With all the uncertainty surrounding which blockchain platforms will come to dominate the panorama long run, firms wishing to launch a platform nonetheless face a dilemma as to the place to focus their efforts. Most established firms nonetheless are apprehensive about working with public blockchain networks. There are a variety of causes for this corresponding to an absence of regulatory readability, which impacts:

Public community compatibility

Even in opposition to this, firms are nonetheless protecting shut tabs on exercise in public networks as with every blockchain initiatives, they need to future-proof their work as a lot as attainable.

Up to now enterprises would usually select between Ethereum, Material or Corda for his or her personal community deployments. Now they have a tendency to deal with applied sciences that will likely be suitable with public networks.

Ought to they select an Ethereum know-how or an alt-layer 1 protocol corresponding to Polkadot that allows them to spin up their very own remoted blockchain?

In the event that they select Ethereum, ought to they be contemplating a layer 2 platform? Optimistic rollups with Arbitrum or Optimism? Or zero-knowledge rollups with Polygon, Linea, ZK-Sync or Starkware? Or maybe look ahead to app chains or layer 3 chains to emerge.

The breadth of attainable combos is mind-bending, however that is partially because of the breakneck pace of developments nonetheless on public blockchains that are vying for person progress and adoption. Even with all of those decisions, the EVM stays the de-facto platform by most for sensible contract growth, and on this respect, no less than this choice is easy.

Beginning with the EVM as the bottom know-how, what’s the most versatile basis to put for a personal community? If one needs to have the ability to benefit from the improvements evolving at breakneck pace with out placing all their eggs in a single layer 2, having a base Ethereum community is a wise place to begin.

Ethereum Shoppers

Specializing in the bottom layer purchasers of Ethereum simplifies the image considerably. The bottom purchasers of Ethereum fall into two camps — execution and consensus layer. The consensus layer purchasers emerged on account of Ethereum’s migration to Proof of Stake (PoS) consensus.

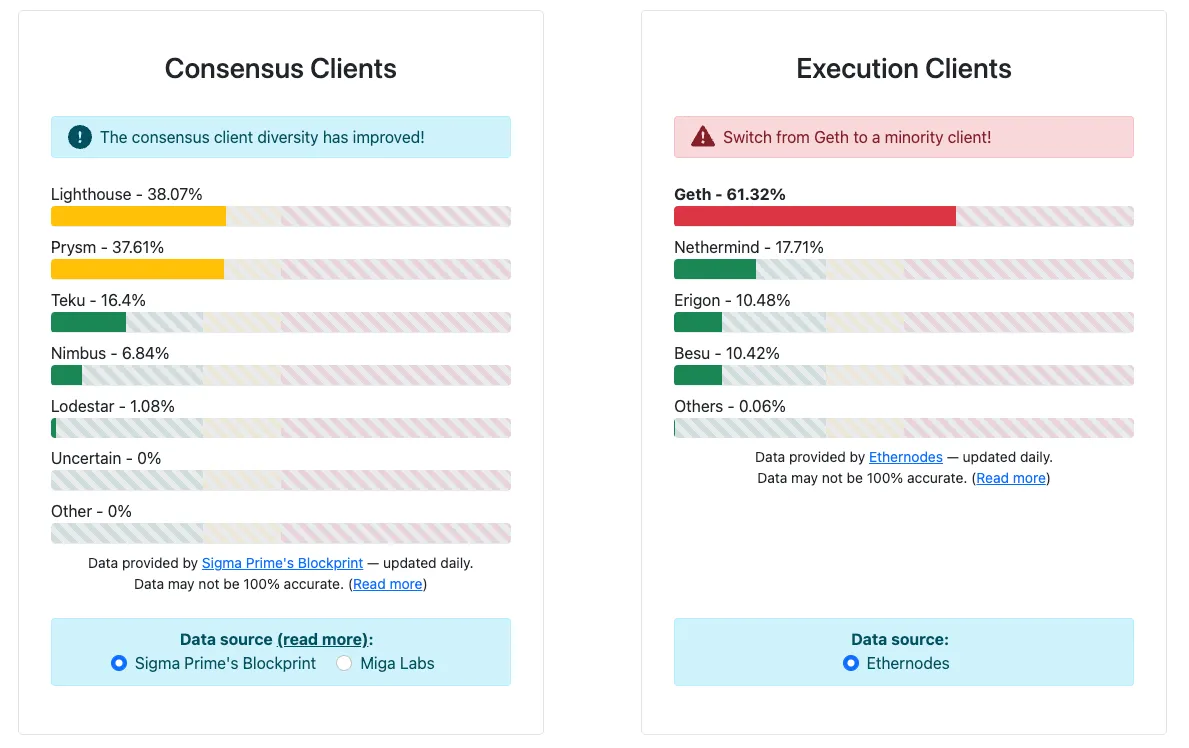

The assorted completely different purchasers accessible and their utilization within the Ethereum mainnet (supply clientdiversity.org)

The assorted completely different purchasers accessible and their utilization within the Ethereum mainnet (supply clientdiversity.org)

Nonetheless, until one is working a public blockchain community, PoS just isn’t vital, as different alternate options exist. These different consensus mechanisms embody proof of authority (PoA), IBFT and QBFT, that are baked into quite a few execution purchasers for Ethereum. This leads us to a path the place the first selection is which execution shopper to decide on. These will be considered as a selection between:

-

Geth

-

Hyperledger Besu

-

Nethermind

-

Erigon

All of those have been designed as mainnet Ethereum purchasers. All of them help proof of authority (PoA) consensus, as that is used for lots of the Ethereum testnets, and their roadmap and have set is primarily dictated by public blockchain actions.

Hyperledger Besu differs from all of them in that it was additionally designed to cater for personal community wants. These personal community wants began with the creation of Quorum, a fork of the Geth codebase by J.P. Morgan in 2016.

Quorum added help for privateness and extra consensus mechanisms to higher serve the wants of enterprise. These additions have been then standardised by way of the Enterprise Ethereum Alliance.

Hyperledger Besu was the one Ethereum shopper that was designed at inception to help these enterprise-specific options in addition to be suitable with the general public networks. It additionally outmoded the fork of Geth because the default shopper utilized in Quorum.

The Hyperledger Basis

The historical past of Hyperledger Besu is useful in appreciating the way it bought to the place it’s now, nevertheless, its additionally helpful to think about the advantages of it being a challenge ruled by the Hyperledger Basis, which is a not-for-profit arm of the Linux Basis that caters for blockchain and DLT particular tasks.

Hyperledger is a impartial entity — it isn’t a business organisation, however its members embody many massive business organisations spanning know-how, finance and different verticals.

For tasks to turn into Hyperledger tasks, they should adhere to governance pointers set by the Hyperledger Basis which be sure that they’re effectively maintained and supported by a number of companies to make sure that they don’t include the important thing maintainer threat of open supply software program maintained by singular entities.

That is very engaging to enterprises because it ensures that tasks have the potential to survive their creators, which implies organisations can have better confidence in adopting this know-how themselves.

All roads result in Besu

It’s this historic context, coupled with the backing of the Hyperledger Basis which has seen its reputation explode through the previous couple of years.

When one surveys initiatives being undertaken within the TradFi panorama, they’re now overwhelmingly utilizing Hyperledger Besu.

-

Fnality International’s Global Payments Platform which is backed by 16 main establishments together with Banco Santander, ING, Nasdaq, Nomura and UBS.

-

Financial institution of Thailand’s Challenge Inthanon for home wholesale fund switch utilizing wholesale CBDC

-

Challenge Inthanon-LionRock, now the mCBDC Bridge Challenge, led by the Financial institution for Worldwide Settlements Innovation Hub, Hong Kong Financial Authority, Financial institution of Thailand, Folks’s Financial institution of China, and Central Financial institution of the United Arab Emirates.

-

Spain’s Good Cash experiment on the technical facets of a digital euro’s distribution, use, and design choices. The initiative was led by Iberpay, plus 16 banks together with CaixaBank, Santander, BBVA, ING, and others

-

The Financial institution of Australia developed a POC for the issuance of a tokenised type of CBDC, with controls for entry and safety that would handle the necessities of a wholesale CBDC and tokenised belongings platform.

As well as, there are different massive public permissioned deployments on Hyperledger Besu together with:

The the explanation why must be clearer now, but when we have been to summarise why Hyperledger Besu is probably the most future-proof blockchain platform:

-

Hyperledger Besu is the one Ethereum shopper designed for each mainnet and personal community use circumstances. This duality ensures there’s a trickle-down impact of options from mainnet being accessible to personal networks.

-

Being a Hyperledger challenge ensures that the lifetime of the challenge will outlive any single business entity and that its licensing mannequin is not going to change to a much less permissive mannequin.

-

It is too early to see any clear winners rising for the layer 2/alt-layer one panorama in public blockchains. As nearly all of those tasks have the power to hook into the Ethereum mainnet, be that by way of a bridge or a rollup know-how, in creating personal layer one networks utilizing Besu, you’re unlikely to come across vital challenges with embracing different scaling applied sciences as they emerge.

Within the coming years, the panorama will evolve and we might even see new platforms beginning to take maintain. However at this time limit, Hyperledger Besu has established itself because the dominant blockchain shopper for permissioned ledgers, therefore it is a smart place to begin for a lot of organisations wishing to embrace blockchain and DLT initiatives.