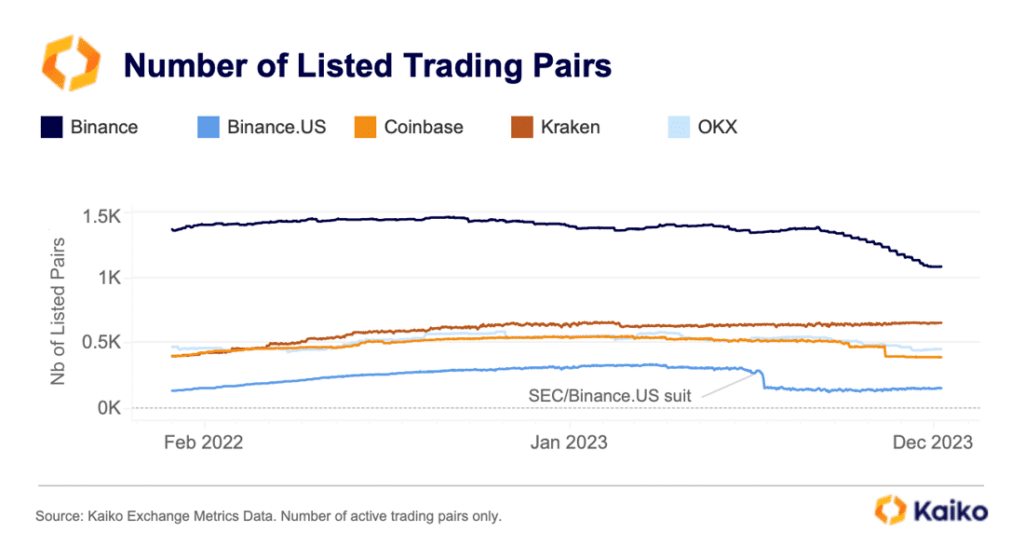

Crypto trade Binance has tightened its itemizing coverage because the variety of listed buying and selling devices declined by 21% in 2023, Kaiko stories.

In line with a brand new report printed by Diving Into DEXs, Binance is now taking an accelerated strategy to delisting entities at a fast tempo after its founder and former chief govt Changpeng Zhao settled a $4.3 billion case with U.S. regulators for, amongst different issues, working an unlicensed trade.

Analysts at Kaiko admitted that Binance was not the one crypto trade in 2023 to scale down its itemizing choices, as Coinbase and OKX have delisted some devices. Within the meantime, U.S.-based crypto trade Kraken, quite the opposite, barely elevated the variety of supported cryptocurrencies, in line with Kaiko information.

In mid-October 2023, Kaiko revealed in a report {that a} whole of over 3,445 tokens or buying and selling pairs have both been delisted or rendered inactive on main buying and selling platforms, representing a 15% improve within the quantity of delisted devices than for all of 2022. Analysts at Kaiko estimate that Coinbase eliminated a complete of 80 buying and selling pairs as of October 2023, bringing the whole quantity of delisted devices from its platform to 176 in 2023.

In early December 2023, Binance’s newly-appointed chief govt, Richard Teng, acknowledged in an interview with CoinDesk that the compliance management the trade had at launch was “insufficient,” including that “errors had been made.” His feedback got here after the U.S. Division of Justice said Binance’s employees “knew that the corporate’s anti-money laundering procedures had been insufficient and would entice criminals to the platform.”