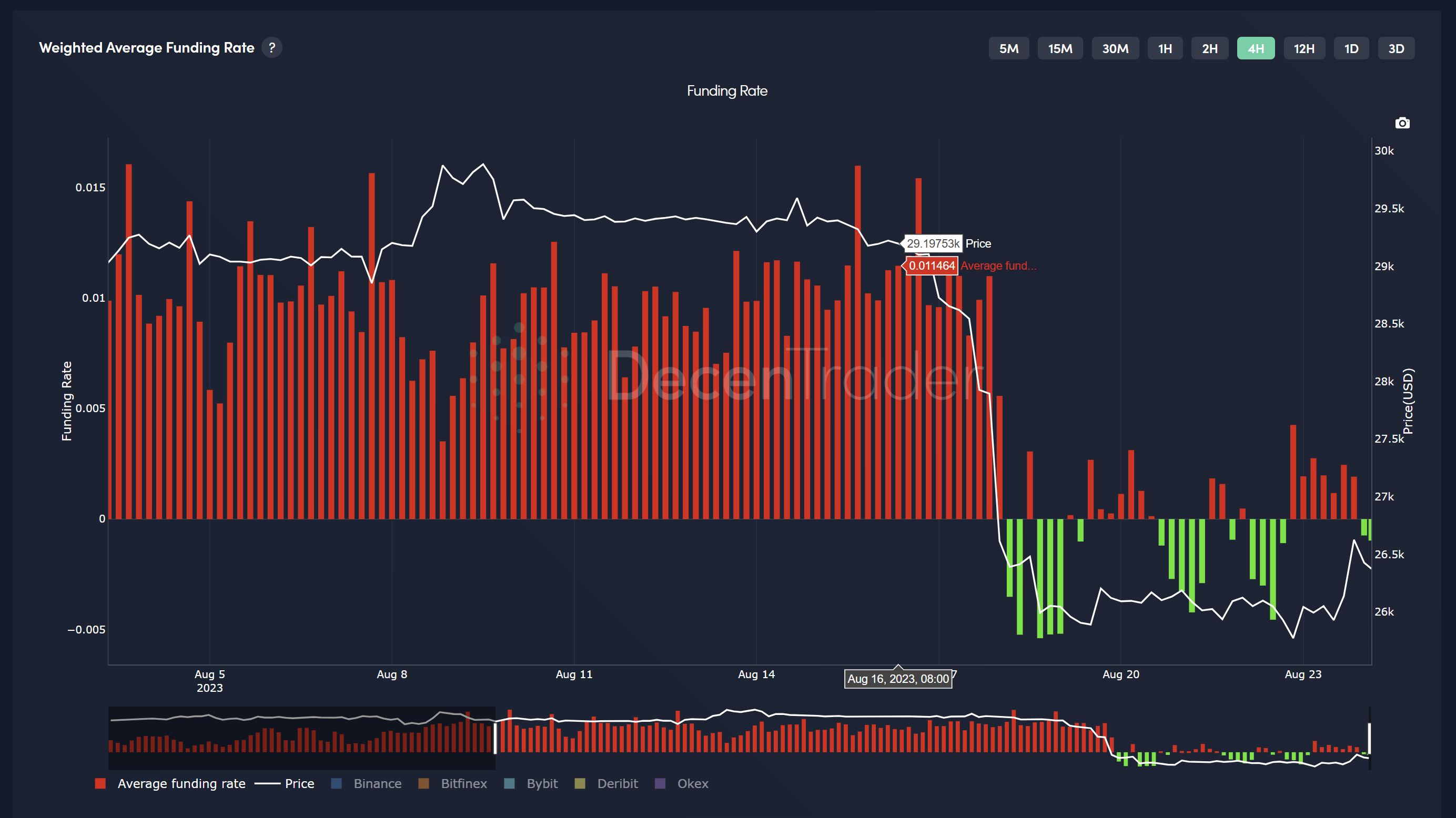

Market intelligence platform Decentrader highlighted the prevailing market sentiment, noting that regardless of Bitcoin’s worth rise, there’s nonetheless a way of uncertainty and concern. This sentiment is additional underscored by the persevering with destructive dip in common funding charges. Whereas which means that sentiment remains to be dangerous, it opens up the likelihood for extra quick squeezes if merchants are raging into shorts.

The Greenback-Index (DXY) and its inverse relationship with Bitcoin additionally performed a component. DXY was rejected just under 104 yesterday and dropped again to 103.5. The SPX confirmed a pleasant aid bounce with USD coming off 103.96.

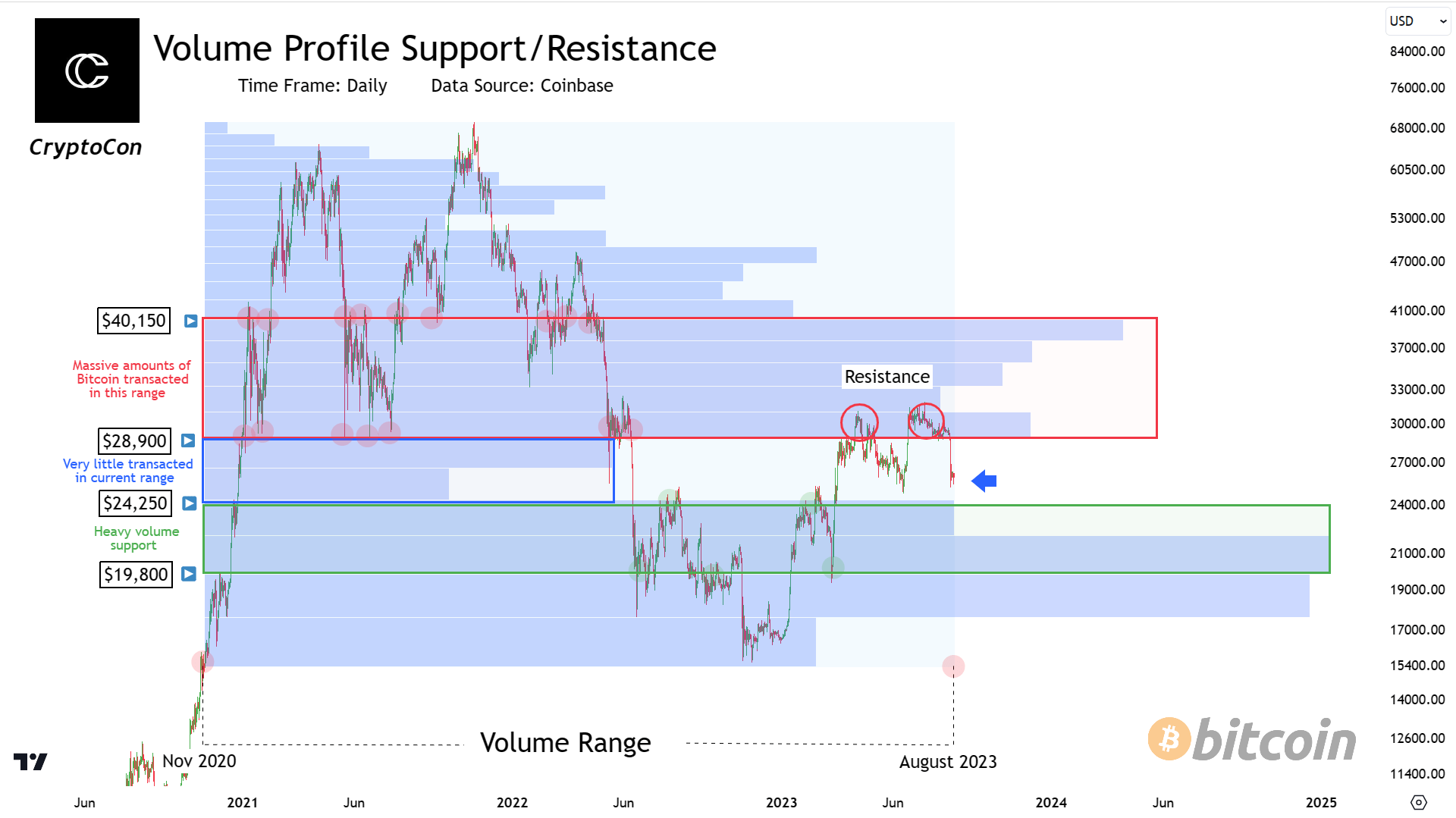

CryptoCon’s quantity evaluation provides a broader perspective on Bitcoin’s worth motion. Since November 2020, the quantity of Bitcoin transacted reveals why the worth halted at its present place. The quantity previous $28,900 acts as a major barrier. Nonetheless, the present vary of 24,000 to 29,000 for Bitcoin is comparatively uncharted, suggesting that Bitcoin is trying to find new help and making ready for a possible transfer to the subsequent resistance zone.

What’s Subsequent For BTC?

The upcoming Jackson Gap Financial Symposium tomorrow, Friday, the place the Federal Reserve will talk about its future methods, is a pivotal occasion on the horizon. Keith Alan of Materials Indicators recalled the impression of final yr’s symposium on Bitcoin, emphasizing, “Bear in mind when FED Chair Powell spoke from Jackson Gap final yr and his hawkish tone triggered a 29% BTC dump?”

Whereas there are parallels in Bitcoin’s worth motion main as much as this yr’s occasion, it’s essential to notice that market reactions will be unpredictable and hinge on varied components. With the Bitcoin market poised for the occasions of tomorrow, the prevailing temper is certainly one of anticipation combined with warning.

At press time, BTC traded $26,464.

Featured picture from iStock, chart from TradingView.com