[ad_1]

- One analyst highlighted ETH’s position to suggest a breakout could be imminent if demand surges

- Further analysis hinted that the accumulation phase may take longer to resolve itself

Ethereum’s [ETH] growth has moderated itself following a robust rally in recent months, one during which the asset gained by 46.65%. Over the last 24 hours though, ETH slipped by 0.13% – A sign of a temporary slowdown.

According to AMBCrypto, this slowdown may be in line with the ongoing accumulation phase—A promising sign for long-term growth. Still, uncertainty remains about how long the market will stay in this pattern.

Is ETH on the verge of a breakout? Analysts weigh in

According to crypto analyst Crypto Jelle, ETH seemed to be trading within a bullish pattern known as a symmetrical triangle (An accumulation phase) at press time, with the same indicated by white lines on the chart.

Historically, this pattern suggests that a rally may follow, with the accumulation phase representing buyers purchasing ETH at a discount before a surge in demand drives the price higher. If this move materializes, ETH could potentially climb to $8,500, based on the chart’s projections.

However, AMBCrypto’s analysis revealed that while the accumulation phase bodes well for ETH’s long-term prospects, it is unlikely to trigger a rally just yet.

Market participants are still bidding at lower price levels, suggesting that a breakout may take more time to develop.

ETH’s market sees active bidding amid accumulation phase

At the time of writing, ETH’s market was noting active bidding – Signs of an ongoing accumulation phase. This has resulted in ETH maintaining its oscillatory movement—Bouncing between the converging support and resistance levels of the symmetrical triangle.

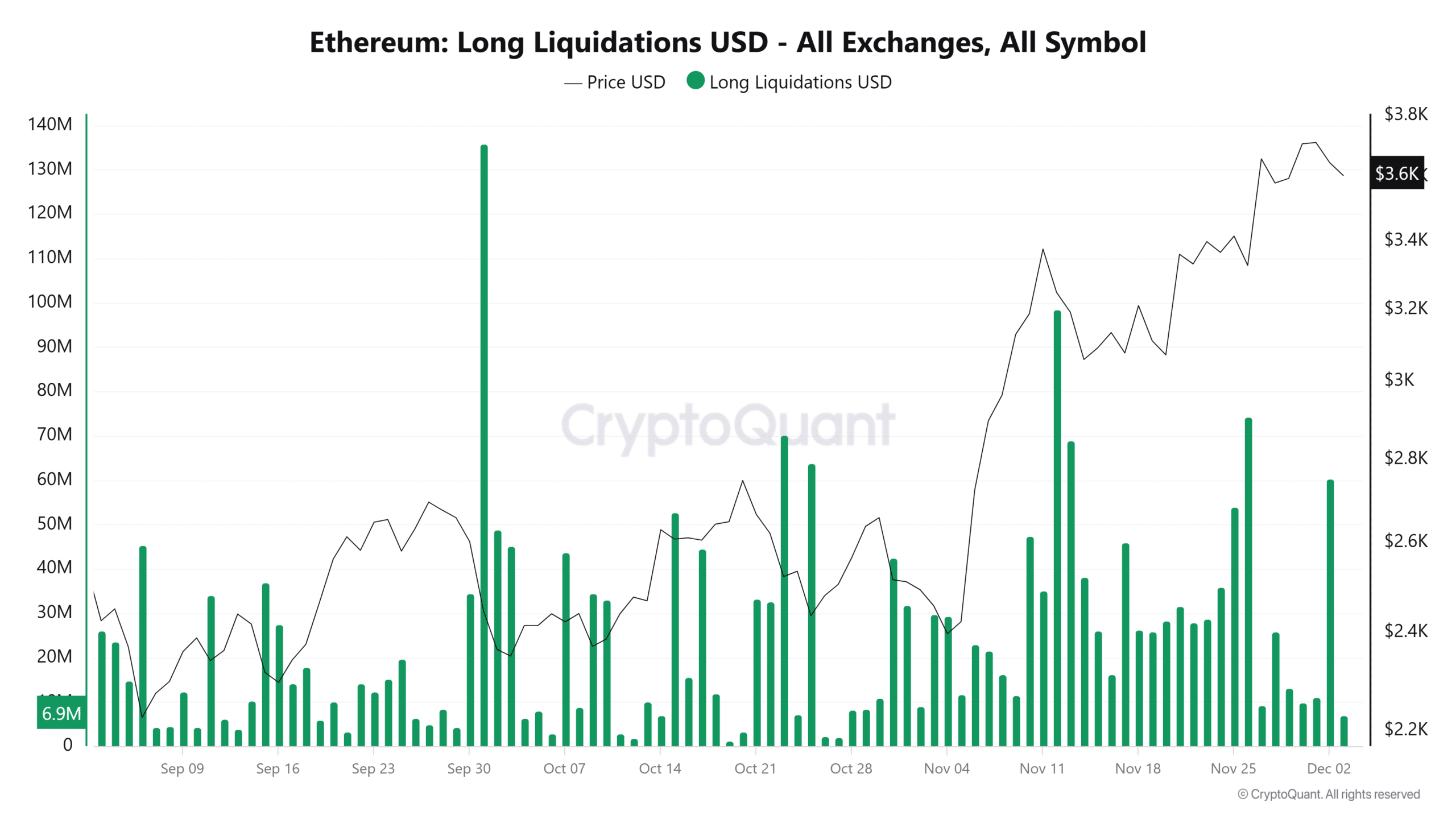

This trend can be evidenced by the spike in long liquidations, which have more than doubled compared to short liquidations. With $31 million in long liquidations recorded, the market seemed to be ready for a downward trend.

AMBCrypto also found that this movement has been fueled by a hike in active addresses, with the same climbing to over 406,000 as many holders sold ETH to lock in profits. This marked a notable increase from 365,000 active addresses recorded just a day earlier.

If long liquidations continue to rise and active addresses remain high, ETH is likely to trend downwards within its ongoing accumulation phase.

Profit-taking activity limits ETH’s rally

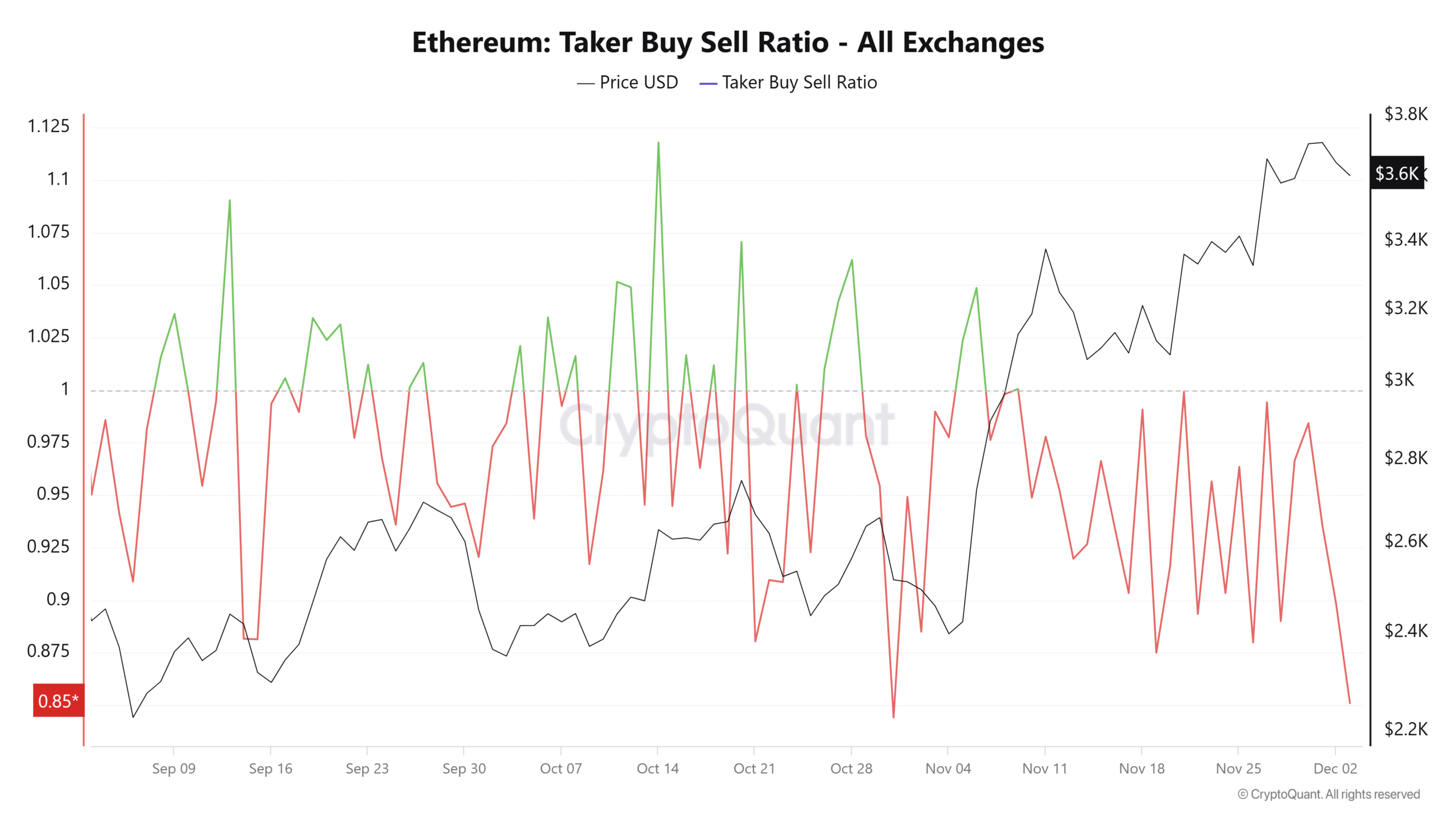

ETH’s rally has been constrained by ongoing profit-taking, as reflected by the Taker Buy Sell Ratio tracked by CryptoQuant.

At press time, the ratio stood at 0.85, indicating that selling volume outweighed buying volume. This imbalance has pushed ETH’s price lower, contributing to the asset’s downward trajectory.

If this trend persists, ETH is likely to remain confined within its press time trading channel, delaying any significant upward movement.

[ad_2]

Source link