- Bitcoin has declined by over 7% over the last 7 days.

- Analysts believe a significant correction could be due if BTC drops below $56k

Bitcoin [BTC], the world’s largest cryptocurrency by market capitalization, has seen considerable depreciation over the past week. In fact, at the time of writing, BTC was down by over 7% to trade at a value of $59,129 on the charts.

August, in general, has been fairly volatile for the cryptocurrency. For instance, BTC dropped to as low as $49,500 on the charts earlier in the month, before recovering soon after. In fact, it later hit a local high of over $65k too, before losing its gains again to drop below $60k.

That’s the reason why many are still uncertain about the scale of the next wave of corrections.

According to Cryptoquant analyst Julio Moreno, however, Bitcoin may register a strong decline if the price declines below $56k.

What does the market sentiment say?

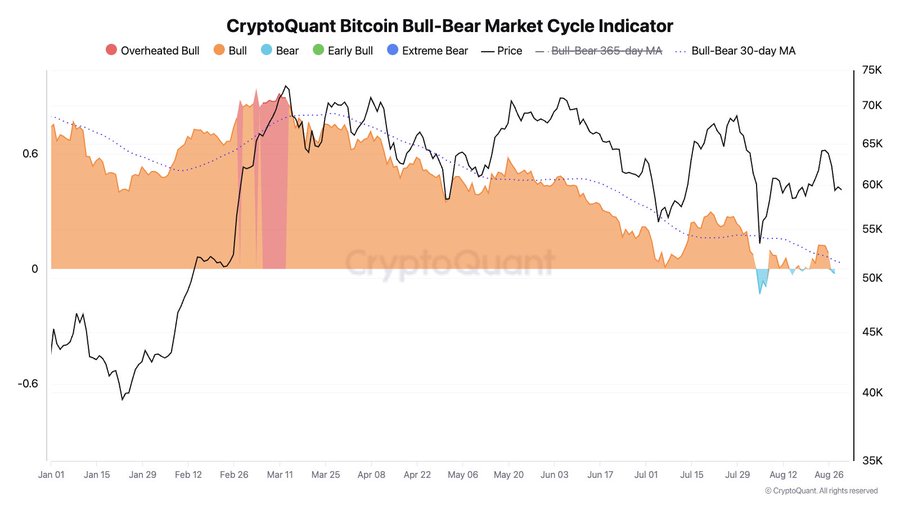

In his analysis, Moreno cited the market cycle indicator suggesting that $56k is the most crucial support level. According to the analysts, if the price falls below this level, the crypto will seen significant weakness. Since the Bitcoin market cycle indicator has turned bearish again, the crypto risks further correction below the demand zone.

The analyst shared the analysis on X, noting that,

“#Bitcoin market cycle indicator is again in BEAR phase (light blue area). From a valuation perspective, if the price pierces $56K to the downside, risks of a larger correction increase.”

Based on this analysis, the Bear phase is well positioned to persist if the bulls don’t reclaim the market.

What do BTC’s charts say?

While these metrics highlighted by Moreno provide possible future price movements, it’s essential to see what other market indicators suggest.

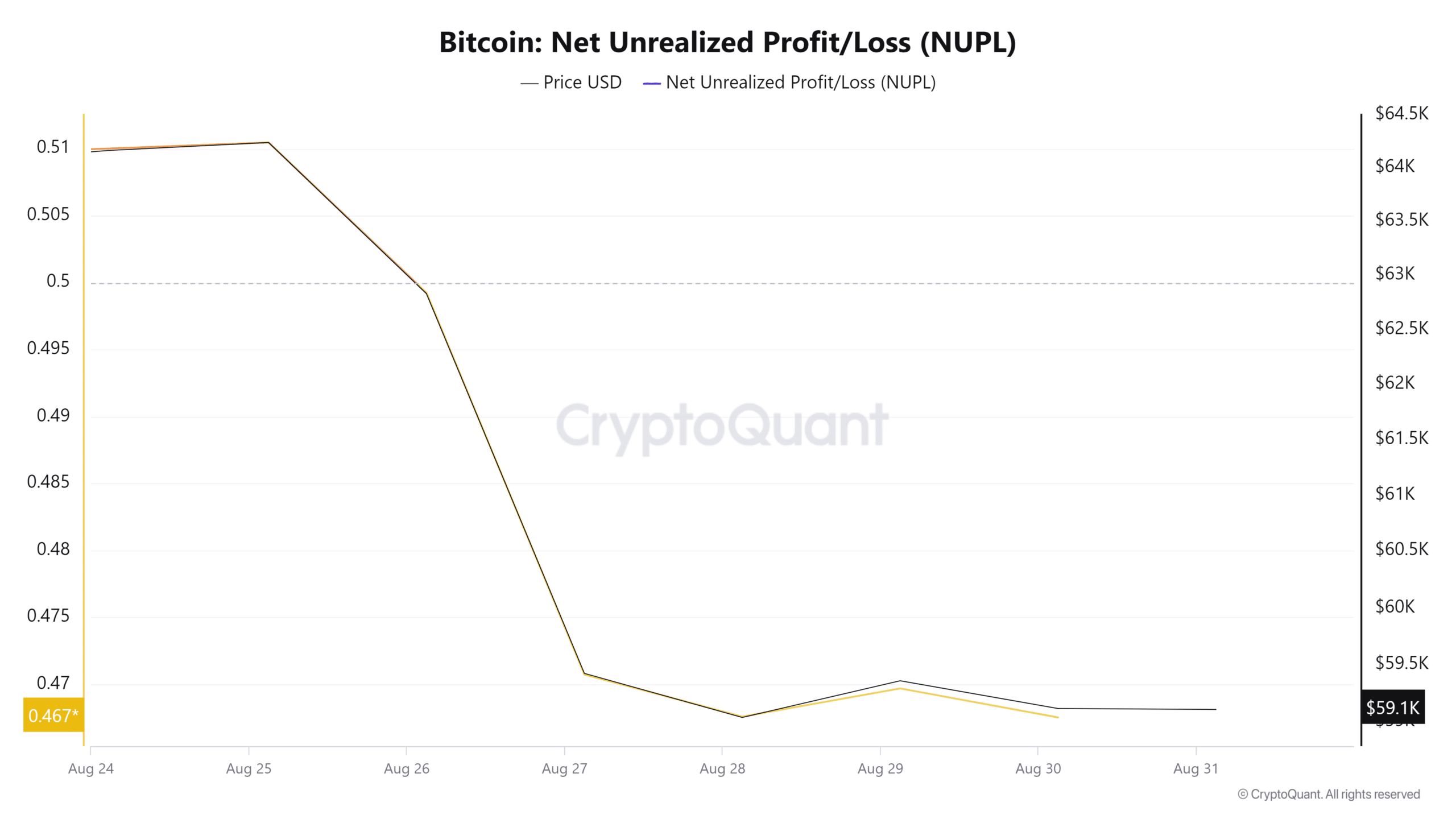

For starters, Bitcoin’s NUPL has declined over the past 7 days. Net unrealized profit/loss declined from 0.5 to 0.4, suggesting that investors are shifting from unrealized profit to unrealized loss.

This is a sign that the market may be leaning bearish. By extension, this means investors are worrying about the sustainability of the current prices, which may result in selling pressure.

Additionally, BTC is reporting a negative adjusted price DAA divergence of -44.31.

This suggests a decline in on-chain activity based on current prices. Such market conditions result in correction as prices adjust to the lower level of on-chain activity.

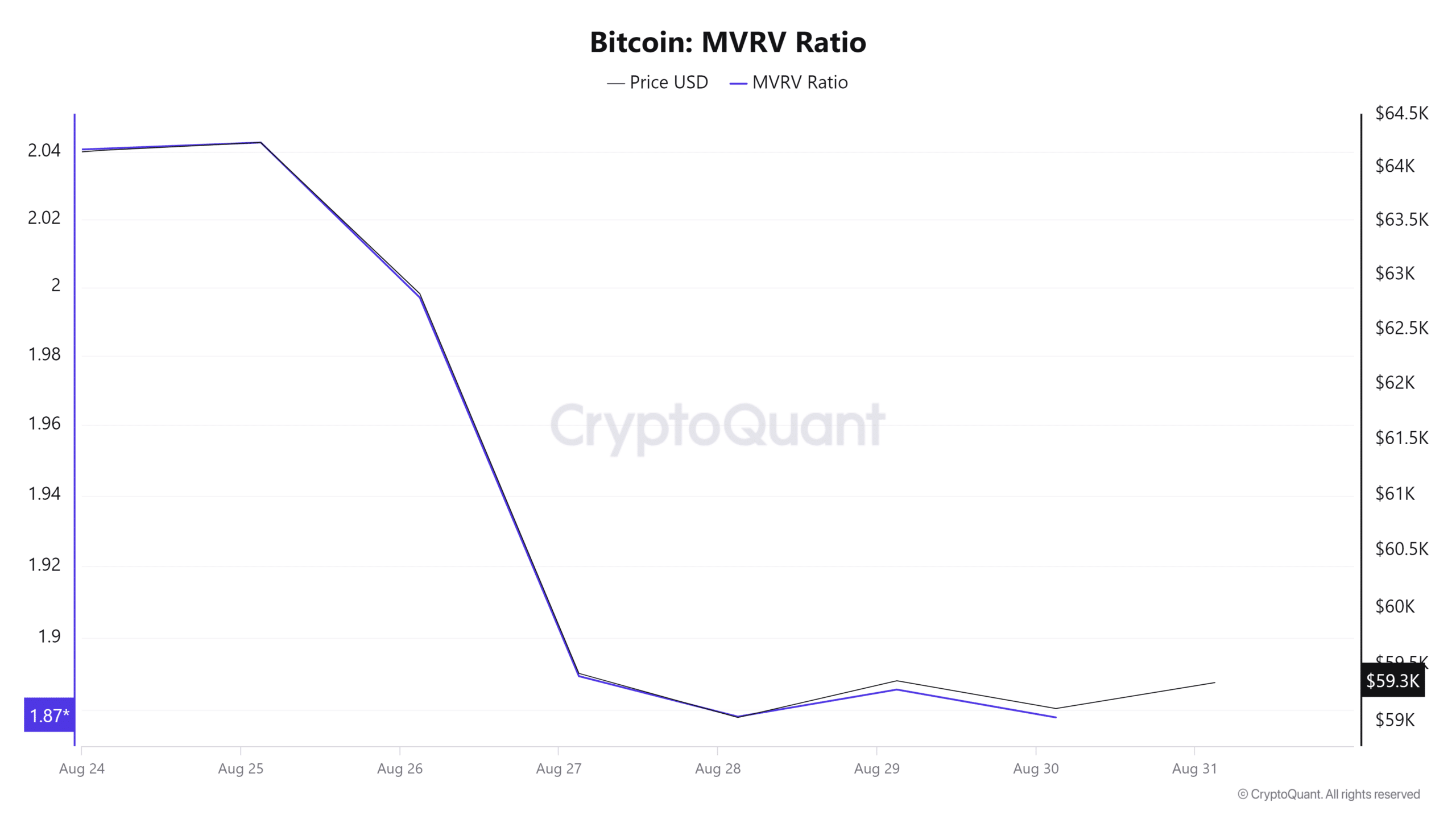

Equally, the MVRV ratio for BTC has remained at 1.8 over the past week. This shows that participants are in profit, which could lead to selling pressure as they aim to realize those gains. Therefore, if BTC holders decide to sell at this rate to realize their profits, it would lead to further price correction.

If selling pressure increases, the market will experience a pullback.

Therefore, as Cryptoquant analyst Julio suggests, BTC is in the bear phase. If the current market conditions hold, Bitcoin may be positioned for a bigger correction. A pullback below the $56 level will see BTC fall below $50k to the critical support of $49k.