How will Norway’s crackdown on crypto mining impact the global Bitcoin market and the country’s economy?

Amid the recent completion of Bitcoin’s (BTC) fourth halving, which saw miner rewards halved to 3.125 Bitcoins, Norway is taking decisive steps to address the energy-intensive practice of crypto mining within its borders.

Against Bitcoin’s price volatility, currently hovering around $66,000, the Norwegian government is gearing up to enact new legislation aimed at reining in data centers, a move partly intended to curb crypto mining activities.

According to a report from local news outlet VG, citing statements from Digitalization Minister Karianne Tung and Energy Minister Terje Aasland, the proposed law marks the first regulatory intervention in Norway’s data-center industry.

Under the new regulations, operators of data centers will be required to register with local authorities in a move to increase oversight and accountability.

The driving force behind this legislative push is the government’s resolve to limit or altogether eliminate crypto mining within Norwegian borders.

Both Tung and Aasland have voiced concerns over the environmental impact of crypto mining, citing its greenhouse gas emissions as incompatible with Norway’s sustainability goals.

Norway’s move echoes similar efforts in neighboring Sweden, where increased taxes on data centers were implemented last year to discourage crypto mining activities.

The aim is clear: to steer the industry towards more sustainable practices and align it with broader environmental objectives.

Current crypto mining legislation in Norway

Currently, there are no explicit bans on crypto mining, but shifting norms indicate that data centers and similar facilities involved in mining may face increased scrutiny.

For instance, the government’s decision to end reduced electricity tax rates for data centers and crypto mining in the State Budget 2023 exemplifies this trend.

In Oct. 2022, the Norwegian government proposed abolishing the reduced electricity tax rate for data centers, effectively subjecting mining electricity to standard rates.

Finance Minister Trygve Slagsvold Vedum emphasized the importance of prioritizing electricity for societal needs amid the growing prevalence of crypto mining.

These proposed changes were projected to generate additional revenue of 150 million NOK (approximately $13.61 million), with 110 million NOK expected to be realized in 2023.

It’s worth noting that the Norwegian government seems willing to jeopardize the entire data center industry to curb the Bitcoin mining sector, which contrasts with its 2018 initiative to establish Norway as a data center hub.

Furthermore, digital currency obtained through mining becomes taxable upon receipt.

Miners are required to determine the market value of the virtual currency mined at different times and convert it into Norwegian kroner using exchange rates provided by Norges Bank.

Miners can claim deductions for expenses related to mining, such as machinery, software, and electricity costs.

Machinery and equipment primarily used for mining can also be depreciated over several years, while deductions for electricity expenses are based on increased usage compared to standard consumption.

The secret sauce of Norway

Norwegian Bitcoin miners, while not dominating the scene, play a crucial role in securing the Bitcoin network.

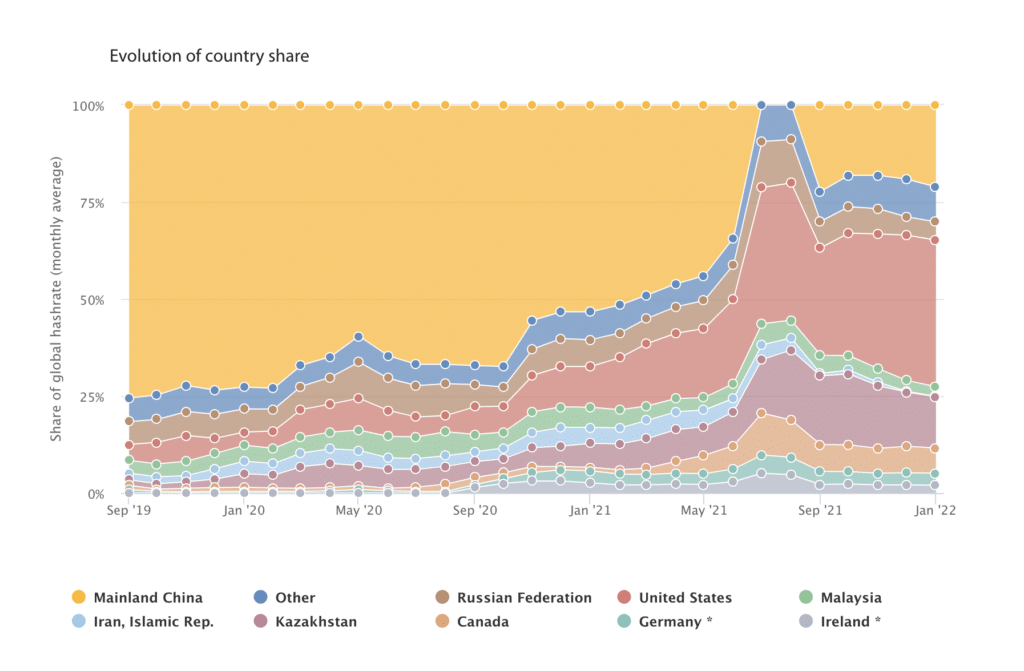

According to Cambridge University CCAF’s Bitcoin Mining Map data from January 2022, these miners contribute approximately 0.74% to Bitcoin’s hashrate, which measures the computational power dedicated to mining.

Operating primarily in Norway’s middle and northern regions, they include both multinational companies like Bitfury and Bitdeer, as well as local entities such as Arcario.

Norway’s appeal to Bitcoin mining stems from its abundant renewable energy sources, particularly hydropower.

The country ranks among the top in electricity generation per capita globally, largely due to its mountainous terrain and wet climate, facilitating the development of numerous hydropower plants.

In 2021, hydropower contributed 92% of Norway’s electricity generation, with an additional 7% from wind power. This reliance on renewables makes Norway an attractive destination for Bitcoin miners aiming for carbon neutrality.

Moreover, Norway’s cold climate naturally cools mining operations, reducing the need for additional cooling infrastructure.

With average monthly temperatures ranging from -4°C to +13°C in northern Norway, miners benefit from lower maintenance requirements and longer equipment lifespan compared to hotter climates like West Texas.

Thus, despite its relatively modest contribution to Bitcoin’s hashrate compared to other nations, Norway’s role in the global mining ecosystem remains crucial.

What could new legislation mean for Norway’s BTC miners?

The proposed legislation could lead to several implications for BTC miners operating within Norway’s borders.

Firstly, increased regulatory hurdles may introduce additional administrative burdens and compliance costs for miners.

This could include adhering to stricter environmental standards, obtaining permits, or undergoing regular audits to ensure compliance with regulations.

Moreover, the shift towards more sustainable practices in response to environmental concerns could prompt miners to reconsider their operations within Norway.

While the country boasts abundant renewable energy sources, such as hydropower, the potential for increased regulation and associated costs may diminish its attractiveness as a mining destination.

Miners may opt to relocate to jurisdictions with more lenient regulations or cheaper operational costs, thereby impacting Norway’s position in the global mining ecosystem.

On the bright side, this could also spark innovation. Miners might start looking for ways to use less energy or find new, more eco-friendly ways to mine, which could lead to new technologies in the industry.

Overall, the new rules could shake things up for Bitcoin miners in Norway, making them rethink how they operate and where they do business. It’s a wait-and-see situation to see how miners will adapt to these changes.