In its new month-to-month report titled “The Bitcoin Month-to-month: Bitcoin Battles Resistance Round Its On-Chain Imply”, Ark Make investments has supplied an exhaustive evaluation of the present market panorama. The report categorizes its findings into bullish, impartial, and bearish views, offering a holistic view of Bitcoin’s present and potential future stance.

Bullish Arguments For Bitcoin

Grayscale Spot ETF and GBTC’s Low cost To NAV: On August 29, a pivotal choice was made by a US Federal Appeals Courtroom. They dominated that the U.S. Securities and Trade Fee (SEC) should revisit and rethink its earlier rejection of the Grayscale Bitcoin Belief’s (GBTC) utility to transition right into a spot ETF. This authorized growth noticed GBTC’s {discount} to NAV shift from -24% to -18% on the identical day, indicating heightened market optimism. By the tip of August, GBTC was at a discount-to-NAV of -20.6%.

Bitcoin’s Common Price Foundation Restoration: Bitcoin’s realized capitalization, which encompasses each its major (miners) and secondary (buyers) markets, is a measure of the mixture value foundation of BTC. Between This autumn 2022 and Q1 2023, the realized cap drawdown stood at -19%, marking its steepest since 2012. This drawdown serves as a barometer for capital outflows from the community.

Ark’s evaluation means that the deeper the drawdown, the upper the chance of Bitcoin holders exiting the market, doubtlessly setting the stage for a extra strong bull market. The realized cap has improved from its all-time excessive in 2021, shifting from a 19% low submit the FTX collapse in November 2022 to fifteen.6%, indicating capital inflows over the previous 8 months.

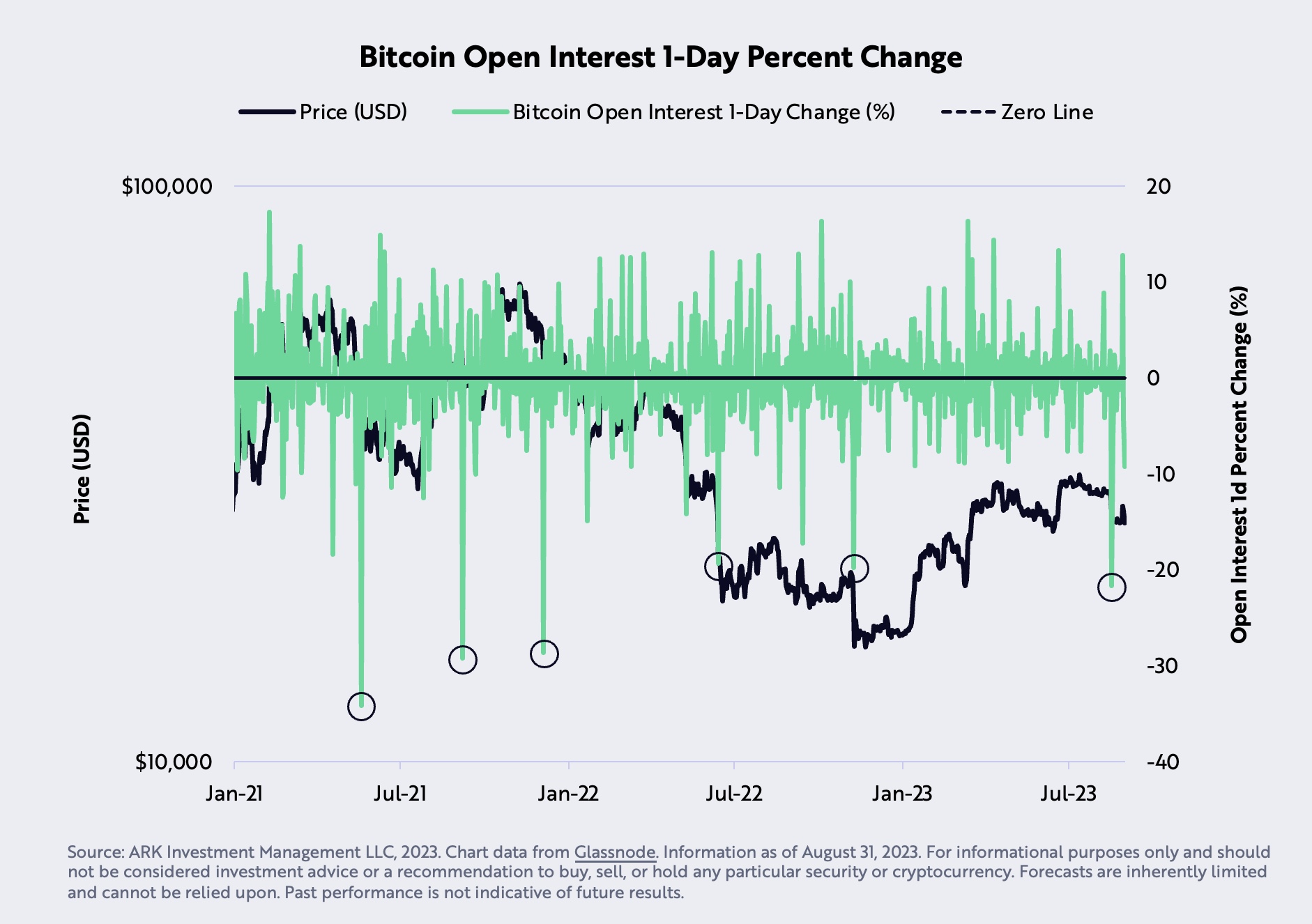

Futures Open Curiosity Collapse: August 17 witnessed a speedy liquidation of Bitcoin futures by 21.7%, the swiftest since December 2021. Ark Make investments interprets this value correction as a “cathartic sentiment correction.”

Impartial Arguments

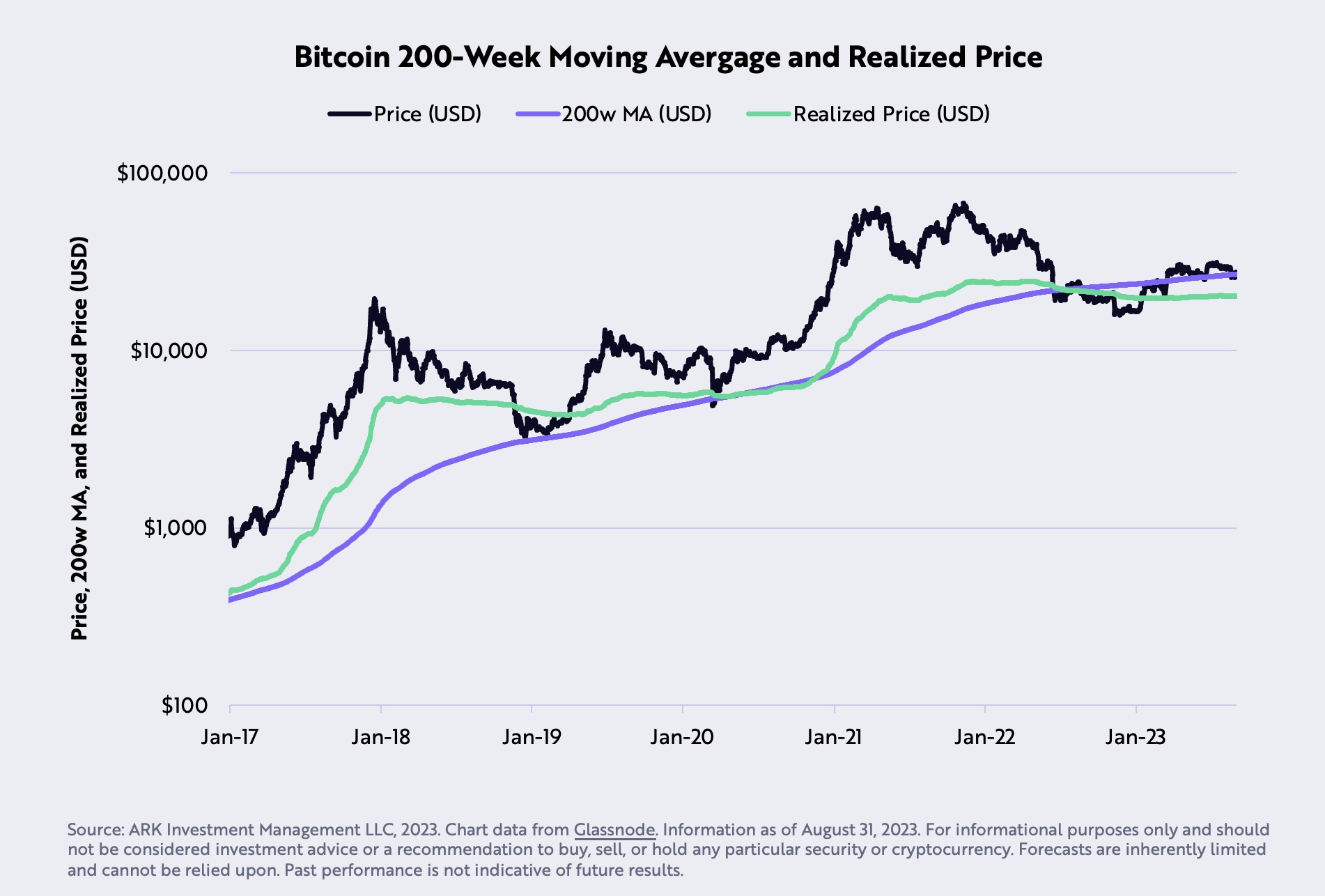

Bitcoin Worth and the 200-Week Shifting Common: August was a difficult month for Bitcoin as its value dipped by 5.4%, settling under its 200-week shifting common at $27,580. This was the primary occasion since June 2023. Nonetheless, Ark Make investments posits that Bitcoin ought to discover substantial draw back assist at its realized value of $20,300.

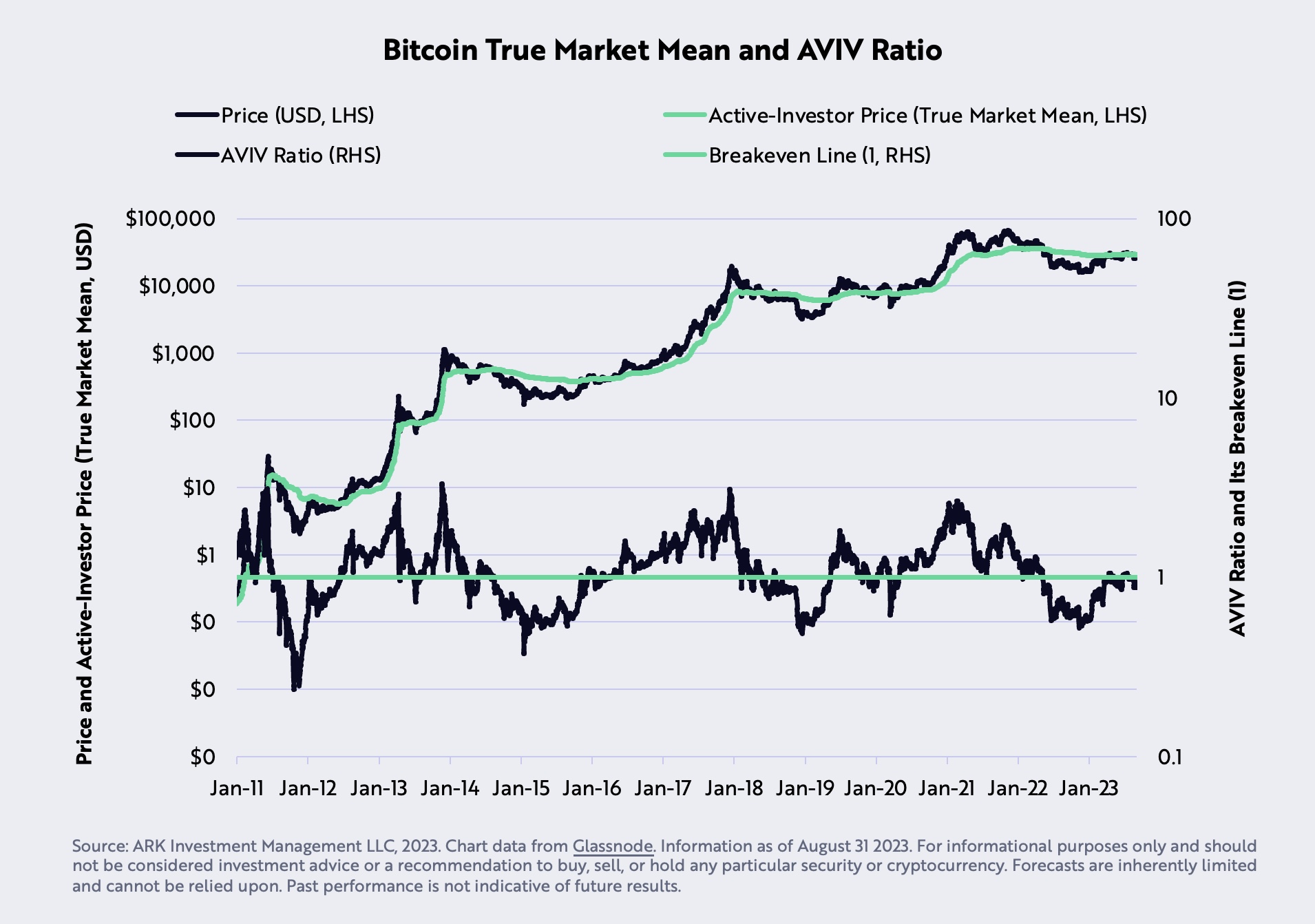

Bitcoin’s On-Chain Imply Resistance: The “on-chain imply,” additionally termed because the “active-investor value” or “true market imply,” reached $29,608 in August, establishing a possible important resistance for BTC. This metric, a collaborative effort between ARK Make investments and Glassnode, calculated by dividing buyers’ value foundation by the variety of energetic cash. These cash are decided based mostly on the mixture time they’ve remained dormant relative to the entire provide.

Stablecoins Market Cap and Liquidity: Stablecoins, usually seen as a liquidity barometer for the market, have seen their 90-day provide drop over 20% from $162 billion in March 2022 to $120 billion at present, signaling a decline in onchain liquidity. Nonetheless, internet inflows throughout the identical timeframe trace at a constructing bullish market momentum.

Bearish Arguments For BTC (All Macro)

Actual GDP vs. Actual GDI Progress Charges: A file divergence has been noticed between the YoY % modifications in actual Gross Home Product (GDP) and actual Gross Home Revenue (GDI). Traditionally, GDP and GDI needs to be on par, as earnings earned ought to equate to the worth of products and companies produced. Former Federal Reserve economist, Jeremy Nalewaik, has posited that GDI is likely to be a extra correct indicator than GDP.

Actual Federal Funds Coverage Charge vs. Pure Charge of Curiosity: For the primary time since 2009, the Actual Federal Funds Coverage Charge has surpassed the Pure Charge of Curiosity, indicating a shift in direction of restrictive financial coverage. This theoretical fee, as conceptualized by New York Federal Reserve President, John Williams, is the speed the place the financial system neither expands nor contracts. With financial coverage’s influence on the financial system being lengthy and variable, lending and borrowing are anticipated to face elevated downward strain.

Authorities’s Employment Revision: Employment, a lagging indicator, has been pivotal within the Federal Reserve’s fee selections. Regardless of the labor disruptions brought on by the COVID-19 pandemic anticipated to have been resolved by now, the federal government has revised nonfarm payroll statistics downward for six consecutive months. This implies a weaker labor market than initially reported. The final occasion of such a pattern, exterior of a recession, was in 2007, proper earlier than the Nice Monetary Disaster.

In abstract, Ark Make investments’s report presents three bullish, 4 impartial, and three bearish arguments on Bitcoin and the broader market, emphasizing that the market could possibly be at an important turning level. At press time, BTC traded at $25,789.

Featured picture from iStock, chart from TradingView.com