The UK parliament is near passing a brand new invoice to guard buyers from monetary crimes involving cryptocurrencies.

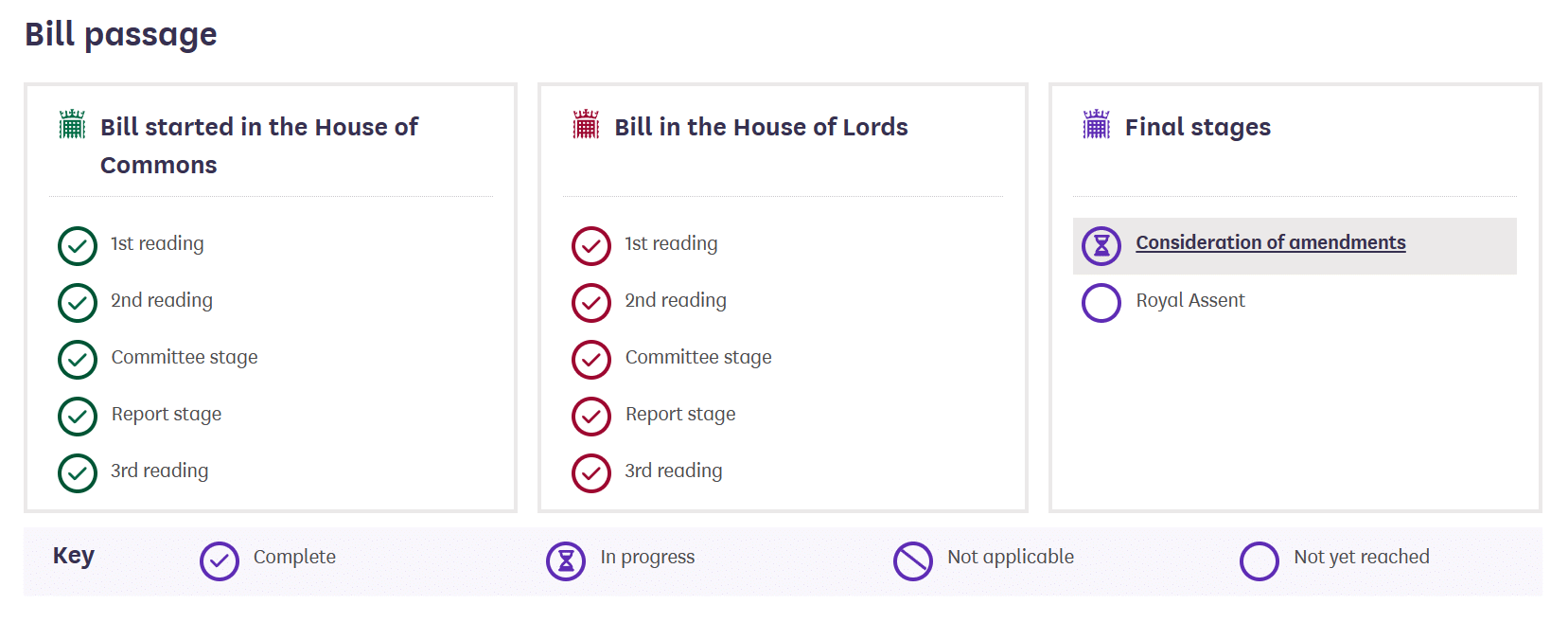

The UK’s Home of Lords has superior the Financial Crime and Company Transparency Invoice, which addresses illicit cryptocurrency actions. Initiated in September 2022, this invoice has handed via legislative homes and is now nearing its remaining approval section.

Whereas primarily targeted on combating crypto monetary crimes, the invoice additionally touches upon company transparency and international enterprise registrations. Because the Home of Commons prepares to overview the invoice’s newest amendments, the ultimate step earlier than it turns into legislation would be the royal assent, marking the monarch’s formal endorsement.

The Financial Crime and Company Transparency bill was first proposed in September 2022. Its important goal is to fight crypto-related monetary crimes corresponding to cash laundering and fraud.

The invoice would require crypto companies to register with the Monetary Conduct Authority (FCA) and adjust to anti-money laundering and counter-terrorism financing guidelines. The invoice will even empower the FCA to impose sanctions on crypto companies that violate the laws.

UK’s crypto progress

The UK has been making vital progress within the crypto sector, particularly after leaving the European Union. Brexit has created new alternatives for the crypto trade within the UK, decreasing the regulatory limitations and rising the pliability for innovation. This has attracted professionals and consultants who imagine cryptocurrencies are right here to remain and might profit the nation’s economic system.

The UK authorities has proven a optimistic perspective in direction of cryptocurrencies, with officers and authorities expressing optimism in regards to the function of crypto within the nation’s financial development. They acknowledge the potential of cryptocurrencies and are eager on creating a regulatory framework that balances innovation and shopper safety. This method contrasts with the EU, which has imposed strict laws on crypto transfers.

Nonetheless, there are nonetheless challenges to beat. A examine commissioned by British lawmakers in contrast the cryptocurrency trade to playing, highlighting the inconsistent stance taken by the nation in direction of the sector. This inconsistency, unsure laws, and an absence of readability can deter companies and buyers from collaborating in crypto, doubtlessly hindering its development and improvement within the UK.