- The influx of institutional demand has likely been one of the major factors that explained why Bitcoin hovered around the previous cycle ATHs.

- Investors need not fear lower timeframe volatility, as metrics support a buy-and-hold strategy.

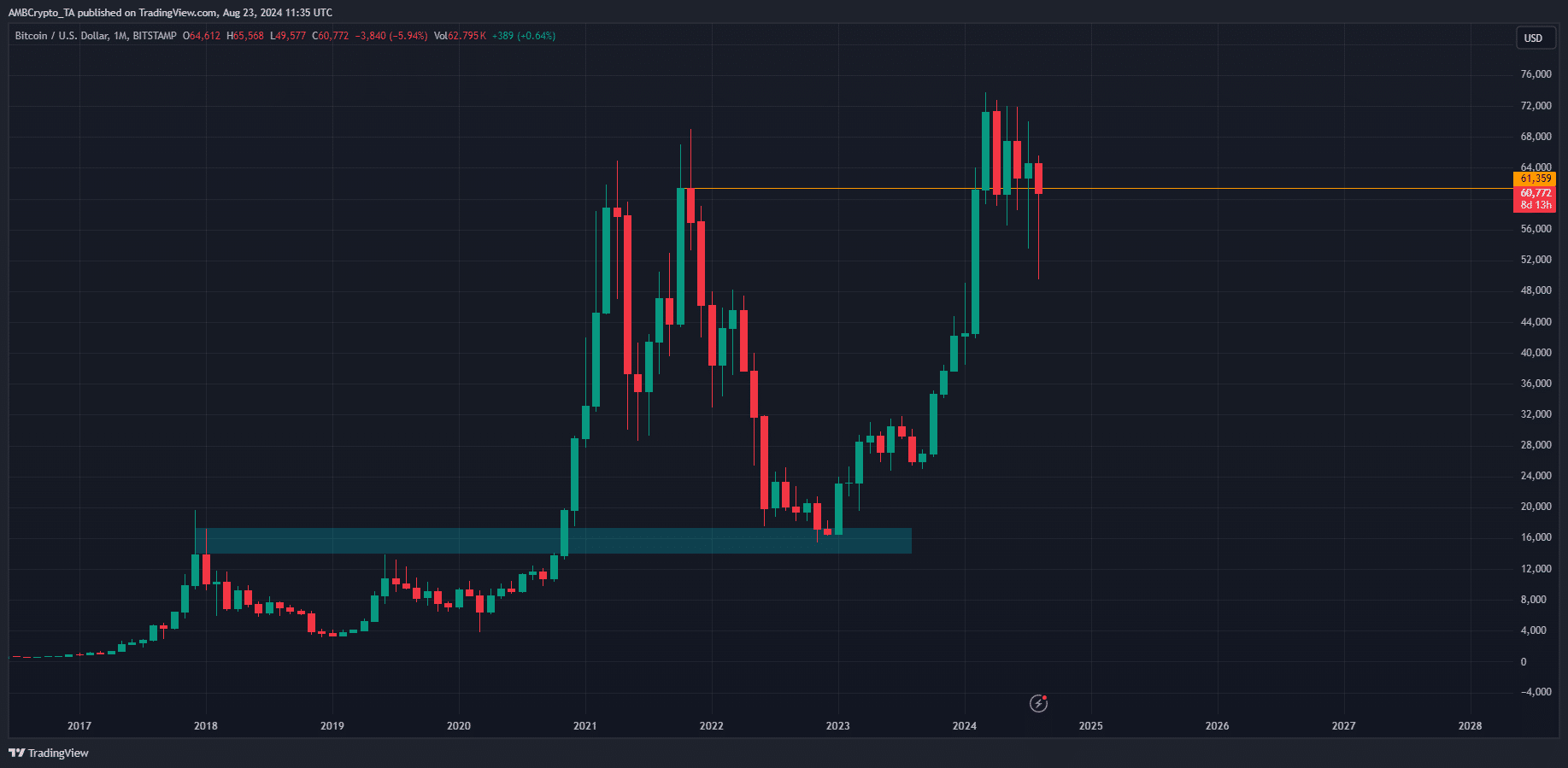

Bitcoin [BTC] was in a downtrend on the weekly chart but an uptrend on the monthly chart. It has consolidated within the $50k-$70k region since March.

While traders and investors might be frustrated with the lack of movement, BTC remained extremely bullish on the higher timeframes.

As a popular crypto analyst pointed out, Bitcoin has closed six monthly trading sessions above the March 2021 monthly session close.

Even the halving event and numerous FUD events across the market were not enough to push the king of crypto off its perch.

Unprecedented Bitcoin price performance

In terms of pure percentage gains, earlier Bitcoin cycles were stronger. Yet, this run has something that has not happened before. During the 2024 BTC halving event in April, the price was above the $61k mark.

It has traded at or very close to the previous cycle’s ATH during and after the halving event. During the 2020 cycle’s halving, BTC prices were close to 60% down from ATH, compared to roughly 10% this cycle.

Hence, lower timeframe volatility aside, Bitcoin remained extremely bullish for long-term investors.

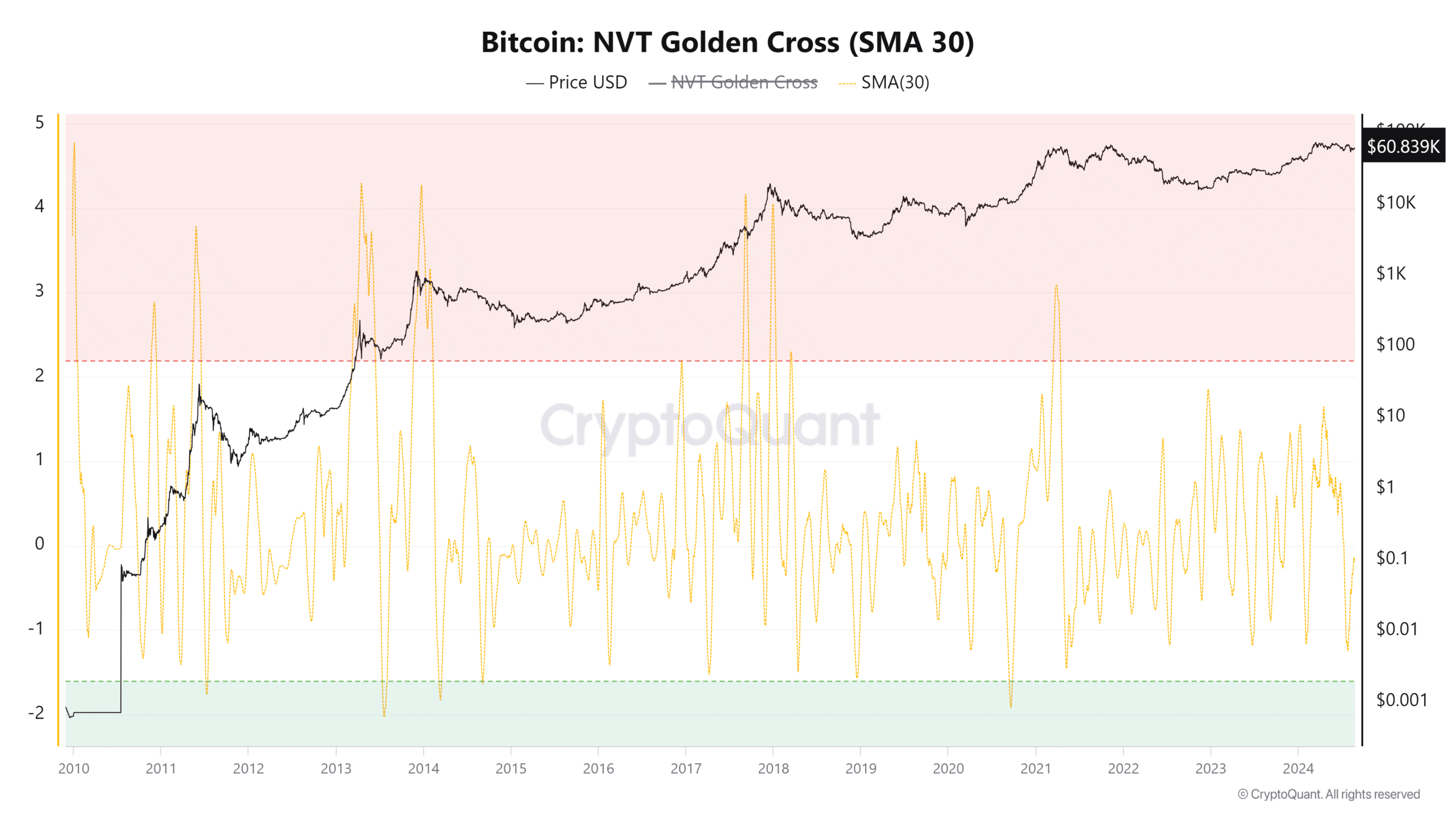

The NVT values encouraged buyers

Source: CryptoQuant

The 30-day simple moving average of the NVT golden cross was at -0.14. Generally, values above 2.2 indicate a cycle top, and below -1 a possible bottom. Hence, the Bitcoin bull run has a long way to go.

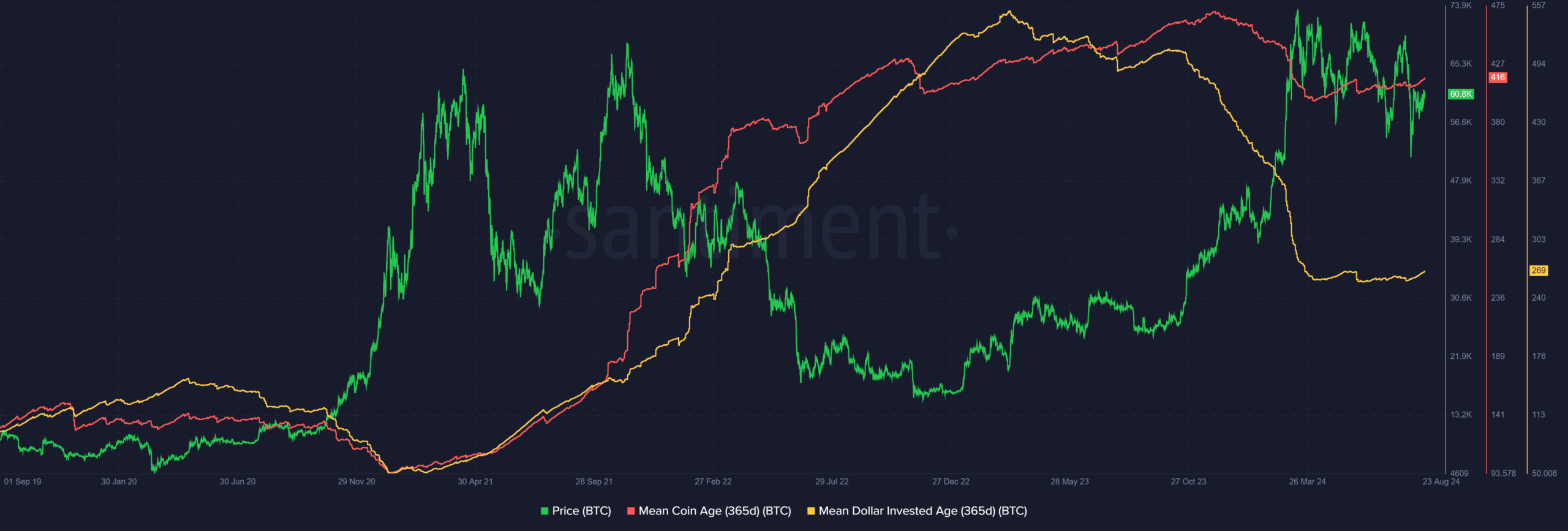

Source: Santiment

The Mean Dollar Invested Age began to fall in November 2023, as prices increased rapidly. Over the past few months, it has been relatively flat.

A falling MDIA is a sign of investments flowing back into circulation and of newer investments.

The MDIA could proceed to fall much further from 269 to the previous cycle lows at 51 before its continued uptrend would begin to indicate network stagnancy.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The mean coin age began to slowly trend higher after the sharp drop in February and March, as the quick price gains led to profit-taking activity and selling pressure.

A continuation of this uptrend would denote network-wide accumulation.