- The crypto market is down today due to a significant correction phase.

- Bitcoin struggles around the $56,000 support level, with technical indicators suggesting a potential reversal.

Checking the crypto market today, you will see nothing but red. The entire market seems to have tumbled, with Bitcoin [BTC] and Ethereum [ETH] taking most hits, dropping far below their critical support levels.

Bullish sentiments in the community seem to be almost completely gone. Once again, investors are panicking, possibly at the edge of giving up. So, what is going on? Why is the crypto market down now?

2024 is generally expected to be a highly bullish year for the markets. And it has. But we are currently dealing with a strong case of the corrections.

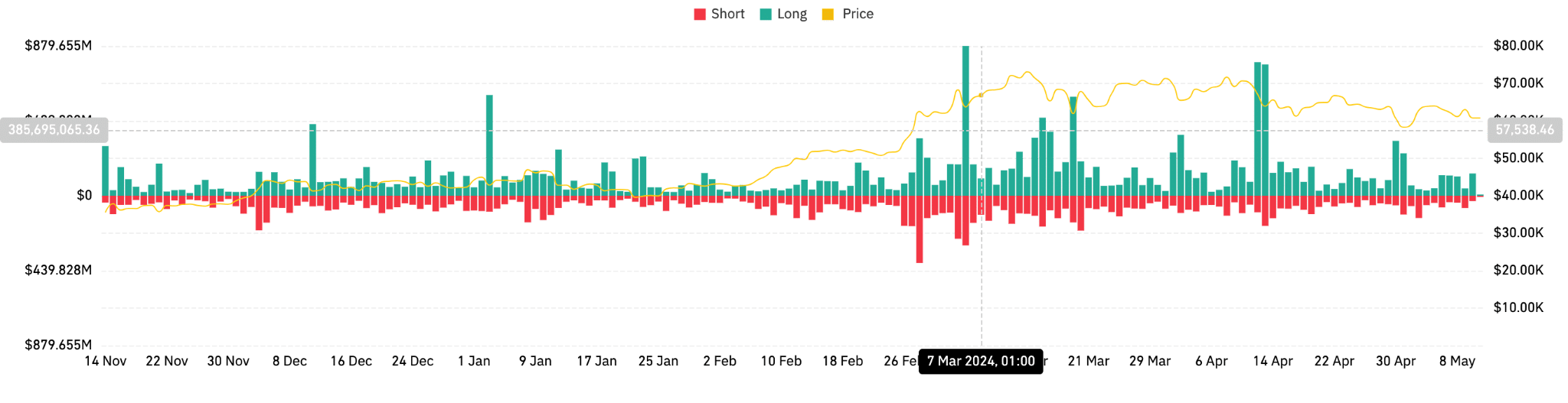

Data from Coinglass shows us that both tokens have seen more inflows than outflows in the past twenty-four hours. Also, liquidations are relatively low.

On the 10th of May, titans of the U.S. banking sector, JPMorgan and Wells Fargo, made headlines with their disclosures of holding spot Bitcoin ETFs.

Yet, this revelation has barely made a ripple in the overall market dynamics. Bitcoin, for one, seems stuck in a prolonged correction cycle, stubbornly testing investor patience.

Why is the crypto market flailing?

The immediate support level for BTC now is somewhere around $56,000, for traders. Breakout is still imminent, as is widely expected by the community.

Data from TradingView tells us that this is where fear and optimism collide, where traders hover between hope for a breakout and dread of further decline.

Bitcoin is retesting its former all-time high resistance levels, now as new support zones.

This activity shows a typical case of RSI Bullish Divergence on the 4-hour chart, hinting that the downtrend’s momentum is losing steam and might soon reverse.

Yet, the currency is still navigating through the perilous falling wedge pattern—a technical indicator suggesting that while the end of the tunnel may be near, the road remains filled with fear and uncertainty.

The community’s consensus leans towards an eventual breakout, which could catapult Bitcoin’s value to new heights, potentially reaching as high as $78,000 in the bullish surges to come.

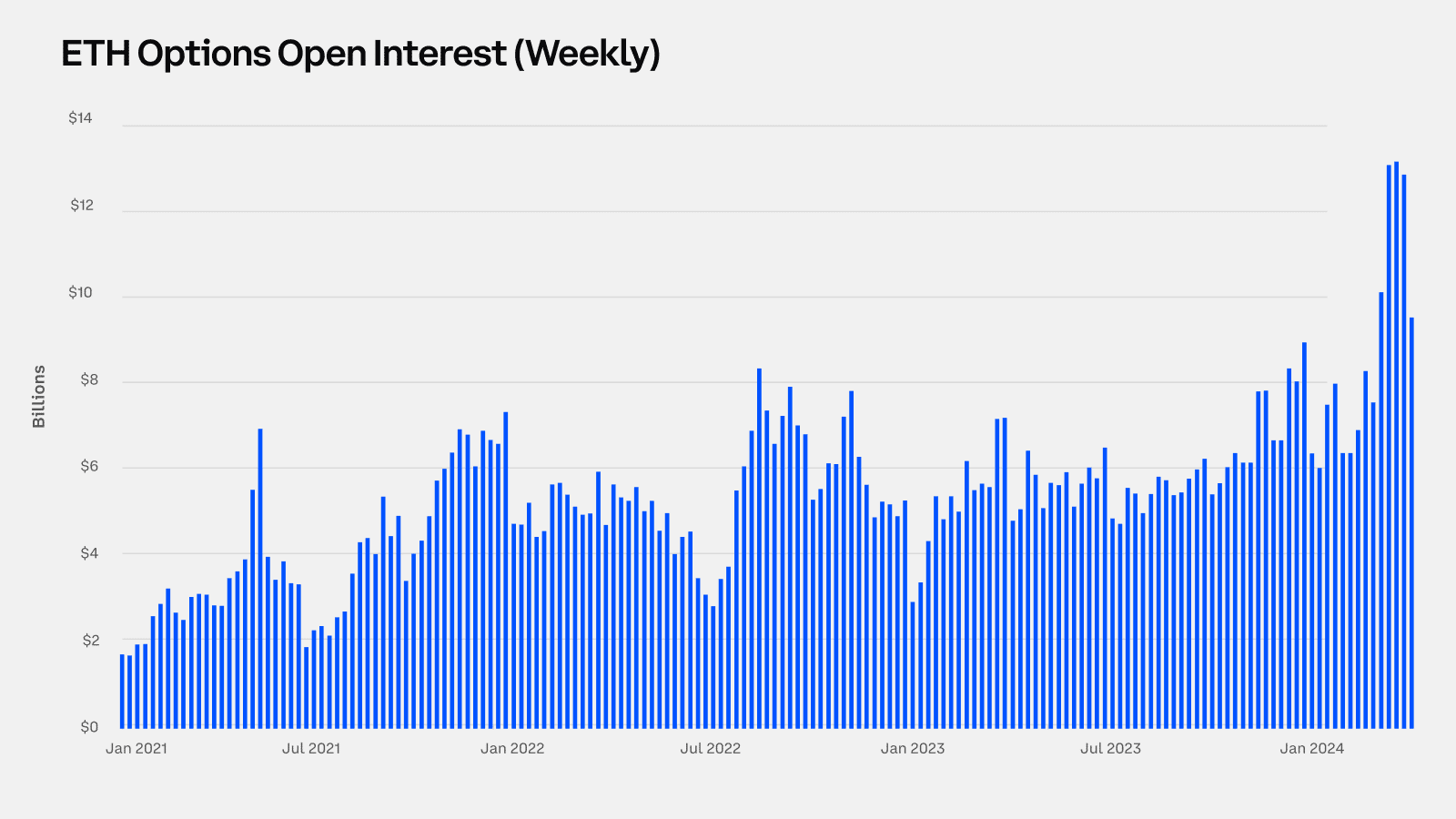

As for Ethereum, its current trajectory is slightly different from Bitcoin’s. The Ethereum derivatives market is showing signs of increased activity and investor interest, according to Glassnode.

Open Interest has surged by 50%, indicating a strong engagement with Ethereum’s financial products.

However, despite these positive indicators in derivatives, Ethereum’s performance relative to Bitcoin this cycle is much slower.

The lag in speculative interest, particularly from the Short-Term Holder group, is a cautious approach among these investors.

Meanwhile, Long-Term Holders seem to remain on the sidelines, eyeing more lucrative opportunities for profit-taking in future rallies.

At press time, Ethereum was worth $2,897.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Even as it battles through the current market downturn, the growing interest in its derivatives suggests that these holders may soon see the favorable conditions they are waiting for.

All in all, the reason for the retreat is that the market is still consolidating, and experts expect a breakout regardless. Investors are advised not to give up. 2024 is still crypto’s year.