Thor Hartvigsen, a data-driven decentralized finance (DeFi) researcher, is questioning the attraction of Injective Protocol, a layer-1 platform whose creators say is designed to expressly energy finance.

As of December 2023, INJ, the native foreign money of Injective Protocol, is likely one of the top-performing cash, surpassing Bitcoin (BTC) and Ethereum (ETH).

Is Injective Protocol Undervalued Primarily based On On-Chain Metrics?

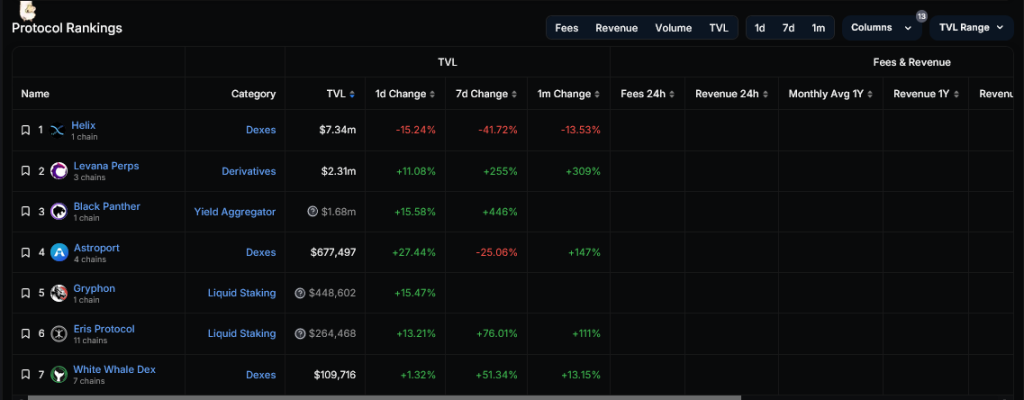

Taking to X on December 14, Hartvigsen highlighted the platform’s comparatively low whole worth locked (TVL) of $11 million and the restricted variety of protocols launched on the platform, presently standing at seven.

Primarily based on the researcher’s evaluation, the most important dapp on the layer-1, Helix Protocol, a decentralized alternate (DEX), solely manages a day by day buying and selling quantity of about $7.4 million.

Hartvigsen states that is considerably decrease than different perpetual futures protocols, together with the Perpetual Protocol. These rivals, the analyst notes, are valued at round $200 and $300 million based mostly on absolutely diluted valuation (FDV).

Thus far, information, there are solely seven energetic protocols on Injective, with Helix managing over 60% of the ecosystem’s TVL, reinforcing its dominance.

If on-chain exercise and the variety of energetic protocol leads, Hartvigsen needs solutions to irrefutably justify Injective Protocol’s $3.2 billion valuation.

The researcher compares Injective with different blockchains, together with Ethereum and Solana. These platforms command comparatively increased buying and selling quantity and on-chain exercise.

For example, Hartvigsen cites DefiLlama data, which reveals that Injective’s quantity ranges from $5 to $7 million day by day from seven dapps.

Alternatively, Solana, a competing layer-1, presently processes between $500 and $700 million. In the meantime, Injective Protocol can not match Ethereum, which processes over $1 billion in buying and selling quantity.

INJ Up 395%, Will Costs Proceed Rising On Investor Optimism?

In response to Hartvigsen’s evaluation, yiggit, a consumer claiming to be a authorized counsel, defended Injective Protocol. The consumer emphasised that TVL, because the researcher cited, can’t be the only determinant to gauge a venture’s potential.

Associated Studying: Bitcoin Deja Vu: Capital Inflows Mirror Pre-2021 Bull Run Momentum

Yiggit added that Injective Protocol’s potential is rooted within the anticipated variety of upcoming apps. Notably, the authorized counsel notes that optimism additionally stems from the Injective Protocol’s origins in Cosmos. Within the Cosmos ecosystem, staking tends to catalyze participation as customers search to obtain airdrops.

Nonetheless, whether or not or not the researcher’s evaluation is legitimate is dependent upon time. Thus far, trying on the INJ value motion within the day by day chart, the coin has been charting increased, registering new all-time highs.

For example, INJ is up 395% from mid-October 2023, rallying because the broader crypto market recovers. At this valuation, CoinMarketCap information shows that the venture has a market cap of over $2.7 billion.

Function picture from Canva, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site solely at your personal threat.