- Northern Data refutes fraud allegations by former employees.

- The firm has moved to dismiss the allegations to pave for its US IPO.

Europe’s largest Bitcoin [BTC] miner Northern Data refuted alleged fraud claims by former employees and moved to dismiss a lawsuit filed by the ex-employees.

In a recent Bloomberg interview, Northern Data’s Chef Operating Officer (COO) Rosanne Smith confirmed the move to dismiss alleged claims.

‘Those complaints are completely without merit. We’ve already filed a motion to dismiss it, and we are confident that the legal process will vindicate the company.’

Smith added that they were not ‘worried’ about the allegations.

Bitcoin miner vs ex-employees

For perspective, the firm’s former executives, Joshua Porter, and Gulsen Kama, reportedly claimed that Northern Data mispresented their financial conditions and committed tax evasion.

Part of the allegations filed in June in California, as reported by the Financial Times (FT), read,

‘Falsely misrepresenting the strength of its financial condition to investors, regulators, and business partners…Was knowingly committing tax evasion to the tune of potentially tens of millions of dollars.’

However, Northern Data refuted the allegations and questioned the timing of the reports given its planned IPO (Initial Public Offering) in the US. Part of the firm’s statement read,

‘Northern Data refutes the allegations in the strongest terms. It is no coincidence that these allegations from disgruntled former employees are being publicized just days after unconfirmed media speculation that the company is evaluating a potential capital markets event.’

Like most BTC miners, Northern Data diversified the AI sector to supplement its revenues. The firm plans to expand its cloud and data center divisions into US public markets and expects a $16 billion public valuation.

However, as Smith mentioned, the alleged fraud could damage the firm’s image ahead of its planned IPO. The firm reportedly could greenlight the IPO as early as the first half of 2025.

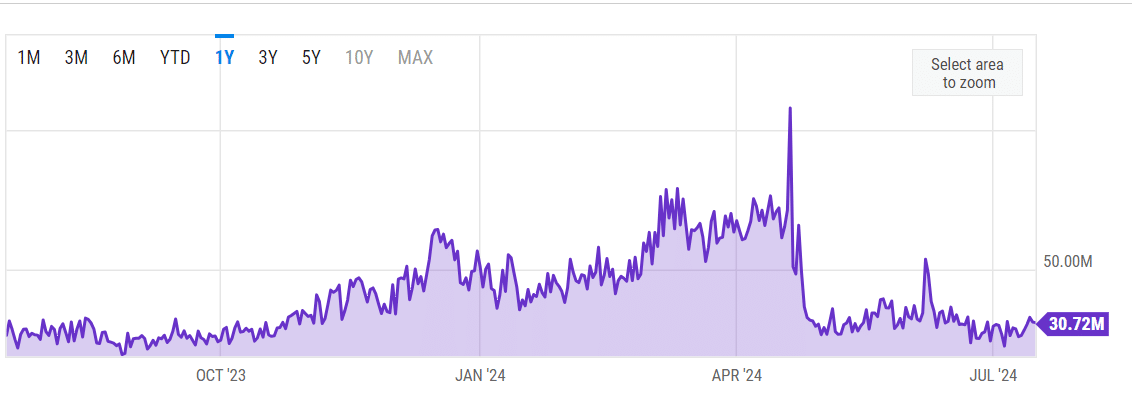

Meanwhile, BTC miners’ daily revenue has remained below $30 million. This differed from over $40 million in daily revenues recorded in the first half 2024.

The drop in revenues post-halving has tipped most miners to diversify revenue streams, especially AI, to stay afloat.