This analysis delves into the Ripple (XRP) price prediction, offering insights into its potential growth and the factors that could shape its journey in the coming years.

In 2024, the cryptocurrency market continues to captivate investors and enthusiasts alike, with Ripple (XRP) as a significant player. The Ripple prediction for 2024 has become a hot topic as investors seek to understand the future trajectory of this prominent digital asset.

Ripple (XRP) forecast: a glimpse into 2024 and beyond

Ripple, known for its fast and efficient cross-border payment solutions, has been a subject of intense scrutiny and speculation. The ripple prognosis in 2024 hinges on several key factors, including regulatory developments, technological advancements, and overall market dynamics. We must consider these elements in detail as we explore the ripple future price.

Ripple’s legal landscape and its impact

One of the most significant factors affecting the XRP price prediction is Ripple’s ongoing legal battles, particularly with the U.S. Securities and Exchange Commission (SEC). The regulator is suing Ripple Labs Inc. for allegedly conducting an unregistered securities offering. The SEC’s lawsuit, filed in December 2020, claims that Ripple raised funds, beginning in 2013, by selling the digital asset XRP in an unregistered securities offering to investors in the U.S. and worldwide.

The outcome of these legal challenges could either propel Ripple to new heights or hinder its growth. The forecast for 2024 will largely depend on how these legal issues are resolved.

In a major move, Ripple Labs, the company behind the cryptocurrency XRP, recently announced a significant move in its corporate strategy. On Jan. 10, the company initiated a buyback of $285 million in company shares from early investors and employees, placing its valuation at $11.3 billion. This tender offer allows investors to sell up to 6% of their stake in the company.

The buyback is part of Ripple’s broader plan to allocate $500 million for repurchasing shares, which includes converting restricted stock units into shares and covering associated taxes. Despite the ongoing regulatory uncertainties in the U.S., Ripple has no immediate plans to go public. The company’s CEO, Brad Garlinghouse, emphasized that the majority of Ripple’s customers are non-U.S. financial institutions, highlighting its global reach.

Ripple and cryptocurrency market

Ripple’s position in the cryptocurrency market is another critical aspect of its future price potential. As we look at the ripple projection for 2024, it’s important to compare Ripple’s performance with other leading cryptocurrencies.

As of January 2024, XRP is the sixth-largest coin per market capitalization. Since the beginning of 2023, its market cap has risen from $17.43 billion to $32.04 billion, which represents a surge of 83%.

Currently, XRP is trading at $0.61. The coin surged 69% during the year. At its peak in July, XRP was worth $0.82. The coin is the 6th largest asset on the crypto market per market capitalization, surpassed by competitor Solana (SOL) in December 2023.

Technical analysis and expert opinions

Delving into the technical aspects, Ripple’s expected price can be analyzed through various technical indicators and expert analyses. These insights offer a more nuanced understanding of Ripple’s price movements and help formulate a more accurate Ripple (XRP) forecast.

In the upcoming year, Ripple (XRP) faces a dynamic market with several pivotal resistance levels that could shape its trajectory. Analysts are closely watching the $0.7000 mark, as a breakthrough above this level could pave the way for XRP to approach its 2023 high of $0.9380.

Several factors are expected to influence XRP’s performance in 2024. These include the outcome of Coinbase’s legal battle with the SEC, the SEC’s potential failure to overturn the ruling on Programmatic Sales, and the results of the U.S. Presidential Election, particularly if the Republicans secure a victory. Additionally, the launch of altcoin-spot ETFs, including those for XRP, could significantly impact the market.

In an ideal scenario, where conditions are favorable, surpassing the $0.9380 resistance could set XRP on a path to revisit its all-time high of $3.5505. However, the market is not without its risks. Adverse developments could see XRP fall below the $0.5658 support level and the 200-day Simple Moving Average (SMA). In such a scenario, the $0.56 mark could become a critical point of intensified buying pressure as it aligns with the 200-day SMA.

Should XRP drop below the 200-day SMA, the focus would shift to the 50-day SMA and the $0.4761 support level. A breach below this support level could bring a longer-term trend line into consideration, marking a significant shift in the market’s direction for Ripple.

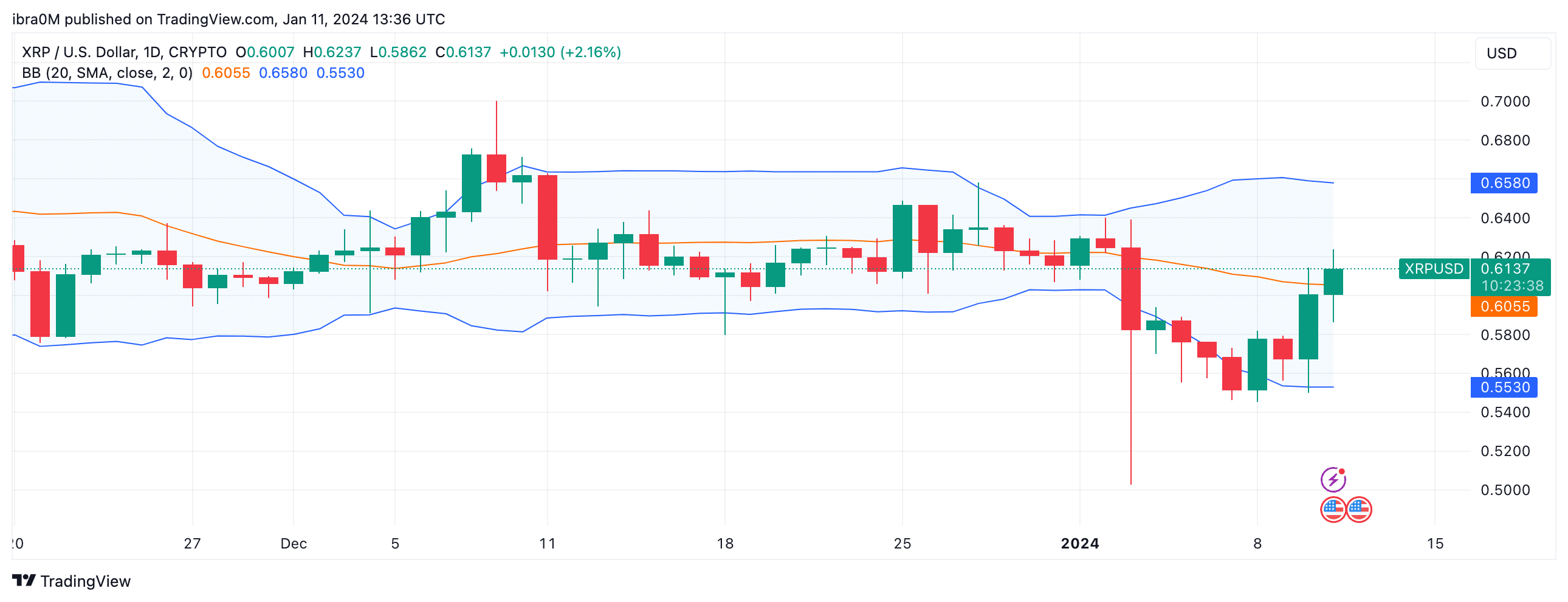

According to crypto.news market analyst Ibrahim Ajibade, XRP is now testing a resistance level at around $0.61, with a decisive breakout potentially leading to a rally toward $0.66.

On the downside, a drop below the vital $0.50 support level could invalidate this bullish forecast, but this seems unlikely amid the ongoing buying trend by crypto whales.

Ripple price predictions: short-term and long-term outlooks

When considering the Ripple price prediction for 2024, it’s crucial to differentiate between short-term fluctuations and long-term trends. Immediate market reactions and news might influence the short-term outlook, whereas the long-term perspective is shaped by Ripple’s adoption, technological advancements, and broader market trends.

Realistic expectations for Ripple’s growth

In setting realistic expectations for Ripple’s future value, it’s important to balance optimism with practical market analysis. The projected price for Ripple should consider both the potential for growth and the risks involved. This balanced approach will provide a more realistic outlook for Ripple’s future.

The three most realistic XRP market forecasts are represented below.

Egrag Crypto, a well-known Ripple analyst, made a bold prediction on X. They forecasted that XRP could reach $1.20 within the next 55 days. Egrag noted Ripple’s tendency for slow movement followed by sudden price spikes, suggesting a potential for rapid value increase.

Meanwhile, Dark Defender, another Ripple analyst, has an even more bullish view. They predict a surge to $1.88, followed by a breakout to an all-time high (ATH) of over $5 per XRP by the second quarter of 2024. This forecast suggests significant growth potential for Ripple in the near future.

Finally, Changelly, a Prague-based cryptocurrency exchange, has conducted a technical analysis that forecasts an average trading price of $0.81 for Ripple in 2024. This prediction reflects a moderate yet optimistic outlook for the digital currency.

Ripple price in five years: long-term view

Looking beyond 2024, the ripple future price in 2025 and even 2030 becomes a topic of interest. This long-term view focuses on Ripple’s potential to sustain growth and adapt to the evolving digital currency landscape.

CryptoNewZ has projected an optimistic future for XRP, suggesting that by 2025, the digital currency could achieve a peak value of $1.53. This forecast also indicates a possible low of $1.06 within the same year, highlighting the volatility and range of possibilities for XRP’s performance.

Looking further ahead, AMBCrypto provides a long-term perspective on Ripple’s potential. Their analysis points to a significant milestone for XRP, predicting that by 2030, the cryptocurrency could soar to a high of $2.01. This ambitious forecast is balanced with a more immediate prediction for 2024, where they anticipate XRP could reach up to $0.61.

Will Ripple go up? Factors influencing Ripple’s price trajectory

The question of “will ripple go up” in 2024 and beyond is influenced by many factors. These include:

- global economic conditions

- regulatory changes

- technological innovations

- Ripple’s strategic decisions

Understanding these factors will help make informed predictions about Ripple’s price potential.

Ripple’s technologies adoption

Ripple’s unique technology and its adoption by financial institutions play a crucial role in its price potential. The more Ripple’s technology is adopted for cross-border payments, the higher the likelihood of an increase in its value. This adoption rate is a key component of the ripple XRP forecast.

Here are just a few core partnerships Ripple concluded in 2023. In November, Ripple revealed an enhanced version of its cross-border payment solution, now known as Ripple Payments. This revamped platform aims to facilitate the integration of blockchain technology into the services of Web2 companies.

Another notable collaboration is with African payments company Onafriq, using Ripple’s technology to enable faster and cheaper remittances into Africa. Ripple also unveiled an upgraded version of its cross-border payment solution, Ripple Payments, to help web2 companies integrate blockchain into their services.

Adding to Ripple’s momentum, the Dubai Financial Services Authority granted XRP the distinction of being the first virtual asset authorized for use within the Dubai International Financial Center on November 2. This approval places XRP alongside other established cryptocurrencies like Bitcoin, Ethereum, and Litecoin, enabling licensed firms in the DIFC to provide services using XRP.

Furthermore, Ripple made headlines on the same day with the announcement of its collaboration with the National Bank of Georgia. The partnership will see Ripple’s Central Bank Digital Currency (CBDC) platform being employed in a pilot program to explore the potential applications and advantages of a digital version of the Georgian Lari. This initiative marks a significant step in Ripple’s expansion and adoption in global financial systems.

Ripple’s market position

Ripple’s competition with other tokens and their market position also affect its price prediction.

The coin Ripple’s XRP is poised for bullish price action following a significant move by Grayscale. The asset management company re-added XRP to its Digital Large Cap (GDLC) index fund, now comprising 2.39% of the $400 million fund. This decision marks a turnaround from Grayscale’s 2020 exclusion of XRP due to the SEC lawsuit against Ripple. The re-addition signifies regulatory clarity for XRP since U.S. District Judge Analisa Torres declared it “not a security” in July 2023.

Whale investors have responded positively to Grayscale’s announcement, with a notable increase in XRP holdings among strategic whale cohorts. These investors acquired an additional 70 million XRP, valued at approximately $39.2 million. This increased buying pressure from whales is a bullish signal, potentially leading to a rise in market demand and boosting confidence among retail stakeholders.

Navigating Ripple’s future

As we look towards 2024 and beyond, the Ripple price prediction encompasses a range of possibilities. Numerous factors will shape Ripple’s journey, from resolving legal battles to technological advancements and market dynamics. While the future of Ripple, like any cryptocurrency, is not set in stone, a careful analysis of these factors provides valuable insights into its potential growth and challenges.

Investors and enthusiasts alike should keep a close eye on Ripple’s developments, as its journey through 2024 and beyond will be a testament to the evolving landscape of digital currencies. With a balanced and informed approach, one can navigate the uncertainties and opportunities that lie ahead in the world of Ripple and cryptocurrency.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

FAQs

Is XRP a good investment?

Whether XRP is a good investment depends on various factors, including individual risk tolerance, investment goals, and market dynamics. XRP has shown potential due to its unique technology and partnerships in the financial sector. However, like any cryptocurrency, it comes with risks, especially considering its ongoing legal challenges and market volatility.

Will Ripple price rise?

The potential for Ripple’s price to rise is subject to several influencing factors, including the outcome of its legal battles, adoption rate by financial institutions, and overall market trends. Positive developments in these areas could lead to a price rise. However, investors should remain aware of the inherent uncertainties and risks in the cryptocurrency market.

How high can Ripple go?

Predicting how high Ripple can go is challenging due to the volatile nature of the cryptocurrency market. Increased adoption, technological advancements, and favorable regulatory outcomes could significantly boost Ripple’s value. Historical data, expert analyses, and market trends can offer some guidance, but absolute certainty is impossible in crypto.

How to buy Ripple (XRP)?

To buy Ripple XRP, follow these steps:

— Choose a cryptocurrency exchange that lists XRP.

— Create an account on the exchange.

— Complete any required verification processes.

— Deposit funds into your account, either with fiat currency or another cryptocurrency.

— Purchase XRP using the deposited funds.

— Store your XRP in a secure wallet, either provided by the exchange or a personal digital wallet for added security.

Can Ripple reach $100?

The possibility of Ripple reaching $100 is a topic of much speculation. While Ripple has the potential for significant growth, reaching such a high value would require substantial market capitalization and widespread adoption. Considering the current market dynamics and Ripple’s legal situation, this scenario seems optimistic. Investors should maintain realistic expectations and stay informed about Ripple’s ongoing developments.