On-chain information reveals the most important Ethereum whales have continued to purchase lately as their holdings have reached a brand new all-time excessive.

Ethereum’s High 10 Self-Custodial Wallets Have Grown Their Provide Just lately

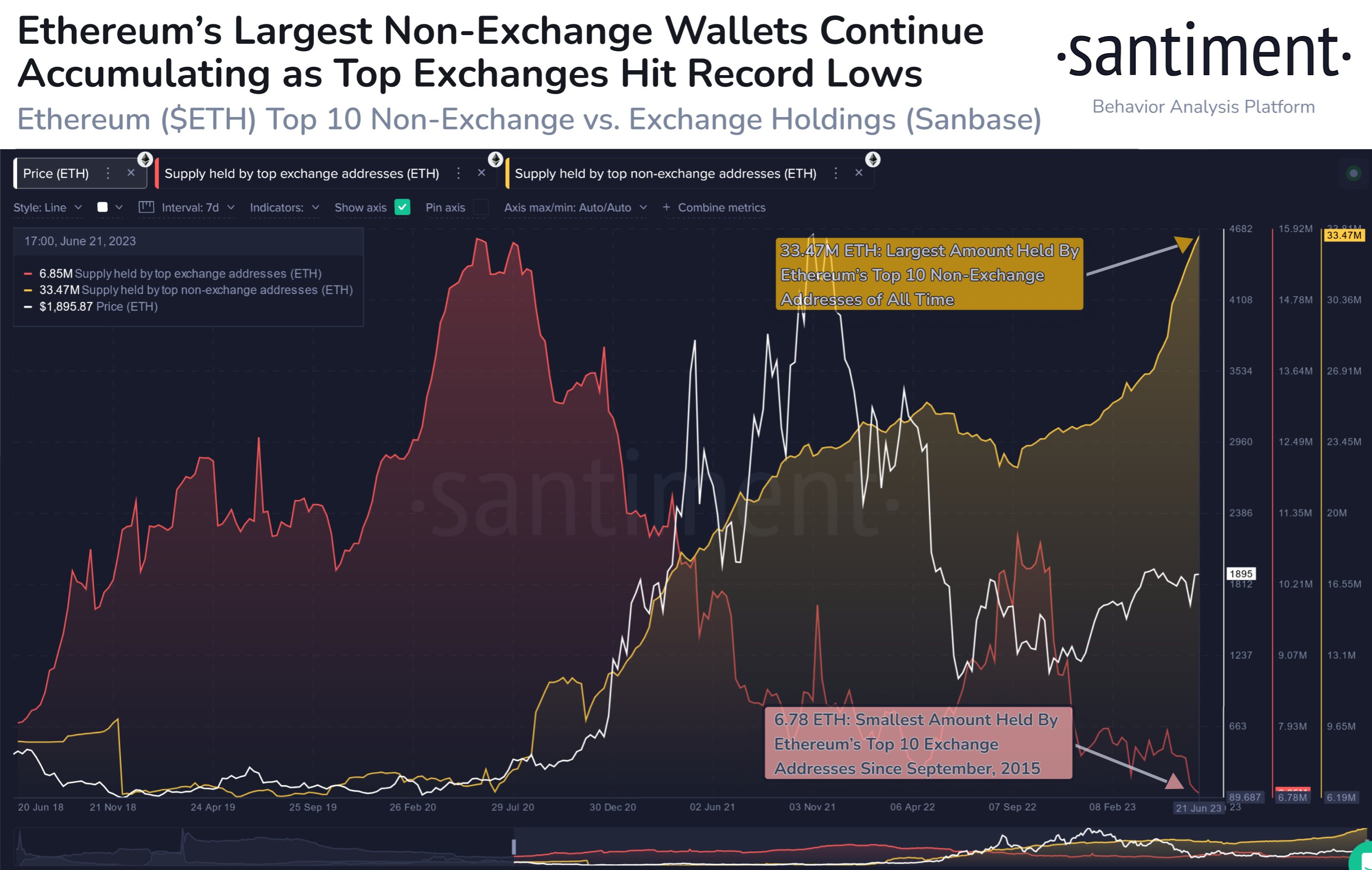

In keeping with information from the on-chain analytics agency Santiment, the highest non-exchange ETH addresses have continued so as to add extra cash to their holdings lately. The indicator of curiosity right here is the “provide held by prime non-exchange addresses,” which measures the overall quantity of Ethereum that the ten largest addresses outdoors of centralized alternate platforms are carrying of their mixed steadiness at present.

Naturally, the one entities who would be capable to personal these humongous self-custodial addresses can be the whales. And because the wallets of focus listed below are particularly the highest 10 ones, the holders of those wouldn’t be simply any atypical whales, however the largest even amongst them.

These traders can be probably the most influential entities on the community (aside from centralized platforms), because of the sheer quantity of cash that they will transfer without delay. Thus, their provide will be one thing to look at for, as any modifications in it could be related to the market.

Now, here’s a chart that reveals the development within the provide of those mega Ethereum whales over the previous few years:

The worth of the metric appears to have been climbing since fairly the whereas now | Supply: Santiment on Twitter

As displayed within the above graph, the Ethereum provide held by the highest 10 non-exchange addresses has been following an total uptrend for a couple of years now. There was a break on this development in the course of the first bear market aid rally, the place this provide went down, implying that a few of these whales took the chance to exit the market.

The indicator largely moved sideways throughout the remainder of the bear market, however because the rally has begun this 12 months, these massive self-custodial addresses have gone again to accumulation.

Within the chart, Santiment has additionally included the info for an additional indicator, the availability held by prime alternate addresses. From the graph, it’s seen that the holdings of the highest 10 wallets on centralized exchanges have registered a decline throughout the identical interval because the self-custodial mega whales have thrived.

The availability of the highest alternate addresses has now dropped to six.78 million ETH, which is the smallest worth since September 2015, when the cryptocurrency first turned accessible for public buying and selling.

The 2 strains shifting reverse to one another would recommend that the most important whales have been withdrawing their cash from these platforms, as they more and more want to carry them in addresses the keys to which they themselves personal.

The withdrawals have been particularly intense lately, and so has the buildup of the self-custodial whales, resulting in the availability of the highest 10 non-exchange addresses hitting a brand new all-time excessive of 33.47 million ETH.

ETH Value

On the time of writing, Ethereum is buying and selling round $1,800, up 8% within the final week.

Seems to be like the worth of the asset has gone stale in the previous few days | Supply: ETHUSD on TradingView

Featured picture from Gabriel Dizzi on Unsplash.com, charts from TradingView.com, Santiment.internet