Final week DeFi confronted one other disaster, this time it was with one of many stalwarts of the ecosystem, Curve Finance.

Curve is a number one decentralised trade, fashionable with many DeFi customers for its liquidity swimming pools which allow depositors to earn a yield on a lot of fashionable tokens. This consists of Bitcoin, Ether, and staked Ether tokens akin to stETH and RETH. Additionally stablecoins akin to USDC and USDT.

What has made Curve so fashionable is that along with incomes a yield on their deposits, liquidity suppliers can enhance their earnings considerably by means of Curve’s governance token, CRV.

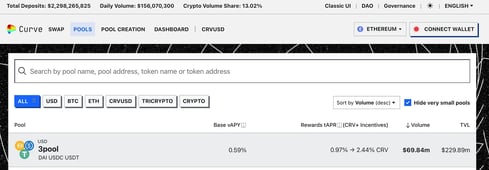

For example, Curve’s hottest pool, 3pool consists of DAI, USDC and USDT. The bottom APY on the pool is 0.85%, nevertheless, this may be boosted from 0.94% to 2.35% in CRV rewards by locking up their CRV tokens.

The Curve Exploit

It is solely when the Tide goes out you study who’s been Swimming Bare

The Vyper bug wasn’t the one situation. Curve’s Founder, Michael Egorov had pledged 34% of CRV’s total market cap throughout a lot of DeFi protocols.

This meant that if CRV’s token began plummeting beneath a sure threshold the CRV collateral would begin flooding the market with a view to liquidate the place.

As Ryan of Bankless identified, the potential CRV promoting stress was plain and easy, leverage going mistaken.

However individuals actually must be listening to who holds the tokens related to the DeFi protocols they’re utilizing. And what these holders are doing with them.

The web impact is that Curve seems to have survived this time round, however it does spotlight clear points nonetheless going through the DeFi ecosystem.

Managing software program vulnerabilities

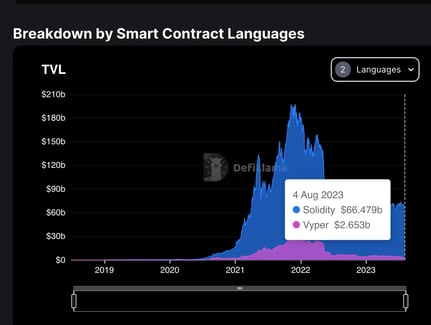

Builders face an limitless sport of cat and mouse with malicious hackers looking for vulnerabilities and exploit their code. Previously, this was constrained to company methods that sat behind firewalls which regularly required social engineering or lax safety practices to get into.

Public blockchains modified this. In creating decentralised purposes, large honeypots of cryptocurrencies have been created for attackers to focus their energies on. Why leap by means of the entire hoops to use establishments, when you’ve gotten a whole lot of hundreds of thousands of {dollars} accessible on public blockchain networks?

Anybody who has spent vital time working as or with builders will admire simply how time-consuming improvement is. No code is ever good or full. There are all the time methods through which it may be improved or optimised.

Heartbleed

It is estimated that 17% of the webs safe net servers have been uncovered to the vulnerability when it was detected. The exploit enabled an attacker to retrieve encryption keys on servers and impersonate others accessing them.

Parity Multi-sig

It’s going to by no means be attainable to get rid of errors in code. Even with AI strategies, the underlying massive language fashions (LLMs) are skilled on code that has been created by fallible people.

Can we ever attain some extent the place decentralised finance can actually fulfil its potential?

I do see areas of the ecosystem through which I’ve nice confidence, akin to Circle’s USDC. Nonetheless, they management token issuance and are very clear in how they function as a enterprise, together with offering audited experiences of their reserves.

Additionally with base community protocols themselves akin to Ethereum. Whereas I do not envisage any occasions on the horizon that might threaten the solvency of Ether or the safety of your complete Ethereum community, there are methods to get well from main occasions because the DAO hack as soon as demonstrated (though few within the Ethereum neighborhood could be supportive of this degree of meddling once more).

Stacking DeFi

The place I consider the issue lies is within the capacity to stack app upon app and create advanced positions unfold throughout a number of DeFi apps. That is the place somebody deposits tokens with Curve, deposits the CRV into Convex for a yield enhance and will additional lock up their CVX tokens. Curve could also be one of many stalwarts of DeFi. Nonetheless, with every further DeFi protocol used the chance to customers will increase considerably.

Inside every DeFi protocol, there will probably be a small variety of builders who actually perceive how their good contracts work. Once you mix a lot of protocols collectively, that quantity turns into even smaller.

Which means a really small proportion of customers can have any thought of how protected their funds actually are, and as an alternative is just chasing the marketed yields.

Groups do take measures akin to partaking auditors to assist confirm their contract supply code. However are these auditors re-engaged with each change? Are these auditors always monitoring all dependencies for updates or vulnerabilities? Even when they’re, some exploits will nonetheless slip by means of.

Defending Mainstream Customers

I consider that for DeFi purposes to go mainstream we are going to want higher safety for customers. This could possibly be within the type of establishments which have sufficient capital to make good for his or her customers within the occasion of exploits. Or just insurance coverage for them.

Maybe centralised exchanges will find yourself being the gateway that many use? Seeing how Coinbase’s Base community evolves on this regard will probably be very attention-grabbing, as they may have the flexibility to supply backstops within the community.

It’s unbelievable the quantity of worth that has change into locked within the DeFi ecosystem in the course of the previous few years. Nonetheless, from a private perspective, I nonetheless do not feel snug placing any significant quantity of funds into DeFi protocols until I can monitor what I am doing with them across the clock.

I’ve fewer issues with stablecoins akin to USDC and Ether, as there’s much more transparency with how they function, which does not require digging by means of good contract code.

With out some breakthroughs in how consumer funds may be protected, I do assume that many DeFi protocols will stay area of interest purposes for these customers who actually perceive what they’re doing. Particularly now as you possibly can deposit funds with regular banks for 4-5% yields which include authorities ensures.

The danger tied with DeFi merely is not value it. I stay as ardent a supporter of blockchain and web3 as I ever have. However elements of DeFi nonetheless really feel like high-stakes video games of poker, and I am no gambler.