- Base scored a home run after dethroning Arbitrum to secure the top spot among Ethereum Layer 2s

- Multiple ATHs contributed to the network’s leading position

Base has been on a dedicated campaign to become the leading Ethereum Layer 2 network. And, it looks like it has achieved that goal now. This year, the network has seen significant growth and utility, culminating in its most recent milestone.

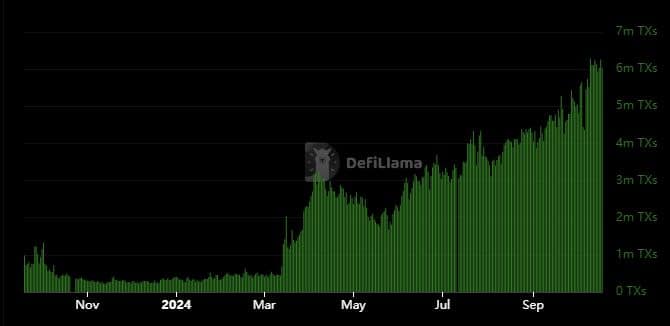

The Base network’s daily transaction count has been on a steady incline since March 2024. Accordingly, the Ethereum Layer 2 recently crossed over 6 million daily transactions.

More so, it has kept up this average figure this week – Its highest level so far this year.

This is the first time that the network has soared above 6 million transactions per day.

Hence, the question – How has this level of network adoption influenced other aspects of the network that underpin growth?

Base becomes leading Ethereum Layer 2

The first major outcome is that it has propelled Base to the top of the Ethereum Layer 2 rankings. In fact, according to Coingecko, it recently surpassed Arbitrum [ARB] to become the leading Layer 2 in terms of volume.

Speaking of volume, Base clocked over $938 million in daily volume over the past 24 hours. Arbitrum, which slid to the second spot, had less than half that amount at $462.7 million.

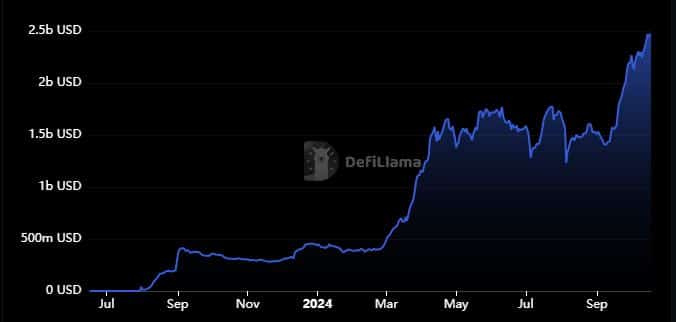

Base also overtook Arbitrum in terms of TVL at $2.47 million, compared to Arbitrum’s $2.41 million, at press time.

Here, it’s also worth noting that the TVL figure soared to a new historic high in the last 24 hours.

The TVL’s new milestone confirmed solid levels of confidence among investors. The network has also maintained decent levels of liquidity, judging by its equally impressive stablecoin market cap growth.

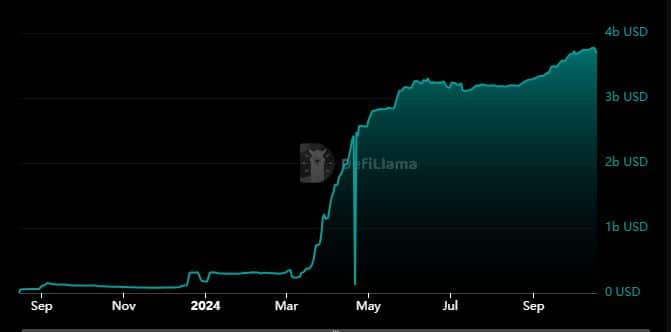

Base stablecoin market cap peaked at $3.77 billion on 16 October. At the time of writing though, it had tanked slightly to $3.68 billion.

These all-time highs in the Base ecosystem have been pivotal towards its dominance in the Ethereum ecosystem.

Also, it has achieved this feat without a native token which, as one would imagine, would likely be soaring high courtesy of organic demand. The project has not yet revealed any plans to launch a native token, but that might be a possibility in the future.

These achievements were due to a combination of factors, including a strong community and a more attractive ecosystem for developers. In fact, the most prominent factors that have contributed to its attractiveness have been efficiency and low fees.