- BTC’s Open Interest has surged to $40 billion.

- Funding rates have also remained positive for days.

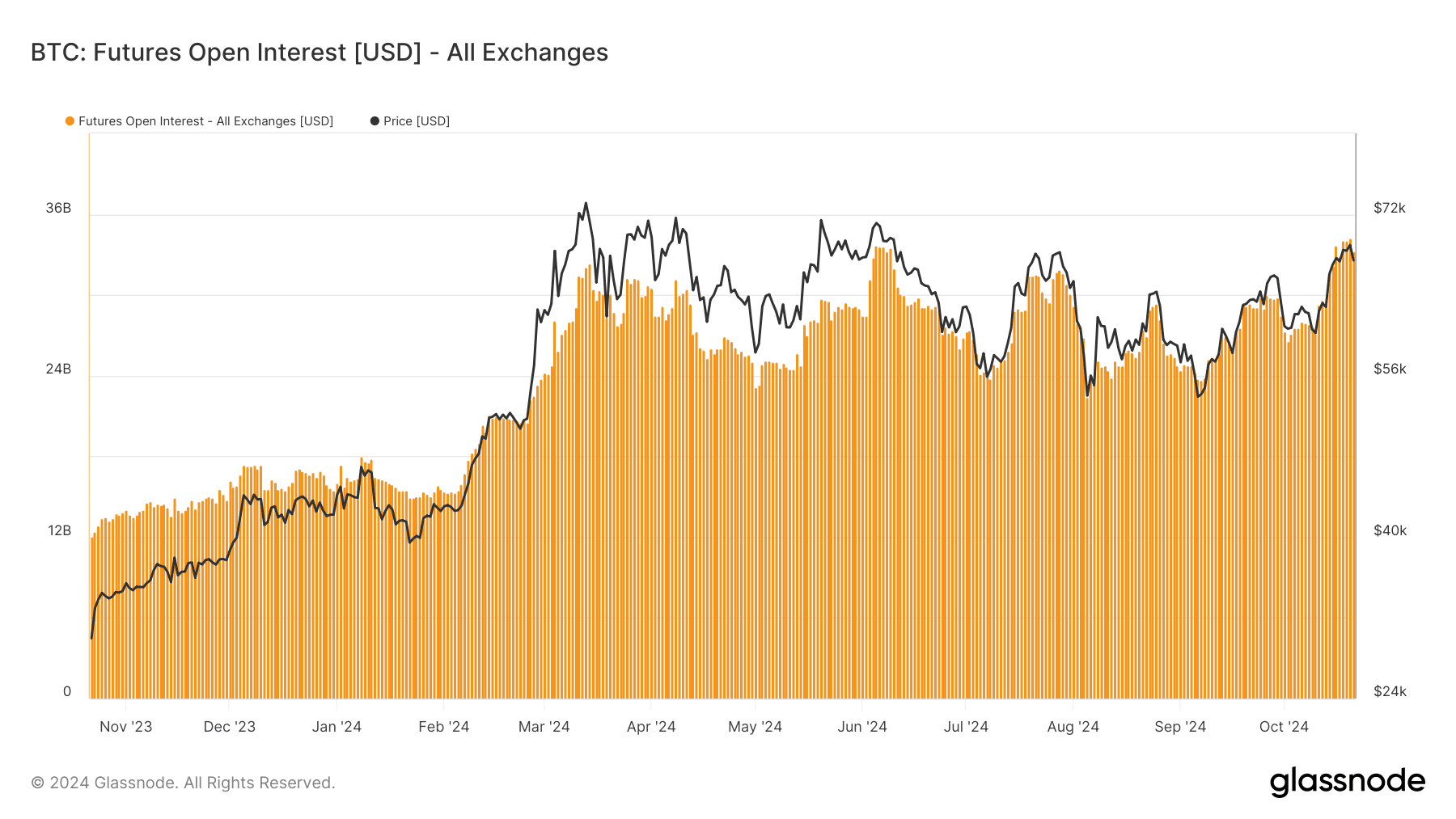

The Bitcoin [BTC] Open Interest (OI) across futures markets has surged to $40 billion, the highest level in 2024. This rise suggests BTC is in a crucial phase, with market participants positioning themselves for possible price moves.

Additionally, metrics like funding rates and price action offer deeper insights into broader market sentiment and potential future trends.

Bitcoin’s price action and Open Interest surge

Bitcoin’s price has been on a consistent upward trend lately. It is currently trading at $67,578, with a significant rise in Open Interest across various exchanges. S

ince early October, BTC has been riding a wave of bullish momentum, supported by strong market sentiment. The 50-day moving average, currently at $62,120, has acted as a firm support, pushing the price toward its present levels.

Technical indicators further strengthen the bullish narrative. The Relative Strength Index (RSI) is at 62.18, indicating that Bitcoin is in a bullish phase but still has room to grow before becoming overbought.

The Chaikin Money Flow (CMF) is also positive at 0.12, highlighting sustained buying pressure and strong inflows into Bitcoin.

This surge in Open Interest, according to data from Glassnode, suggests that traders are opening more leveraged positions. The move anticipates further upward momentum or a significant upcoming price movement.

Historically, a spike in OI is often a precursor to heightened volatility as traders prepare for substantial market changes.

Bitcoin funding rates show bullish sentiment

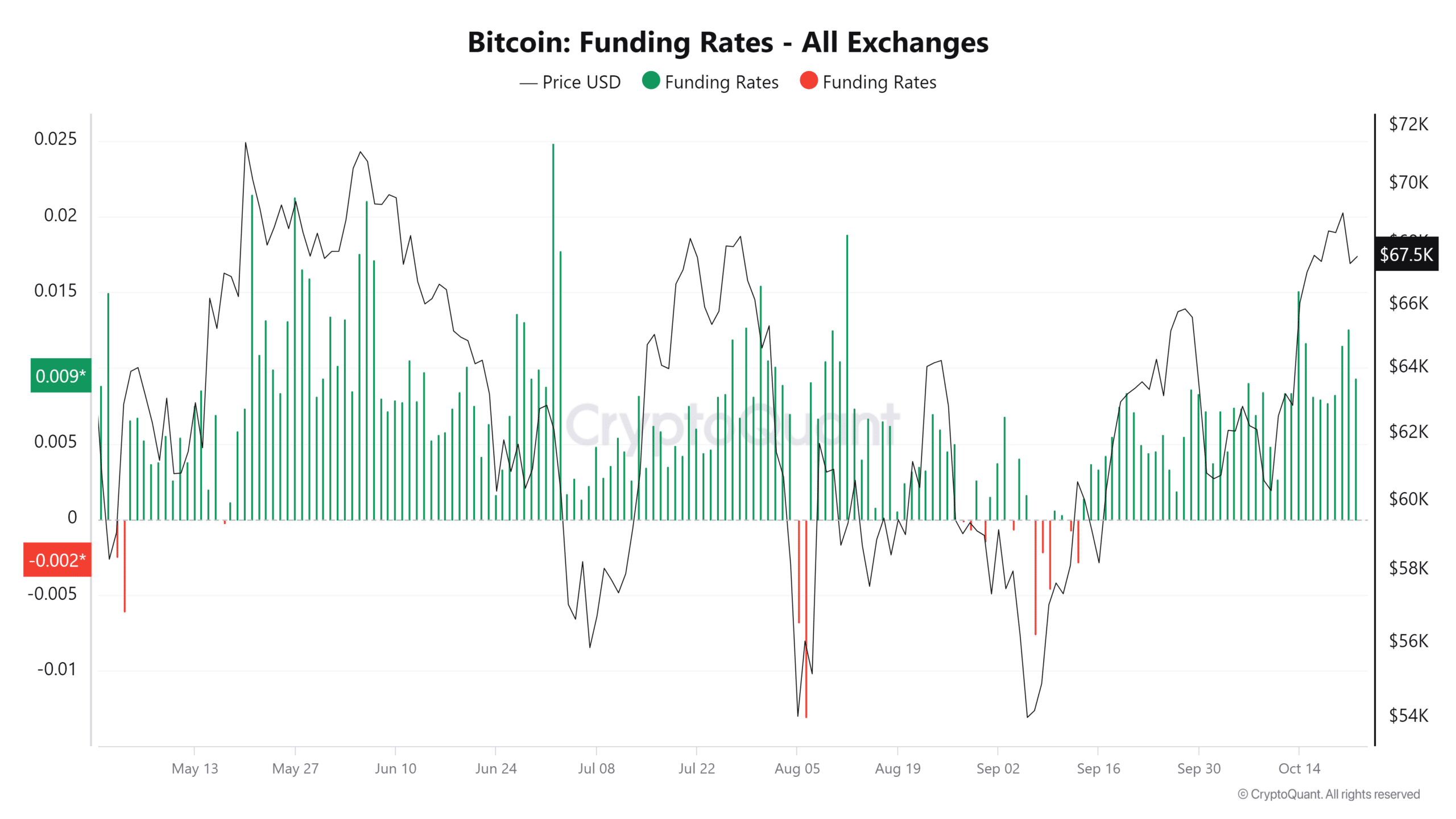

An analysis of Bitcoin’s funding rates across exchanges reveals consistently positive rates. This indicates that traders holding long positions are paying a premium to those holding short positions, further signaling bullish market sentiment.

However, while positive funding rates suggest optimism, they also come with a warning. Prolonged high funding rates can lead to overleveraged conditions, increasing the risk of long liquidations if the price suddenly corrects.

Since early October, funding rates have spiked alongside price increases, suggesting that while the market is bullish, it could be nearing resistance or profit-taking points.

OI and volatility signals ahead

The surge in Open Interest and sustained positive funding rates reflect growing optimism in the Bitcoin market. However, with OI reaching $40 billion, traders should prepare for potential volatility.

The Average True Range (ATR), currently around 96.16, indicates growing volatility, which could lead to sharp price swings in either direction.

Read Bitcoin (BTC) Price Prediction 2024-25

Another price surge could follow if Bitcoin can maintain its current trajectory and break through key resistance levels near $68,000.

However, the high OI and elevated funding rates also mean a potential price correction is on the horizon, particularly if long positions get liquidated during a price drop. This sets the stage for a possible shake-up, making it essential for traders to stay vigilant in the coming days.