- We could see an ETH approval this week.

- The approval news is based on the confidence of observers in the space.

The recent prediction of an imminent approval for an Ethereum [ETH] ETF has sparked excitement in the market, resulting in one of Ethereum’s most impressive price runs in weeks.

Interestingly, despite this dynamic activity, social activity surrounding Ethereum has remained relatively calm.

Is an Ethereum ETF imminent?

Nate Geraci’s recent speculation about the approval of an Ethereum ETF this week, while not based on specific regulatory indications, highlighted an optimistic outlook fueled by broader industry movements.

His confidence seemed to be bolstered by the recent actions of several ETF issuers, such as VanEck and 21Shares, who submitted amended registrations in the past week, in the hope of securing the SEC’s approval to list spot Ether ETFs.

This strategic move by these issuers is part of a trend where institutions are quick to follow up on the positive regulatory momentum created by the approval of a Bitcoin [BTC] ETF.

Geraci’s belief reflected a broader sentiment in the crypto community that the regulatory environment was ripe for another ETF approval.

All trends look normal

Despite the significant anticipation surrounding the potential approval of an Ethereum ETF, its social metrics have remained relatively stable.

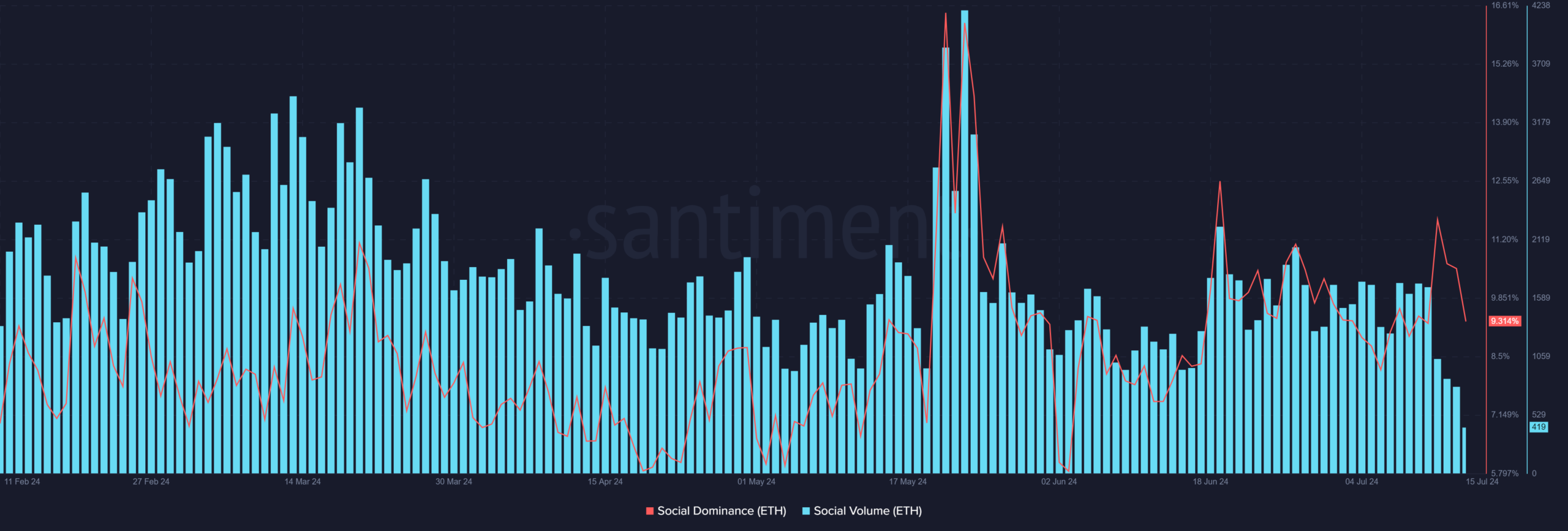

According AMBCrypto’s analysis of the Social Dominance via Santiment, its highest point in the last two weeks was about 11%. Thus, of all crypto-related conversations during that period, Ethereum was part of 11%.

As of this writing, its Social Dominance had slightly decreased to approximately 9.4%, having dropped from just over 10% the previous day.

Additionally, the Social Volume—an indicator of the total number of mentions or posts about Ethereum across various social platforms—has not shown any significant spikes.

The press time Social Volume was at around 380.

Prices react to ETF approval news

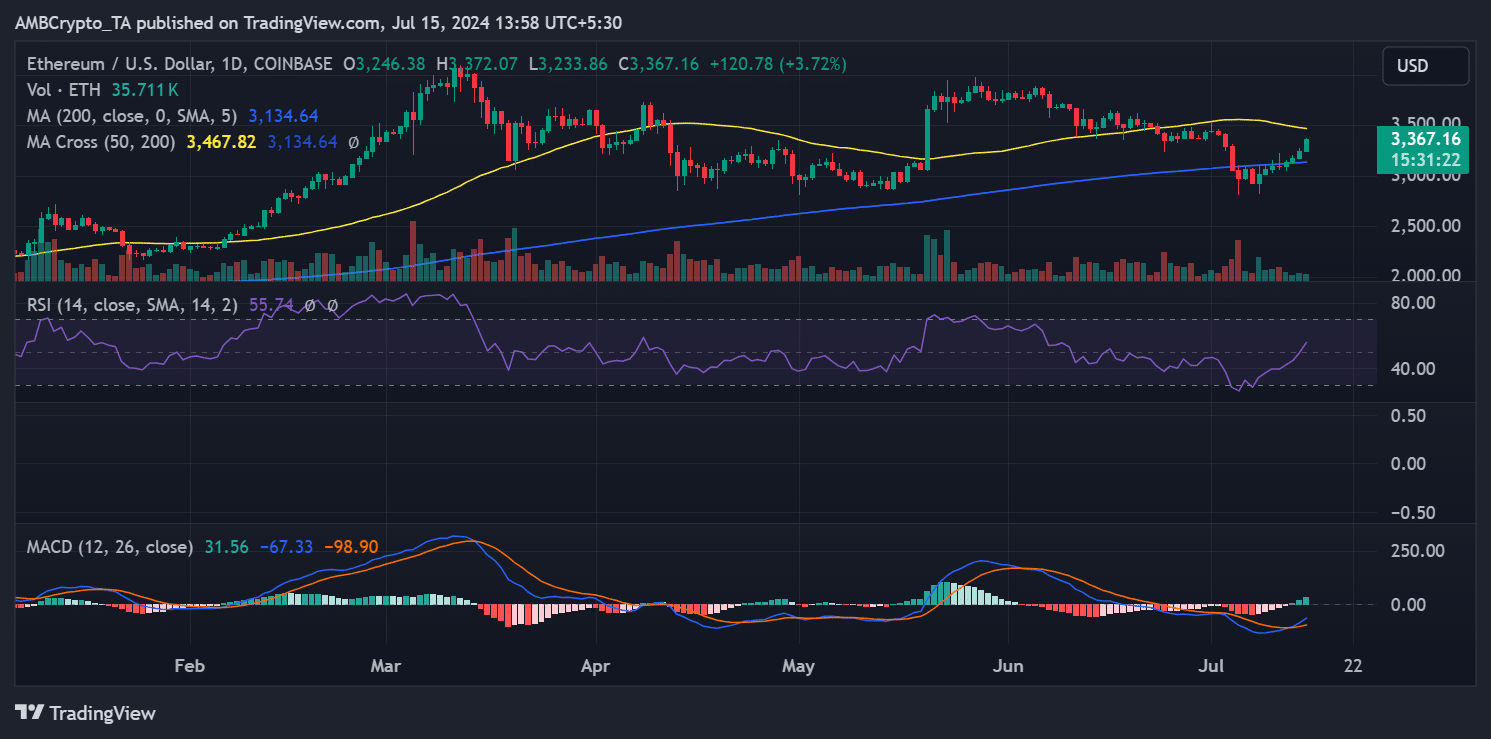

AMBCrypto’s look at Ethereum on a daily time frame chart highlighted a building momentum in its price.

After a significant downturn, ETH has begun to rebound, with a notable uptrend in progress. As of the latest data, it was trading up by approximately $3.7, reaching around $3,360.

This marked its highest price point in almost two weeks and positioned it near its short moving average (yellow line).

The yellow line had acted as a resistance level at around $3,400 and $3,500 over the past two weeks.

Read Ethereum’s [ETH] Price Prediction 2024-25

The potential approval of an Ethereum ETF could be a pivotal factor in ETH breaking through these resistance levels.

If the ETF is approved, it could significantly boost investor confidence and increase institutional participation, potentially driving the price to reclaim its all-time high (ATH).