- BTC continues to decline as federal rates cuts speculation persists.

- An analysts eyes a recovery to $62000 after FED decision.

Bitcoin [BTC] has experienced extreme volatility over the the past month. While it has attempted to break the September curse for the past week, the crypto has lacked enough momentum for the uptrend.

The last week has seen BTC move from a local low of $52546 to a local high of $60,670. However, over the past 24 hours, it has experienced fluctuation losing most of the gains. As of this writing, BTC was trading at 58,552. This marked a 2.38% decline over the past week.

Prior to this, Bitcoin was in upsurge rising by 5.98% on weekly charts. While the crypto has declined over the past 24 hours, its trading volume has surged. In fact, the past day has seen a 100% increase in trading volume to $26.9 billion.

The current market conditions have sparked widespread discussion. This has left many analysts see the possibility of upcoming Fed rates as the cause.

Popular crypto analyst Hasan has suggested federal cuts are one of the factors driving market sentiment.

What’s next for Bitcoin?

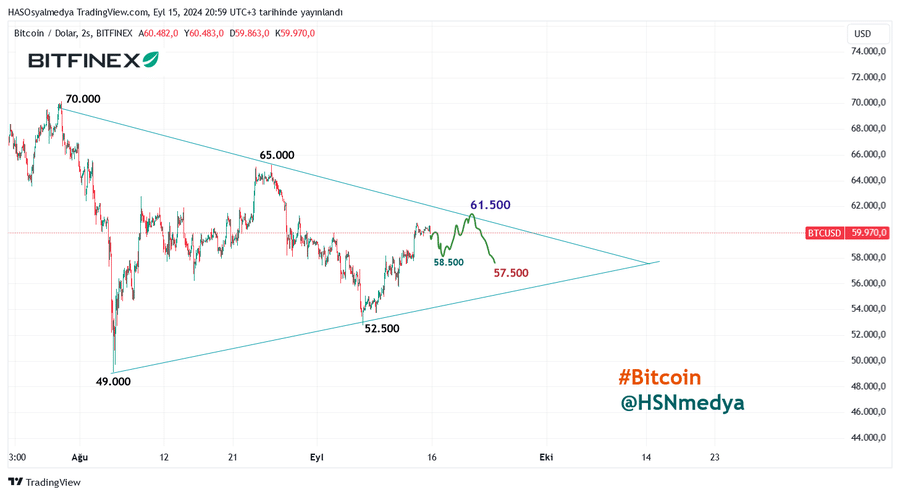

In his analysis, Hasan cited the upcoming federal cuts this week as the main factor driving market uncertainty.

According to his analysis, BTC markets will experience a sell-off of around $58500 making this the critical support level until the Federal cuts decision is out.

However, the analyst posits that even though the markets may experience some sell-off at this level, he expects recovery from this level to $61500.

Therefore, if the FED announces 25 basis point interest rate cuts, BTC will recover and price sales will surge to the $61500 and $62000 range.

However, if the market experiences a correction following the FED decision, BTC prices will decline to $57500.

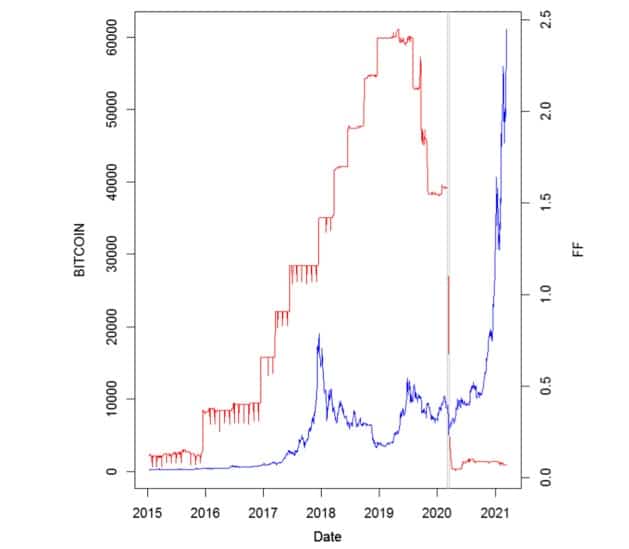

Historically, federal rate cuts have positively impacted BTC prices. For instance, in 2020 March, BTC prices surged surpassing its previous highs following the cuts resulting from the COVID-19 economic shock.

Therefore, the expected rate cuts after 4 years are likely to increase cash flow among retail and institutional traders thus increasing the BTC fund flow ratio. However, if the crypto abandons the historical tendency, it will experience further correction.

What BTC charts suggest

As noted by Hasan, the market uncertainty has increased over the FED rate cuts anticipation. Thus until then, the current market conditions show further decline.

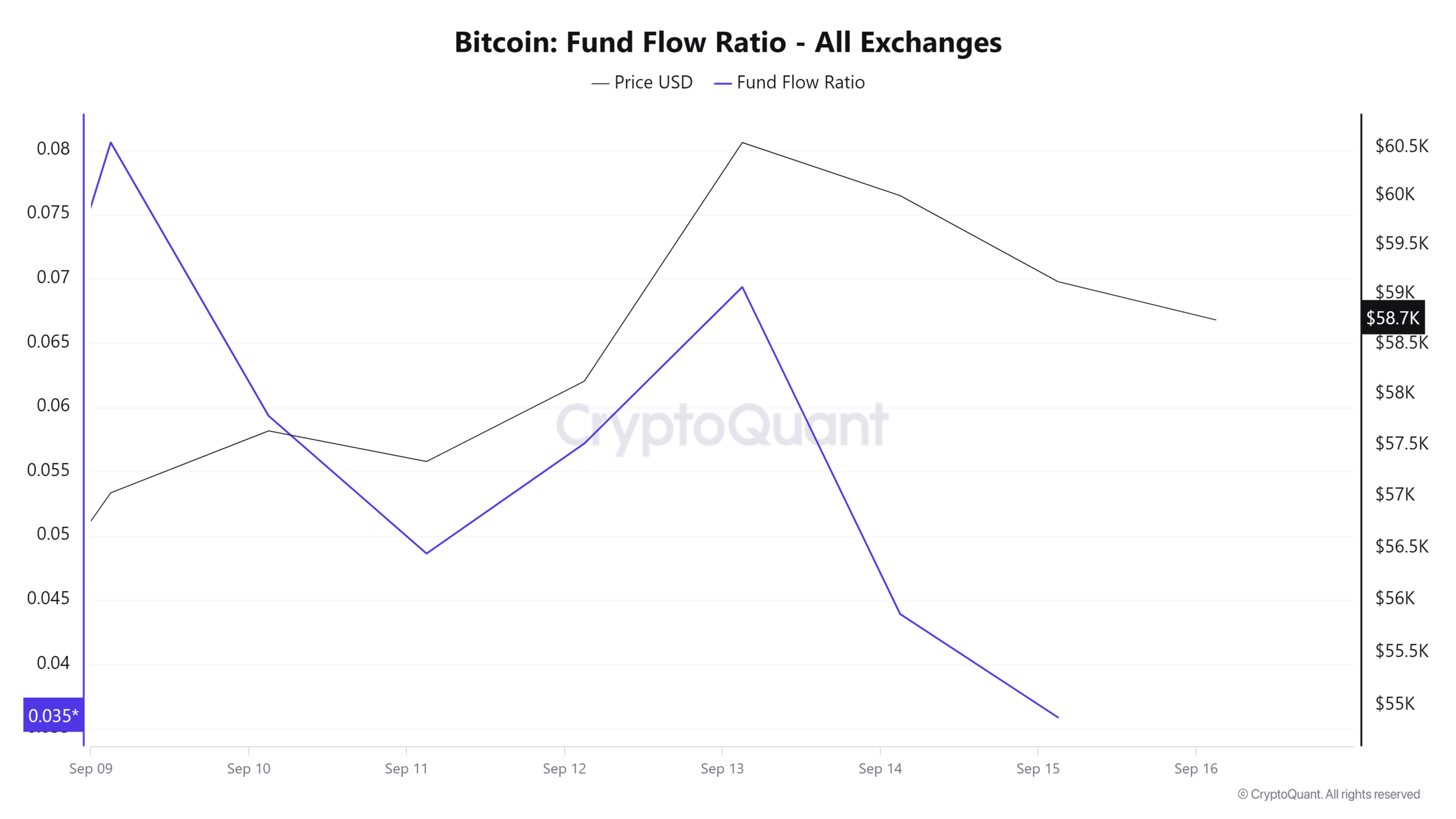

For example over the past week, Bitcoin’s fund flow ratio from a high of 0.08 to 0.03. The decline suggests more funds are exiting the market than those entering. This flow is supported by a 100% increase in trading volume.

Thus, these trading activities are causing selling pressure which further pushes prices down.

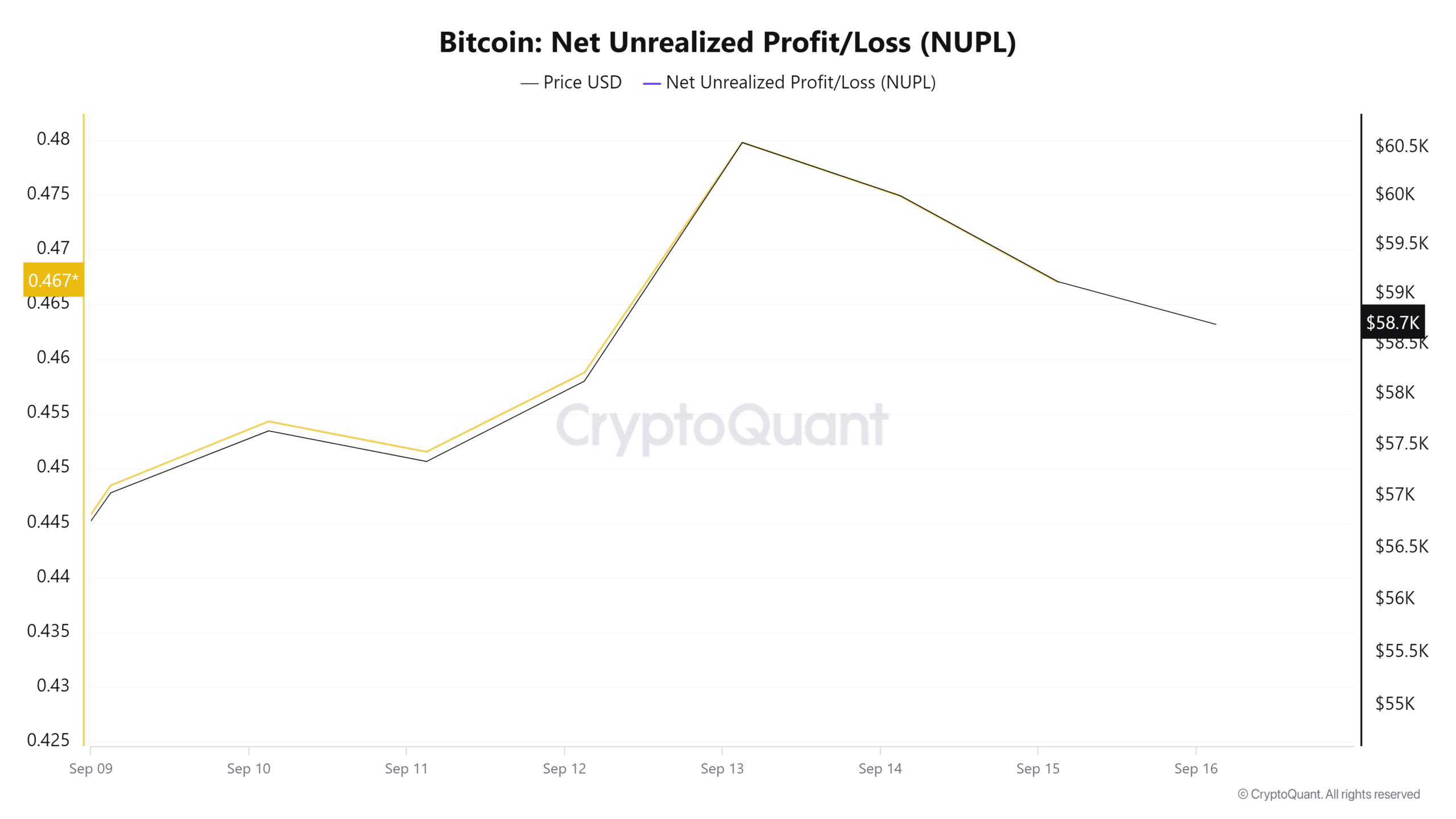

Additionally, BTC’s net unrealized profit/loss has declined over the past 3 days. This indicates that there’s a decrease in the number of holders in profit while those in losses increase.

Such a market condition leads to bearish sentiment as investors start to panic and sell to avoid further losses. This further leads to higher selling pressure.

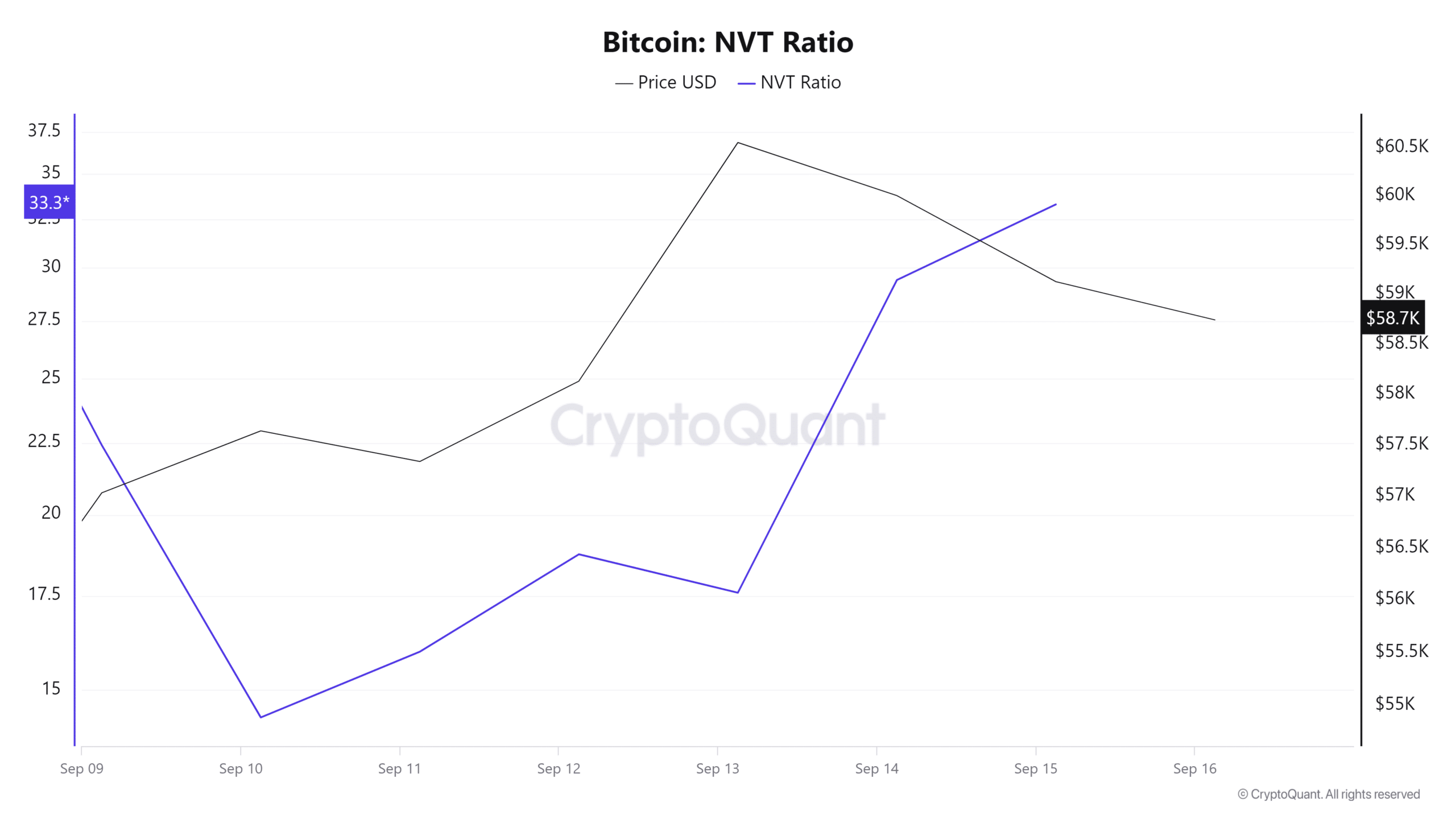

Finally, Bitcoin’s NVT Ratio has increased over the past week from a low of 14.3 to 33.3. An increase in the NVT ratio suggests that the recent price increase resulted from speculative buying.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Thus the recent price growth is unsustainable without adequate fundamentals to back it up. This results in correction for market compatibility, and that’s what BTC is experiencing after the recent spike.

Therefore, until FED rates are cut, BTC will experience further decline. If the market reacts positively to upcoming rate cuts, it will challenge $62852. However, if the market experiences a correction, it will decline to $57,342.