Because the mud settles on ‘the merge’ – Ethereum’s main blockchain improve – it’s an apt time to check out the way it performed out and what the preliminary outcomes have been.

Profitable execution

From a technical standpoint, Ethereum’s largest protocol improve to this point was an unimaginable achievement. The end result of numerous hours of labor carried out by a whole bunch of individuals over a lot of years, it had been topic to a number of delays alongside its timeline.

Skeptics – of which there have been many – confidently declared that it merely couldn’t be completed. To aim such a factor on a community that didn’t maintain a lot in the best way of worth wouldn’t be all that noteworthy. Nonetheless, to take action on a reside community holding upwards of 160 billion USD in worth is exceptional. Some had likened it to having to swap out the engine of a automotive whereas the automotive remains to be in movement.

It wasn’t simply skeptics who had been stunned with the seamlessness of the result. In a current interview, Ethereum co-founder Vitalik Buterin acknowledged: “The entire transition has occurred much more easily than just about everybody – together with myself – anticipated”.

Enterprise as common

As is par for the course in crypto, there was an extreme quantity of hype surrounding the merge. With that hype got here the event of misconceptions within the minds of many in regard to what the final word final result can be.

Advertising 101 with Chipotle’s ‘Proof of steak’: IMG SRC

Advertising 101 with Chipotle’s ‘Proof of steak’: IMG SRC

Profitable execution of this venture definitely is a confidence booster, however it’s only the primary in a sequence of deliberate upgrades wanted to ensure that Ethereum to satisfy its potential. The merge hasn’t mounted community congestion or excessive community charges.

As crypto investor and analyst Miles Deutscher reminded us some weeks previous to the merge, it’s the first of 5 main protocol upgrades on the street in direction of an Ethereum scalability degree of 100,000 transactions per second.

Subsequent up comes the ‘surge’, adopted by the ‘verge’, ‘purge’ and ‘splurge’. That subsequent section is timetabled for 2023, however keep in mind that earlier expertise demonstrates that delays are doubtless.

At an Ethereum convention in Paris in July, Buterin had additionally acknowledged that Ethereum would stay a piece in progress post-merge. On the time he estimated that the venture can be 55% full as soon as the merge had been achieved.

Purchase the rumor, promote the information!

In tandem with the merge hype, from a markets perspective, it was very a lot a case of ‘purchase the rumor, promote the information’. From June onwards, Ethereum continued to persistently make unit value features. The worth peaked a few days earlier than the merge was applied, earlier than truly fizzling out over the course of the times that adopted.

‘Promote the information’ occasions are nothing new in crypto. That mentioned, the merge could go down in historical past as some of the traditional examples, given the multi-year lead into the improve and the extent of anticipation related to it.

Present me the (institutional) cash!

It’s virtually a cliché in crypto at this level however the declare that ‘the establishments are coming’ has lengthy been anticipated and has by no means materialized to any substantive diploma.

Within the lead as much as the merge, many within the Ethereum neighborhood had talked when it comes to the chance of a direct bail-in by establishments into ETH post-merge on the idea that they’d be attracted by the yield on provide. With the transfer to proof of stake comes the chance to stake Ethereum tokens for an ongoing interval to safe the community. As a reward for staking, customers obtain a yield of round 5%.

That hasn’t transpired within the first couple of weeks post-merge. The macro-economic atmosphere had been difficult main as much as the protocol improve. The Dow Jones Index suffered its worst day since panicked pandemic circumstances in 2020. Following the improve, we’ve seen continued concern in fairness markets and on prime of that, FX and bond markets have been thrown into chaos.

Moreover, the Ethereum neighborhood could have forgotten that establishments transfer slowly, cautiously and conservatively. In tandem with antagonistic market circumstances, statements from regulators within the speedy aftermath of the merge could have spooked them.

Regulatory worries

Only a coincidence or intentionally timed? On the very day that Ethereum moved to a proof of stake primarily based consensus mechanism, comments from SEC Chair Gary Gensler appeared within the Wall Avenue Journal that appeared to be related to Ethereum (though he mentioned he wasn’t referring to any particular digital asset) .

He claimed that any crypto that implicated staking (which Ethereum now does post-merge) may very well be deemed a safety on the idea that buyers had the expectation of a return primarily based on the work of a 3rd occasion.

Any trace of the Ethereum Basis, the Ethereum core dev. workforce or co-founder Vitalik Buterin being hauled over the coals within the courts for providing unregistered securities (as has occurred with Ripple) would ship any potential institutional investor working for the hills.

Because of actions taken by the SEC in opposition to sure crypto tasks within the final couple of years, lots of the venture originators have tried to distance themselves from crypto tasks. However the situation is how can the guardians of the Ethereum venture distance themselves from the venture when Buterin believes it to be simply 55% full at this level?

This situation has many questioning if bitcoin’s Satoshi vanishing with out hint means he/she had securities legislation in thoughts, making him a genius or whether or not that’s simply coincidental.

Centralization concern

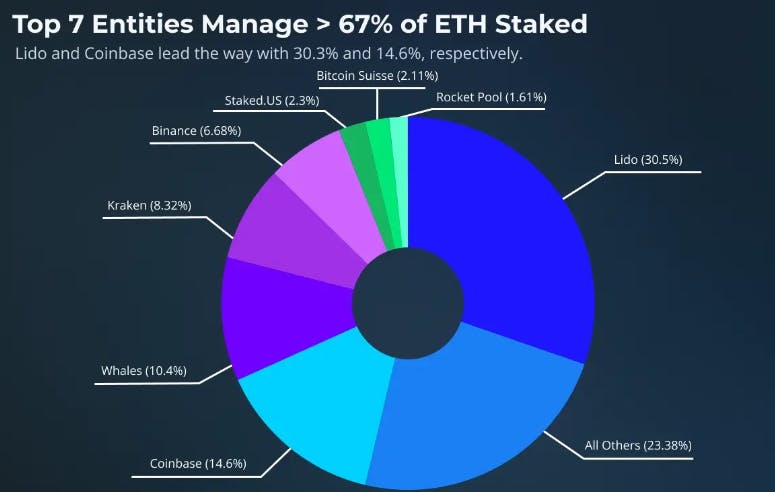

Ethereum’s transfer to proof of stake has additionally introduced up considerations when it comes to the centralization of staking. Reasonably than stake straight, customers can delegate their cash to providers like Coinbase, Lido Finance and Kraken. Of the primary 1000 blocks validated after the merge, 420 of these had been validated by Coinbase and Lido Finance.

With the Twister Money saga contemporary within the minds of these within the crypto area, that concern might not be misplaced. Former Ethereum co-founder Charles Hoskinson, who later went on to discovered rival venture Cardano, drew consideration to the truth that 42% of the blocks are held by two centralized entities, indefinitely locked in proof of stake.

ETH staking breakdown : IMG SRC

Critics are claiming that the merge has steered Ethereum in direction of higher effectivity at the price of decentralization. Then again, defenders of the venture declare that the proof of work-based system it left behind was extra centralized because of the centralizing impact of the economic system of scale related to mining.

Ethereum sprouts inexperienced credentials

Alongside bitcoin, Ethereum has shipped widespread criticism for its large vitality use. The community’s electrical energy use is now minimal, having been lowered by 99%. Following the implementation of the merge on September 15, international electrical energy consumption was lowered by 0.2% in a single foul swoop.

Non-fungible tokens (NFTs) hit new ranges of recognition in 2021. The event introduced many new customers into the digital belongings area who up till that time had proven little curiosity in cryptocurrency. Nonetheless, many potential customers shunned the notion on the idea that Ethereum-based NFTs got here with an outsized carbon footprint. With the merge, that objection goes away.

It has been argued that this improvement alone may result in a brand new wave of adoption.

Improved financial coverage

The merge has resulted in a lot of provide shocks for Ethereum that might work out favorably for token holders. On a mining-based system, miners would dump a few billion {dollars} price of Ethereum every month to cowl working prices. That gross sales stress has disappeared with the transfer to proof of stake.

On the time of writing, staking itself takes 12% of Ethereum token quantity off the market. There’s each motive to imagine that the proportion of staked ETH will increase going ahead, driving the circulating provide down additional.

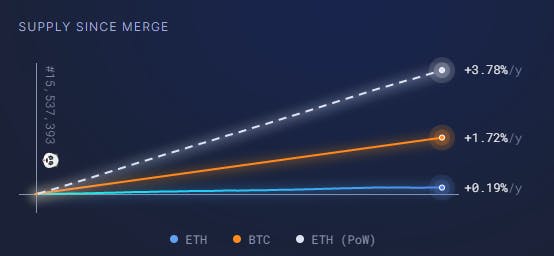

Because the Ethereum community will get used extra, extra ETH shall be burned in transaction charges, lowering circulating provide but once more. Total ETH issuance has been lowered because the chart beneath demonstrates.

All of those modifications level to tokenomics which may result in Ethereum turning into deflationary. All of it feeds into the digital asset performing higher over time as lowered provide set in opposition to doubtlessly rising demand goes to use upward stress on the Ethereum token value.

Negligible inflation fee on Ethereum post-merge : IMG SRC

Constructive outlook

Whereas we’ve recognized a few points when it comes to regulatory considerations and attainable centralization, as long as the venture can navigate its means via these points and proceed onwards with its deliberate improvement, the outlook for Ethereum popping out of the merge is basically optimistic.

Though institutional funding hasn’t occurred instantly following the merge, it doesn’t imply to say that it received’t as we transfer ahead. The establishments want regulatory readability. In the event that they get it, then there’s each chance that Ethereum shall be on their listing of belongings to achieve publicity to.

Investing in keeping with Environmental, Social and Governance (ESG) coverage is a giant deal for company buyers. Ethereum’s inexperienced transformation will little doubt make the venture way more engaging to the establishments on that foundation.

One of many key metrics for any digital asset venture is the credibility of the event workforce. There’s loads of work to be completed nonetheless however on the idea of what was achieved with the merge, there’s going to be much more confidence that the Ethereum venture may be developed to some extent the place it might really ship on the potential so many imagine it to have.